Submitted by Taps Coogan on the 24th of May 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

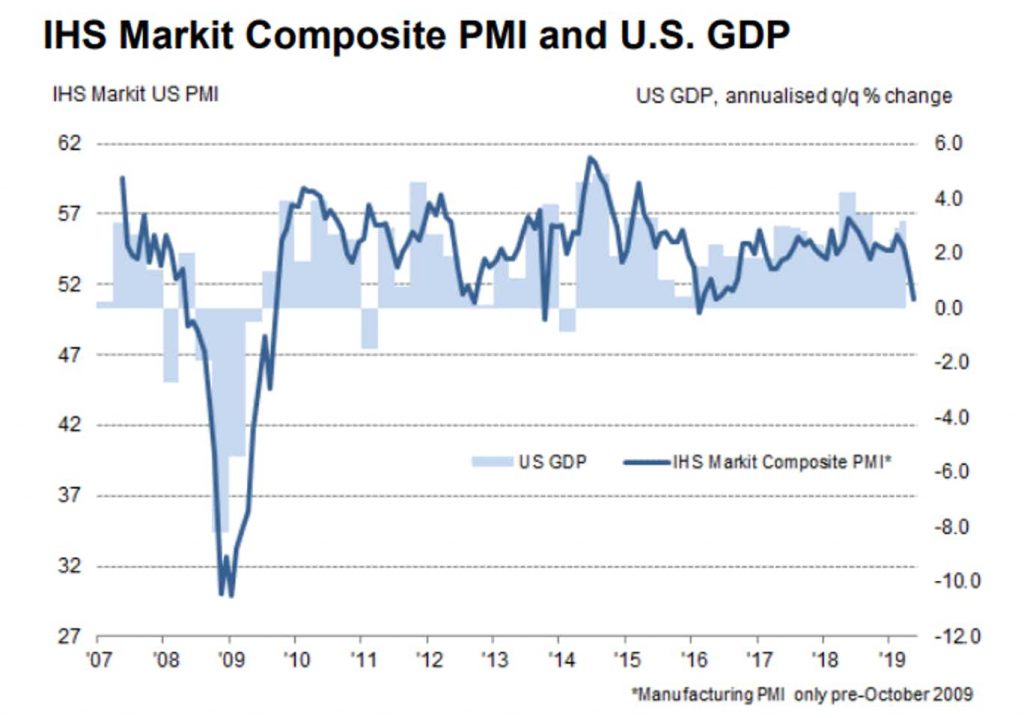

Yesterday, the US Markit© manufacturing and services ‘Flash’ PMI cratered. The manufacturing PMI hit its lowest levels in nine years and the services PMI hit its lowest level in three years. The composite index hit its lowest level since the economic slowdown in early 2016.

The composite PMI is now 50.9. Values below 50 imply that the economy is contracting. PMI surveys are considered to be one of the few semi-reliable leading indicators of economic slowdowns and recessions. These ‘Flash’ surveys released are not the ‘final’ PMI numbers reported at the end of each month, but generally tell the same story. As can be seen in the chart above, the PMI composite index has slowed to roughly these levels three times since the Financial Crisis and then recovered. The key moving forward is that the data recovers.

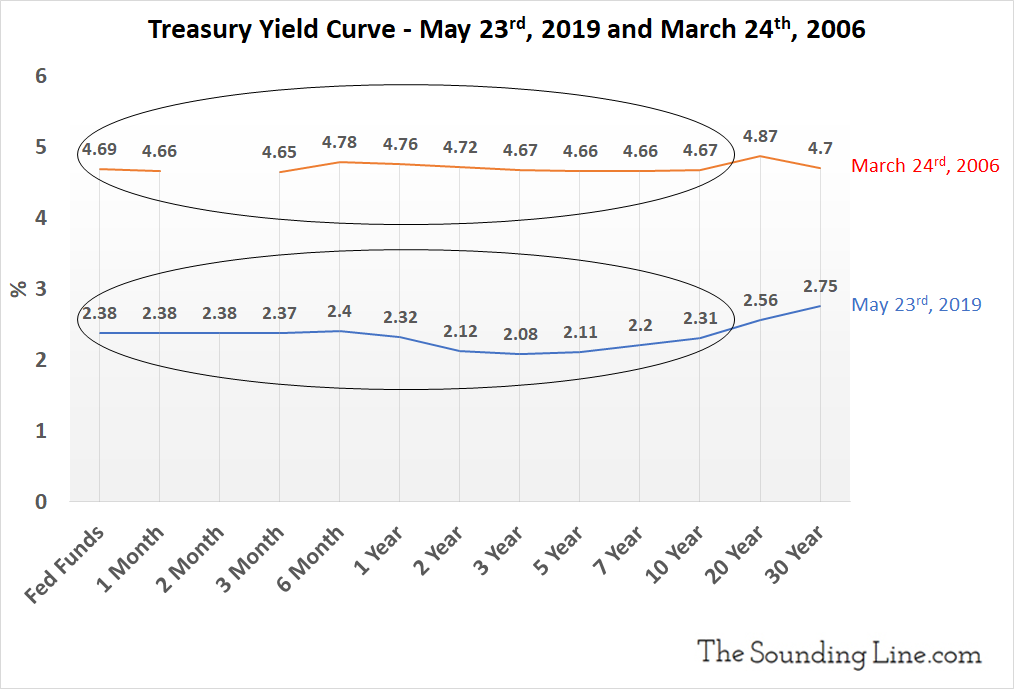

The Yield Curve Is Almost Entirely Inverted

‘Important’ parts of the yield curve significantly inverted for the first time on March 22nd and have inverted on-and-off again since then. As of yesterday, May 23rd, 2019, every part of the yield curve 10-years and shorter is flat or inverted with the Fed Funds rate. Anyone who dismissed the earlier yield curve inversion because it hadn’t been sustained long enough, or because it hadn’t inverted enough, needs to start paying attention. The last time the yield curve was inverted from the 10-year to the Fed Funds rate was March 24th, 2006. Today, the middle of the yield curve is significantly more inverted than it was then and rates are at half the level.

A 3-month to 10-year spread inversion has proceeded every recession since 1957 by an average of roughly one year, and has only given one false positive (in 1965).

The Fed is the Only Show Left in Town

To my eyes, the sharp rebound in markets since the lows on December 26th, 2018 was built on four things: the ‘dovish’ pivot from the Fed, endless jawboning about how close we were to a sweeping trade deal with China, Brexit not happening, and a stabilization in global economic data.

A trade deal with China is now recognized as increasingly unlikely, as any discerning observer should have suspected all-along. While Brexit has not happened yet, yesterday’s MEP election is likely to hand the Conservative party a historic defeat. Theresa May is going to be replaced by someone who is a genuine Euro-skeptic and who has advocated for ‘Hard Brexit.‘ How that individual will actually deliver Hard Brexit is unclear, but that is the direction the UK is headed in. With yesterday’s disappointing PMI survey data, further yield curve inversions, global growth downgrades, and signs of a collapse in Chinese imports, the global economic data is no longer ‘stabilizing.’ It is not necessarily imploding, but it is increasingly hard to argue that it is not continuing to weaken.

Next month, the current US economic expansion will be the longest in American history. The bull market in US stocks is already the longest in history without a 20% decline on a closing basis. Ten years post the Financial crisis and all that is left to the growth narrative is easy money. Frankly, that may be enough to keep the show on the road, but let’s be honest about what we are betting on at this point.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.