Submitted by Taps Coogan on the 15th of July 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

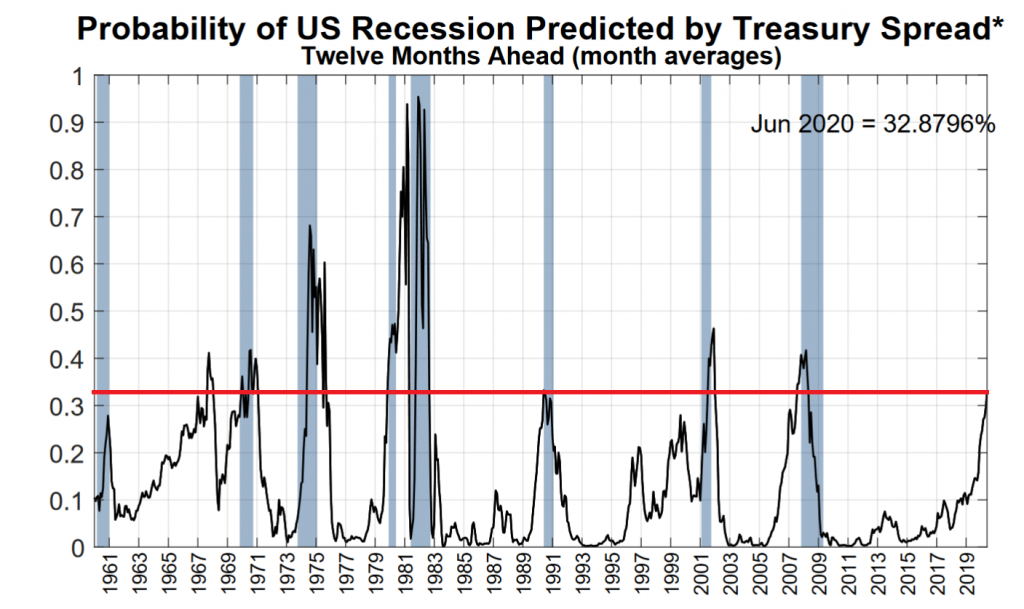

The most reliable leading indicator of recessions since World War II, the treasury yield curve, has now been deeply inverted for roughly two months. Almost every time this has happened since World War II, a recession has ensued within two years. The single exception was in 1967 when it took roughly three years for a recession to arrive.

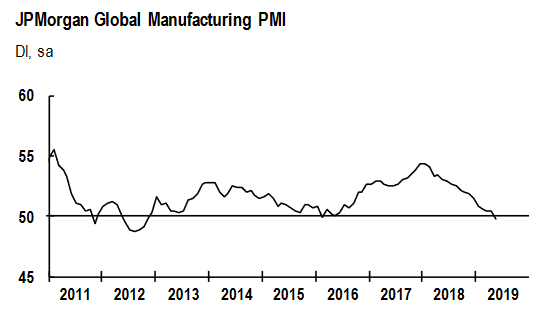

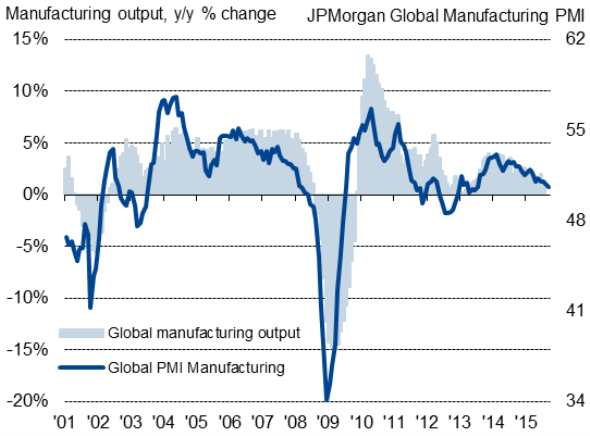

The global manufacturing PMI, another leading indicator that is reasonably well correlated with recessions, is now in contraction for the first time since the European Sovereign Debt Crisis in 2012.

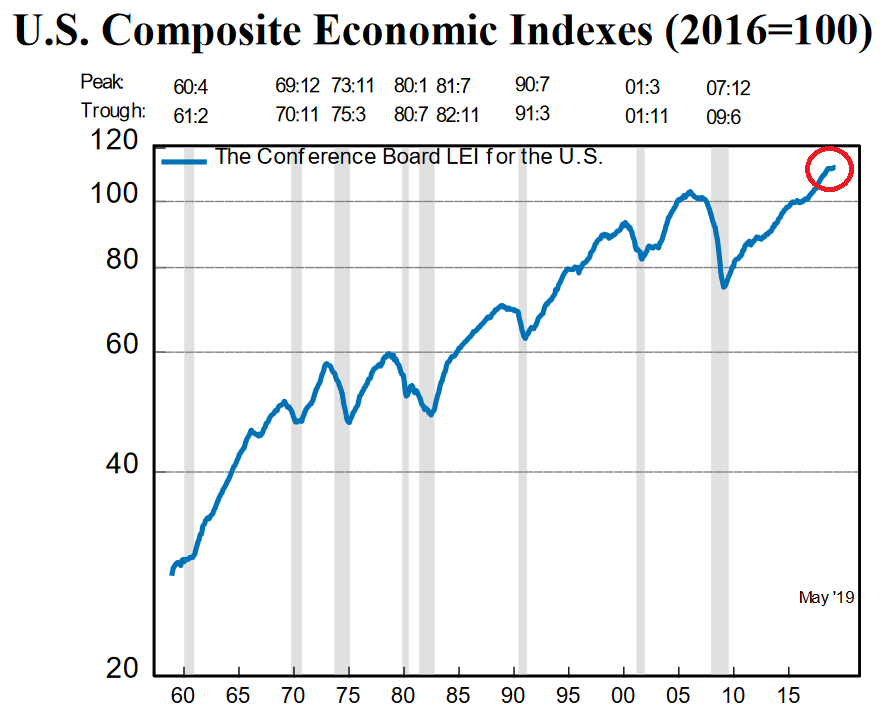

The Economic Council’s Composite Economic Index is also showing the early signs of a slowdown.

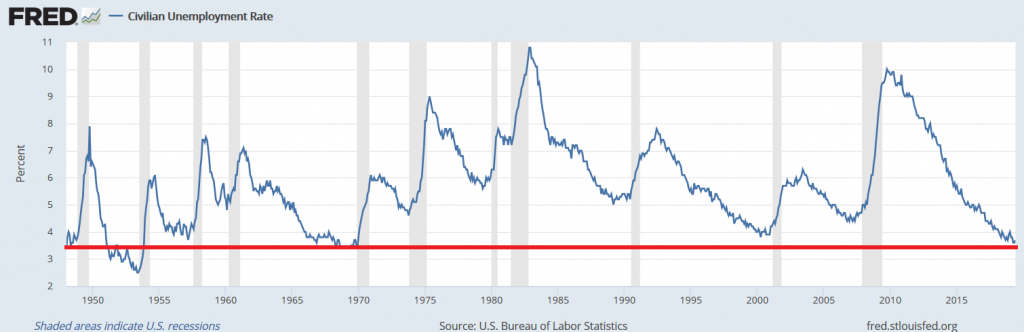

Many point to the strength of the US labor market as the economy’s saving grace. However, the labor market is not a leading indicator and does not linger at full employment for very long. Since WWII, the start of a recession has followed the cycle low in unemployment by an average of less than four months. Since WWII, the unemployment rate has only been lower than it is now (3.7%) for about two years before the 1953 recession and for about two years before the 1970 recession.

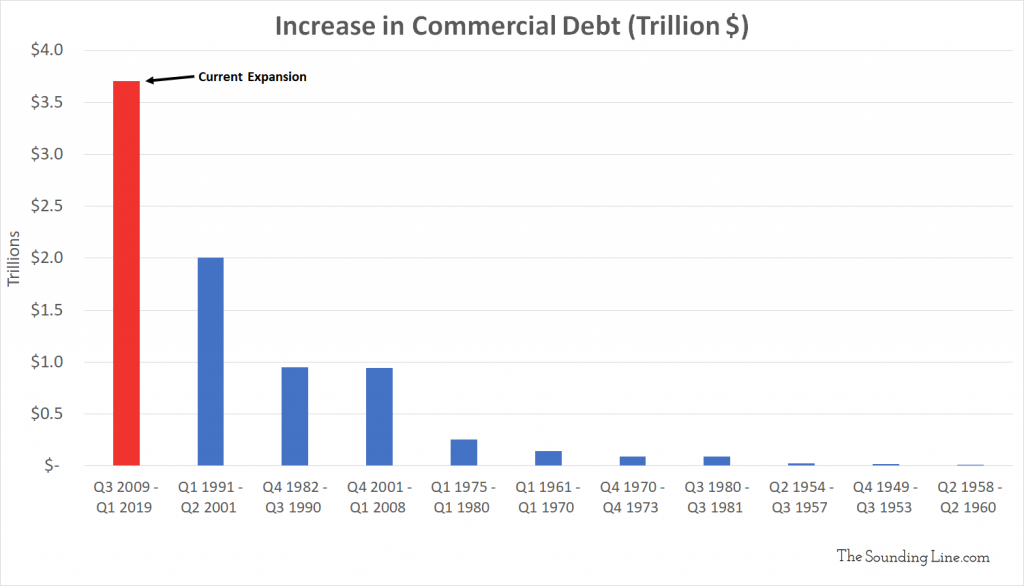

Meanwhile, we are in the midst of the largest increase in corporate indebtedness on record and witnessing the highest government debt levels since WWII. Globally, total debt levels have likely never been higher in absolute terms or relative to the global economy.

A Speculator’s Market

Trillions of dollars of global bonds are pricing essentially no inflation in any developed economy for decades. Meanwhile, equity markets are pricing in a large monetary stimulus but not the recession that usually accompanies it.

What comes next is anyone’s guess. Maybe central banks will flood financial markets with stimulus and push asset prices to the moon. Maybe they will finally succeed in creating persistent inflation. Maybe all of the recession indicators are correct and markets will take a dive.

Whatever the outcome, financial markets are becoming a siren song for investors, pulling them deeper into what is essentially a speculator’s game.

Speculation is defined as the “assumption of unusual business risk in hopes of obtaining commensurate gain.” That sounds like a fitting definition for nearly all so-called investments these days.

Bullish or bearish, it seems unlikely that most investors will find long-term success in such an environment.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.