Submitted by Taps Coogan on the 25th of February 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

Since January 2009, China’s M2 money supply has grown by over $133 trillion Chinese Yuan, or nearly $20 trillion.

During the same period, China’s annual GDP grew by roughly $8.4 trillion.

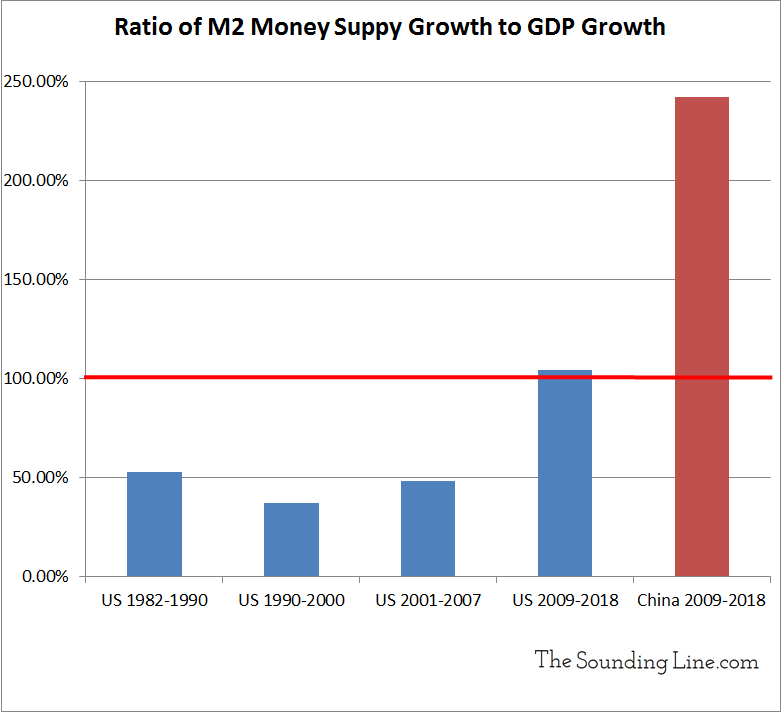

Amid a historic torrent of financial accommodation and credit creation, the amount of money in China’s economy has outgrown the goods and services in China’s economy by roughly 2.4 fold, and outgrown US money supply growth by over three fold.

During the same period, US M2 money supply increased by ‘just’ $6.1 trillion, while the US economy grew by $6.09 trillion (based on 2018 Q3 GDP). Despite, years of zero interest rate policy and trillions of dollars of quantitative easing, US money supply just barely outgrew the US economy.

In previous, more normal economic cycles, US money supply growth has lagged GDP growth. From 2001 through 2007, M2 growth was roughly 48% of GDP growth. From 1990 through 2000 it was 37% of GDP growth. From 1982 through 1990 it was 53% of GDP growth.

In a healthy economy, the economy itself grows faster than the money supply. In an economy being pumped up by financial and monetary stimulus, money supply tends to outgrow the economy. It is not a good thing. When the supply of money grows faster than the supply of goods and services in the economy, inflation and/or cross currency devaluation typically loom on the horizon. China’s economy has been pumped with unprecedented amounts of fiscal and monetary stimulus for a decade. In fact, it has created nearly $14 trillion more currency than the US in the last decade while growing its economy only $2.3 trillion more.

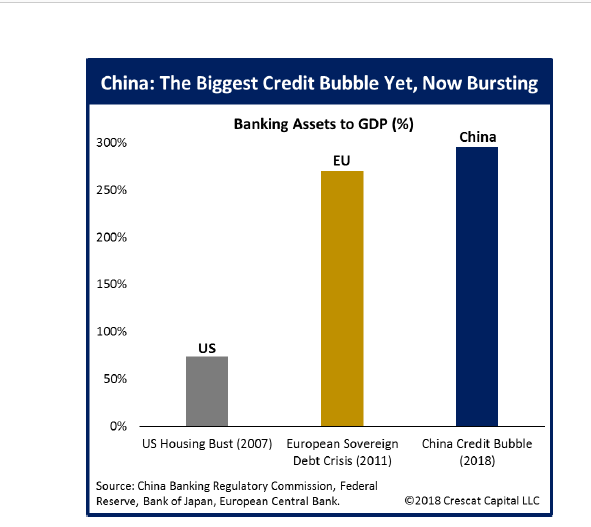

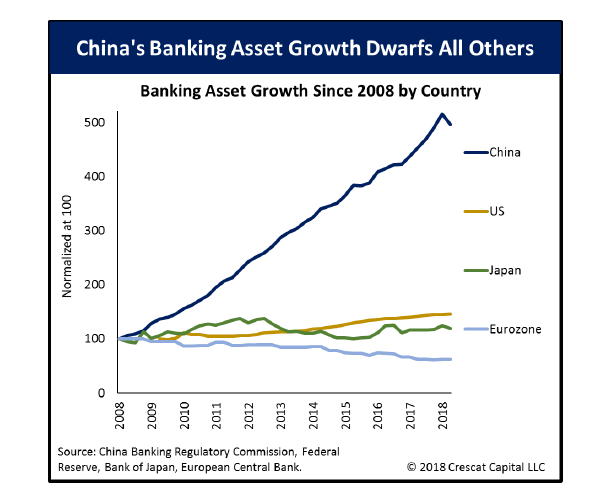

By many metrics, China is in the midst of one of the largest financial bubbles in modern history. It’s ratio of banking assets to GDP is higher that the US at the peak of the housing bubble and higher than the EU on the eve of it’s sovereign debt crisis.

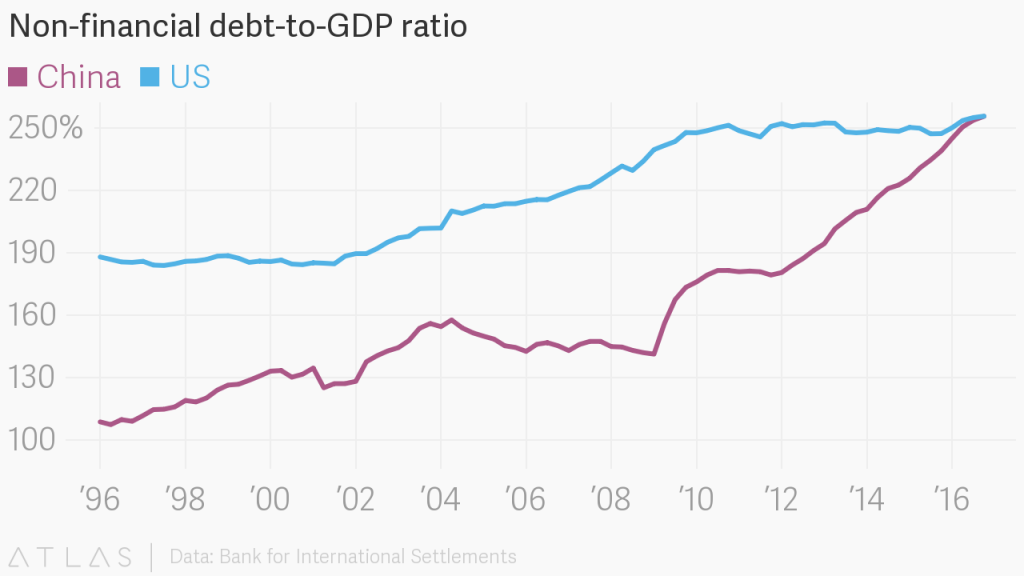

It’s fiscal deficit is now only slightly behind the notoriously large US deficits and its overall economy is more indebted than the US.

China’s enormous size, closed capital system, pegged currency, penchant for making up economic statistics, and state directed economic model mean it can hide and delay economic problems for far longer than virtually any other economy. The downside is that the extra time appears to be allowing China’s problems to compound to historic levels.

The apparent easing of trade tension between the US and China probably adds yet more time to the clock. Meanwhile, big trouble is brewing in China

If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Well said, your article did a great job of putting before us some of the problems China currently is facing. In January, Beijing injected a staggering $685 billion in new credit into its financial system. China continues to prop up the unpropable, and yes, while no such word exists, when it comes to China’s economy it should, for “unpropable” describes the financial collapse that can only be postponed but not stopped. The article below argues that this will have a major impact in currency markets going forward.

https://brucewilds.blogspot.com/2019/02/china-continues-to-prop-up-its.html