Submitted by Taps Coogan on the 19th of July 2018 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

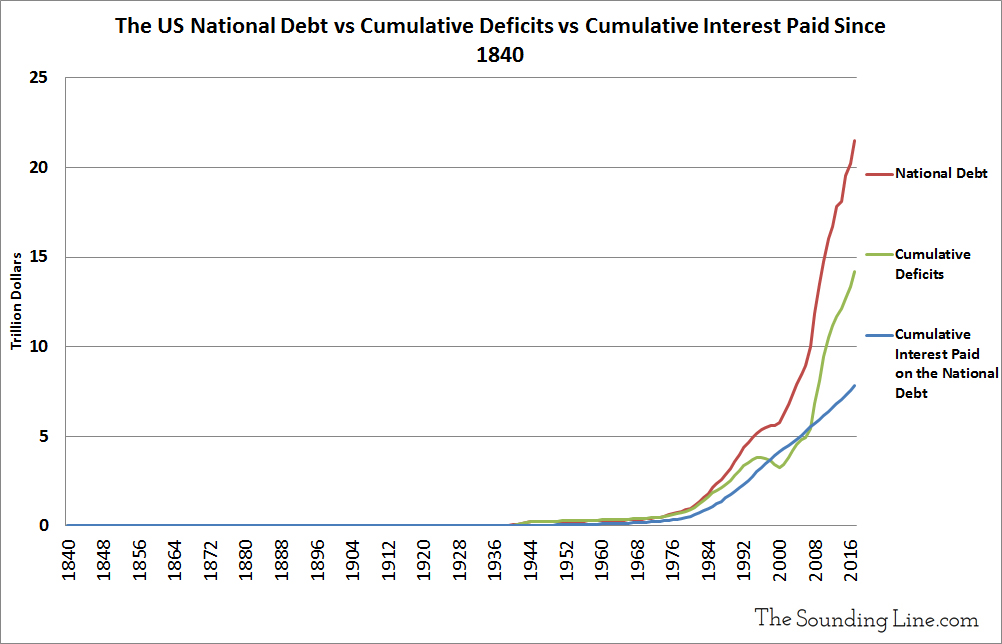

The last time the US completely paid off the national debt was in 1840. It was the result of decades of balanced budgets under Presidents James Monroe, John Quincy Adams, and Andrew Jackson.

In the 179 years since 1840 (counting the 2018 budget), the US has run a deficit 109 times and a surplus or balanced budget just 70 times, amounting to a cumulative net deficit of $14.2 trillion. All of the surpluses combined in the last 179 years amount to $580 billion, less than the deficit in 2017 alone ($665 billion).

Since the national debt was last eliminated in 1840, the US has paid a cumulative $7.8 trillion of interest on the national debt. Despite running ‘only’ $14.2 trillion in deficits over that last 179 years, and despite having already repaid essentially all debt issued more than 30 years ago, the national debt today is $21.4 trillion. The difference between the cumulative deficit and the national debt, $7.2 trillion, represents off-balance sheet spending and circular lending schemes like the Social Security ‘Trust Fund.’

A full 36% of today’s national debt is, in effect, accumulated interest paid on past debt. In a sense, a portion of the money the government borrowed in 1841 is still being paid for today via rolling the debt forward.

The last time the national debt decreased on a yearly basis was in 2000 when it fell from $5.7 to $5.6 trillion dollars. Since 2000, the US national debt has nearly quadrupled to $21.2 trillion and the US has spent a cumulative $4.1 trillion dollars on interest expenses, more than during all previous American history combined.

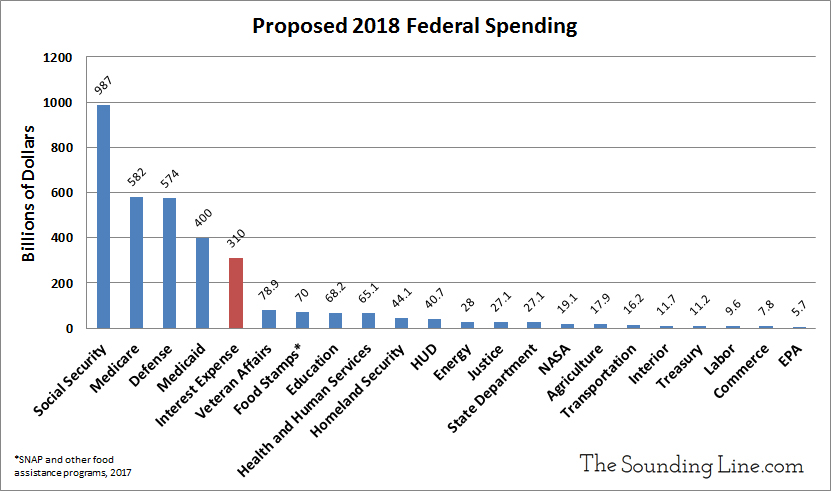

Yet, because so much of the recent growth in the national debt has taken place since the 2008 Financial Crisis, and has been borrowed at historically low interest rates, taxpayers have been shielded from much of its cost. However, if the federal government continues to borrow at the same rate or higher, as it is planning to do, there is a good chance that future borrowing will come at significantly higher interest rates. Consider that the government already spends more servicing the national debt than the combined amount spent on food assistance for the poor plus the departments of: Homeland Security, Housing and Human Development, Energy, Justice, the State Department, NASA, Agriculture, Transportation, the Interior, and the EPA. If debt levels and interest rates rise, even more government spending will be diverted from real programs towards servicing the national debt. It is a total waste of taxpayer money.

Now is the time to balance the federal budget. The economy is expanding, the labor market is relatively strong, the need for large fiscal stimulus is low, and borrowing may get much more expensive in the near future. In the long run, not doing so is simply a massive waste of taxpayer money.

This article was updated on August 28th, 2019.

If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Will never happen. Fiscal control that is. It’s easy to be Santa instead of making tough budgetary decisions like most families have to do. Total financial collapse & Reset is baked into the cake.

It is unlikely, though given the stakes, one can hope

Balancing your budget the month before you go bankrupt makes total sense… it can’t be fixed without default

If you balanced your budget, you wouldn’t be going bankrupt, cause you’d be making your interest payments.

It’s worth a shot

“Reset is baked into the cake.” By design.

BIS IMF have been warning.. openly and descriptively.

War and Reset.. this is it, now or never. Part of reason why nobody (either party) talks seriously about debt. Canada sold all of its gold.. think about it.

New currency paradigm. AI Robotics Quantum computing .. Homo Evolutis. Natural progression of species.