Submitted by Taps Coogan on the 9th of January 2018 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

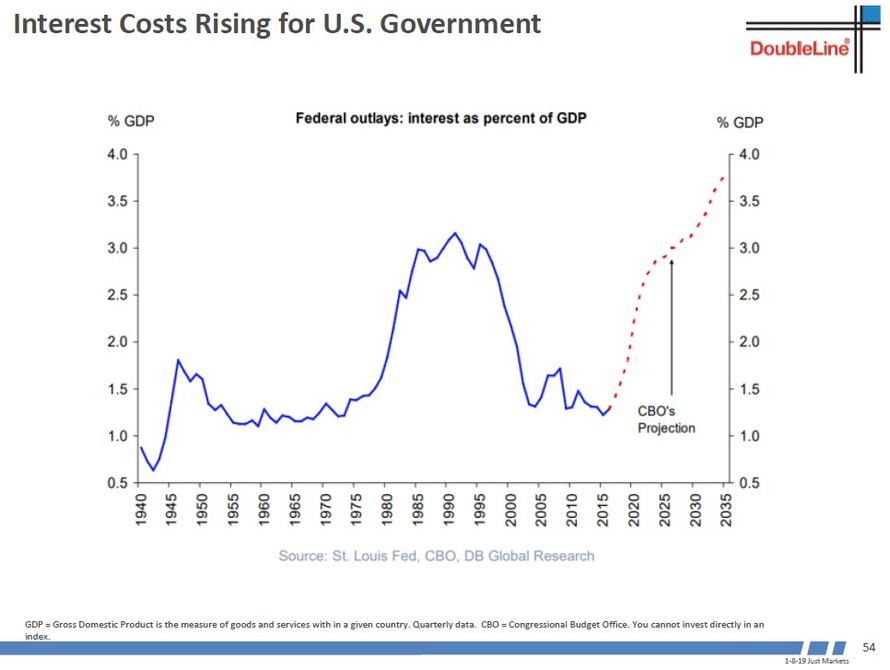

The following chart, courtesy of DoubleLine’s Jeffery Gundlach, shows the Congressional Budget Office (CBO) projection for the interest expense on the US national debt in the coming years.

The CBO forecast shows the interest expense hitting 3% of GDP (over $670 billion) by the late 2020s and approaching 4% of GDP by the mid 2030s. By then, the interest expense will be higher than the entire national defense budget, which is forecast to remain at roughly 3.5% of GDP for the foreseeable future.

The forecast assumes that the US avoids a recession for at least the next 17 years and that inflation remains steady between 2% to 2.1% a year.

Needless to say, it is a highly optimistic forecast. The US is already nearing the longest expansion in its history without a recession. Another 17 years without one would be unprecedented. As we first noted here, during the economic contraction that followed the Dot-Com bubble, US federal tax revenues fell by over $260 billion (roughly 20%) between 2000 and 2002. As a result of the 2007 housing bubble and financial crisis, federal tax revenues fell by over $493 billion (nearly 30%) between 2007 and 2009. Meanwhile, government spending increased by over $660 billion (22%) between 2008 and 2010 as government stimulus and welfare spending surged. The result, that nobody expected in 2007, was that the already high national debt would double during the following ten years.

Even if the US avoids a recession or unexpected increases in spending, and keeps inflation at a Goldilocks 2% forever, the national debt will be more taxing on the economy than it was in the 1990s, when interest rates and inflation had spent the previous decade in the teens.

If things don’t go perfectly in the future, the national debt will be an even bigger nightmare.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.