Submitted by Taps Coogan on the 11th of March 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

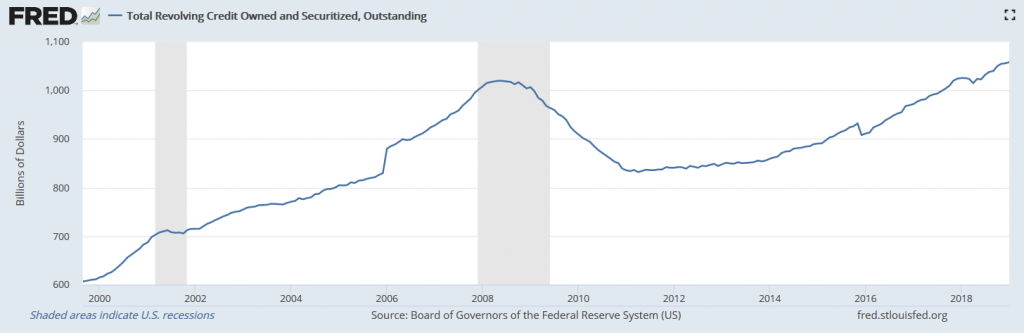

A number of recent articles have warned about the rise in US credit card debt (and revolving credit) since the Financial Crisis. Revolving Credit, which includes credit card debt, now stands over $1.05 trillion, higher than its peak of $1.019 trillion in early 2008.

While that may sound ominous, keep in mind two things. First, the US population has expanded from 301 million at the end of 2007 to 325 million by the end of 2018. Second, due to inflation, $1 at the end of 2007 is the equivalent of roughly $1.21 today.

Apply those two factors and the rise in revolving credit becomes somewhat less worrisome. At the end of 2007, per capita revolving credit in today’s dollars was roughly $4,024. Today, revolving credit is roughly $3,228 dollar per capita. In inflation adjusted terms, per capita revolving credit has declined 20% compared to the eve of the Financial Crisis.

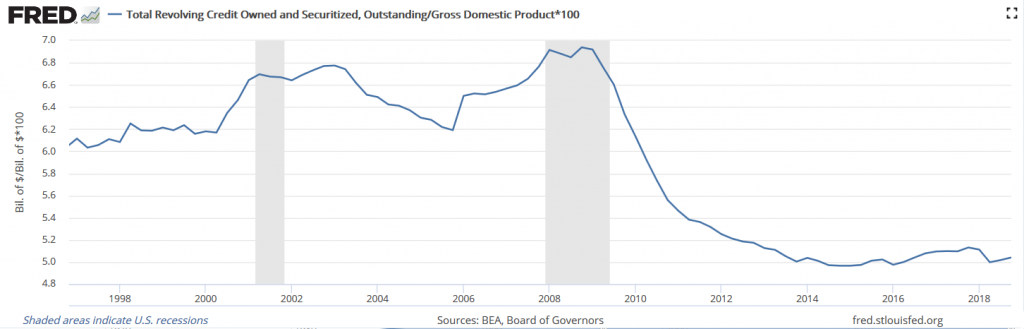

Similarly, revolving credit has declined significantly relative to the economy, reaching roughly its lowest levels since the mid 1990s.

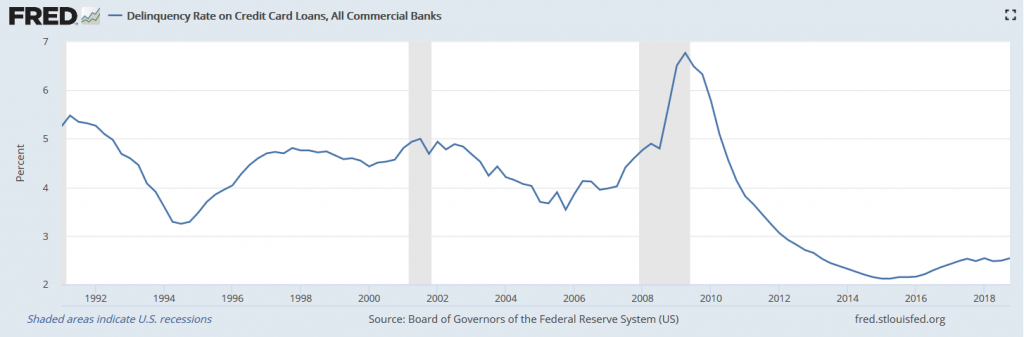

Furthermore, delinquency rates have plummeted since the Financial crisis and, despite rising modestly since 2016, are far below levels seen at any point from 1991 to 2013.

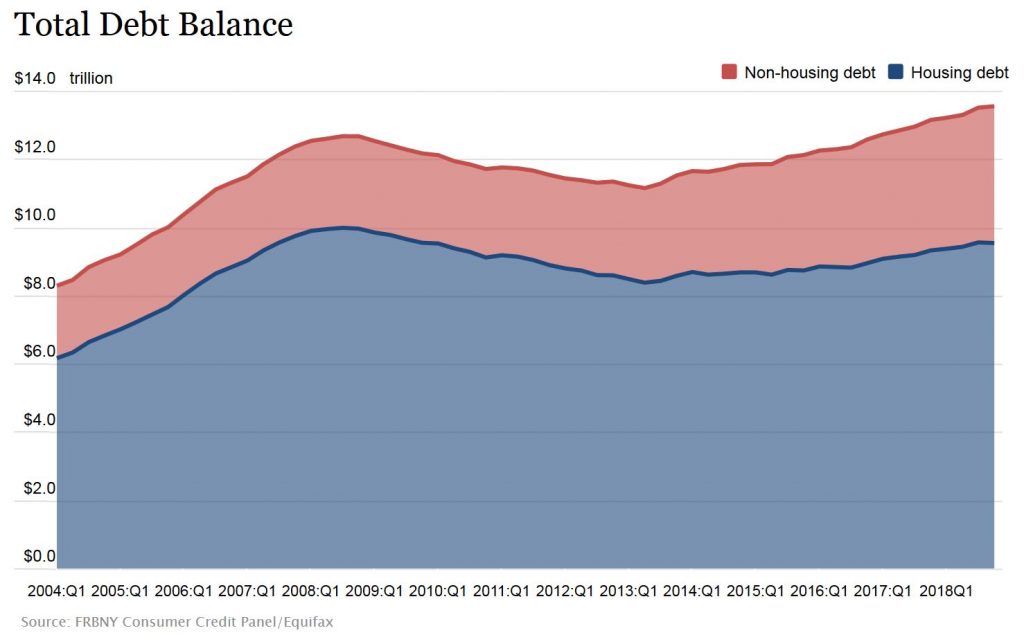

In fact, it is not just revolving credit that has improved. Overall household debt, which includes mortgages, student debt, auto-loans, consumer debt, and revolving credit has followed the same trend. Although absolute levels suggest record high debts, adjust for population and inflation, and the picture looks better. At its peak at the end of 2008, per capita household debt was roughly $48,737 in today’s dollars. Today, household debt is roughly $41,466 per capita. In inflation adjusted terms, per capita household debt has declined 15% compared to its peak during the Financial Crisis.

Household debt has declined by nearly 20% relative to GDP since 2008

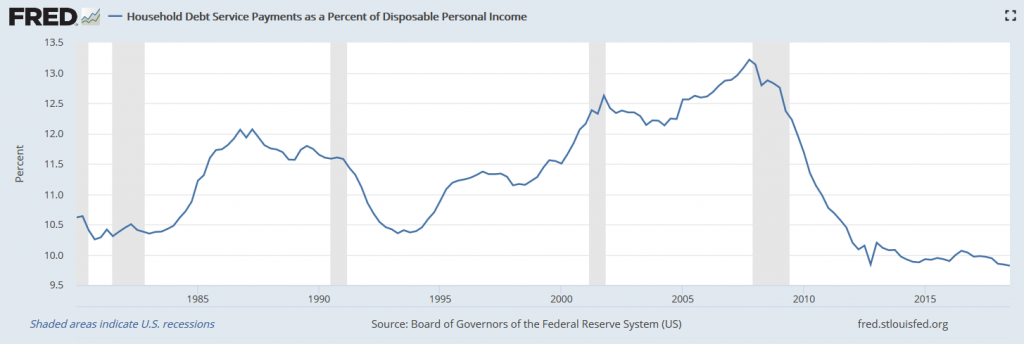

The interest expense on household debt, relative to disposable income, is the essentially the lowest on record.

It is true that household debt and certain types of delinquency have risen in recent quarters, and for certain zip codes and segments of the population that poses real challenges. Household debt levels are still high and debt and delinquency rates need to fall even further. $41,466 per person in the country is still a mountain of debt. Nonetheless, the reality of the situation, as the charts and figures above lay bare, is different from the narrative in much of the press. This is not what a major housing bubble looks like. Not yet at least.

There are lots of very worrisome trends in the global economy. The modest real deleveraging of US household’s isn’t at the top of the list.

To see which countries have the largest housing bubbles, read here.

If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Bad news sells, and Jim “Bear Stearns is fine” Cramer is shoved down throats 24/7.

And everyone else in the middle finding ways to put lipstick on pigs…

For what it’s worth, when I write an article like this, I get 10 times more flack, and a lot less eyeballs, than if I were to just say the debt went up so it must be the end of the world. IMO, there are a lot of people out there that truly want to believe ‘everything is the worst ever.’ There is also an audience for whatever crock that the Jim Cramer’s of the world are selling. But I have zero interest is writing articles that I don’t actually believe in, just because they appeal to an easy audience.… Read more »

You are completely free to write what you want, and actually thought it was ok (though, I think these per capita denoms actually mask the who holds the debt vs those who have been effectively locked out the credit system since 2008) until you felt the need to call out zerohedge as example which I thought was a bit distasteful (despite some of its flaws).

You are right. It was distasteful and I have removed the reference to Zero Hedge which, despite its flaws, is an important read that I link to frequently. Thank you.