Submitted by Taps Coogan on the 28th of August 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

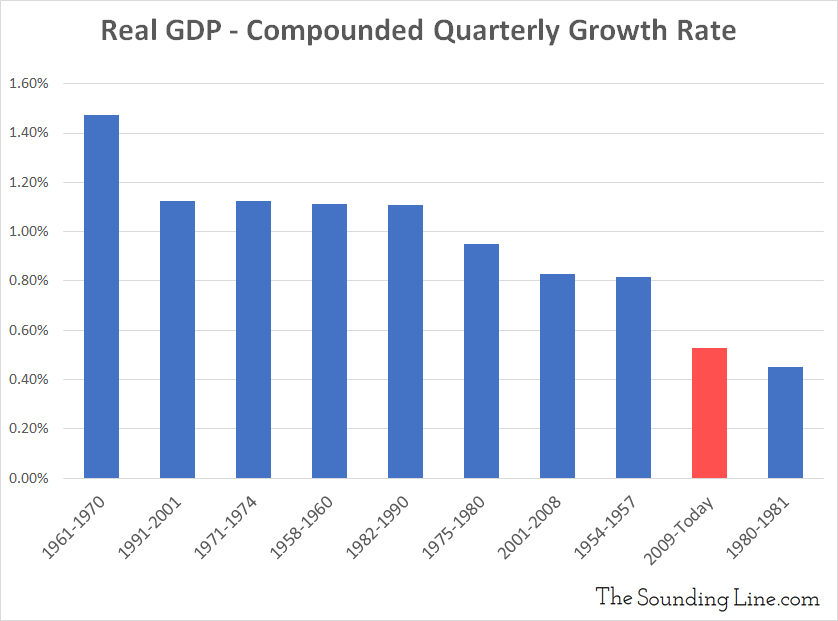

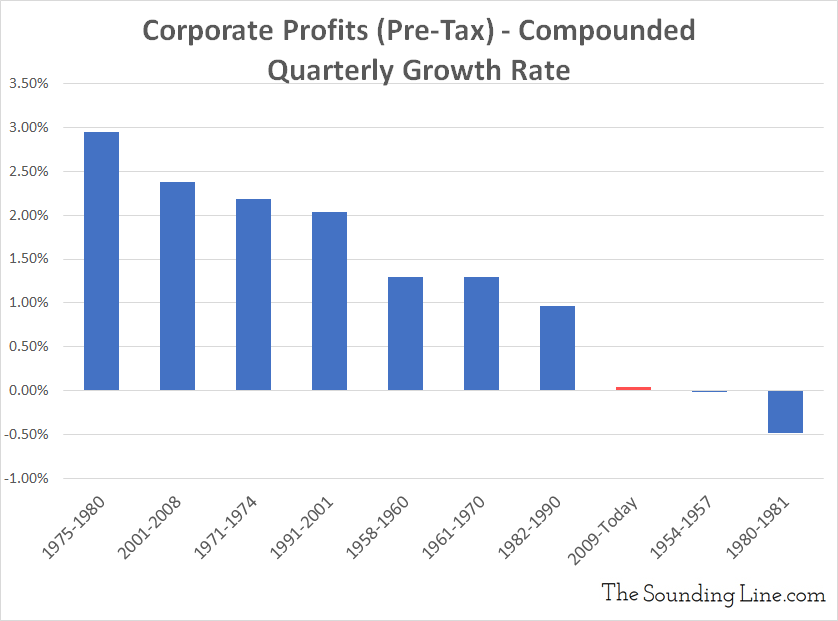

It is a well observed fact that the post-Financial Crisis economic expansion, while long, has been among the weakest in modern history. As we noted here, cycle peak to cycle peak growth rates in real GDP and pre-tax earnings have been among the lowest on record.

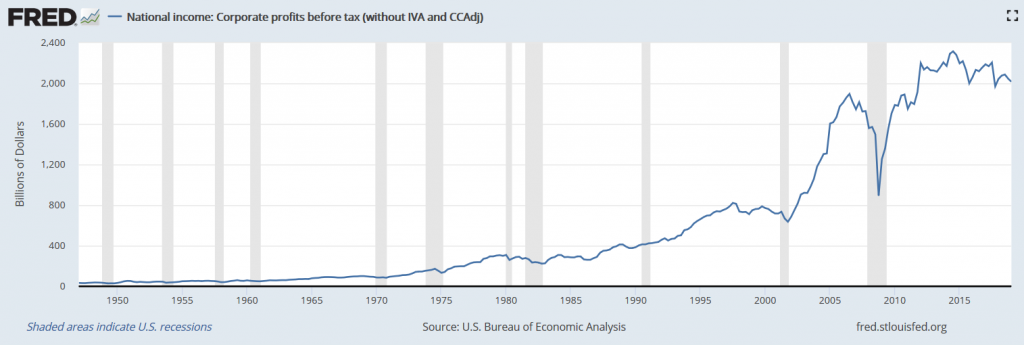

Pre-tax corporate earnings have only grown 6% since their pre-financial crisis peak during third quarter of 2006. When adjusted for inflation, pre-tax corporate earnings have actually fallen 16% since then.

Nonetheless, the S&P 500 has risen roughly 80% since its 2007 peak and total stock market capitalization has risen from 110% of GDP in 2007 to nearly 140% today. The only time that it was higher was in 1999 at the height of the Dot-Com bubble.

The Total US Stock Market Capitalization to GDP Ratio

The current bull market, the longest in American history, has not been built on the strongest economic expansion in history. It has been built on the most accomodative interest rates in recorded human history. That accomodative environment has, in turn, been enabled by years of historically disappointing global growth and ceaseless recession fears. We have stumbled from the Financial Crisis, to the Arab Spring, to the European Sovereign Debt Crisis, to the collapse in commodity prices, to more European sovereign debt crises, to Brexit, to an earnings recession, to a transportation recession, to a Chinese deceleration, to trade wars, and to the current global economic slowdown.

Sandwiched in between those various ‘crises’ was 2017 and 2018, when the US managed to implement some of the only examples of meaningful pro-growth structural economic policy since the Financial Crisis. It is probably not a coincidence that, during this expansion, 2018 was both the strongest year for the US economy and the worst year for the S&P 500. The market only started to recover when everything got gloomy again and central banks started talking about re-accommodating.

Fast forward to today, and everyone, everywhere is talking about a looming global recession. For what it’s worth, I cannot remember a recession that everyone predicted in advance.

As long as it doesn’t get wildly out of control, bad news on trade, more downward growth reversions, and occasional downward volatility in markets are just going to get the central bank printing presses running faster.

Sooner than later, central banks will run out of policy space for further accommodation. Until then, financial markets remain the only transmission mechanism left for economic stimulus. Bad news is good news and more bad news seems inevitable.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.