Submitted by Taps Coogan on the 2nd of October 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

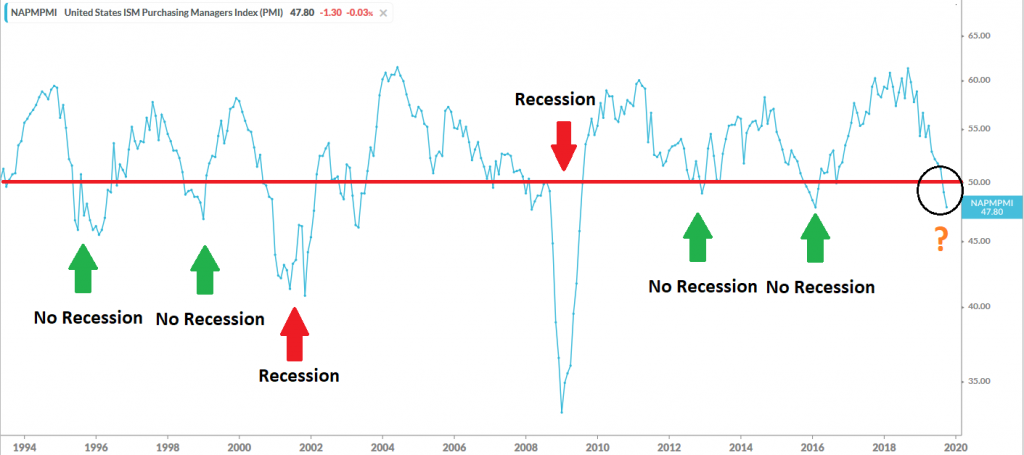

September’s ISM Manufacturing PMI survey results, a measure of manufacturing business activity and sentiment, were a disaster. Not only did the headline number fall to 47.8, nine out of ten of the sub-components are now in outright contractions (denoted by a value below 50). Although the current ISM number is technically the lowest since 2009, practically speaking, it is the same level reached during the economic slowdown in 2015-2016.

Since the early 1990s, the ISM manufacturing number has fallen below 50 six times prior to the current fall (when counting the 2003 dip as a continuation of the 2001 Recession). While all of the falls were correlated to declines in GDP growth, only two led to a formal recession and sustained bear market. In both cases, the number fell significantly below today’s level. Today’s bad ISM reading does not guarantee a recession, but, if it gets much worse, it may.

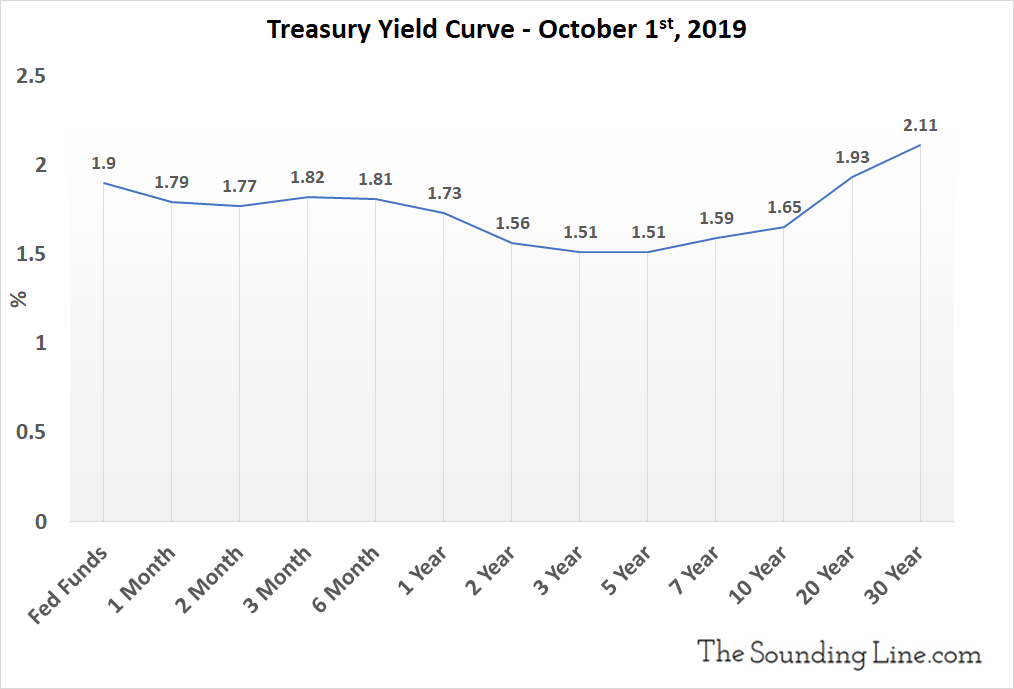

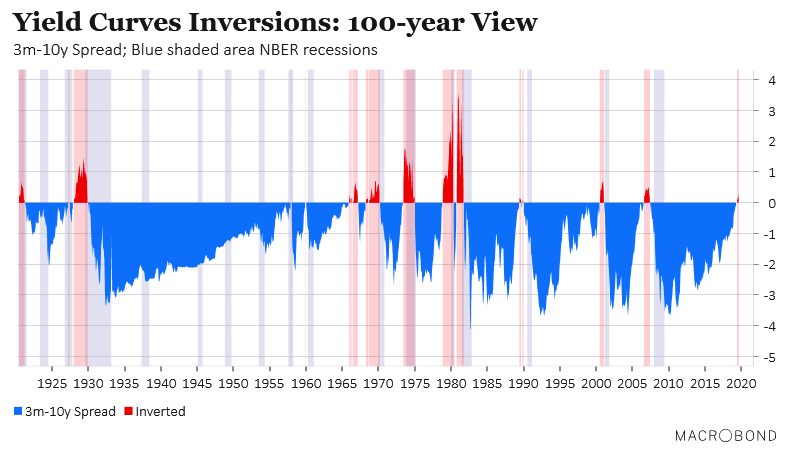

Meanwhile, the US yield curve remains substantially inverted. Large parts of the US yield curve, including the 3-month to 10-year, have now been inverted since May 2019. A 3-month to 10-year spread inversion has proceeded every recession since 1957 by an average of roughly one year and has only given one false positive (in 1966). Prior to 1957, there were many recessions that were not proceeded by inversions, but no inversions that weren’t followed by a recession. Could the current inversion be a repeat of 1966? There are unprecedented distortions in the global interest rates and some peculiar parallels between today and 1966 that suggest that perhaps this is a repeat of 1966. However, the odds are strongly against it.

Another relatively reliable predictor of recessions since the 1960s, the difference between consumers’ expectations about the future versus their confidence in the present, is flashing a recession warning as well. The latest reading showed one of the largest differentials on record.

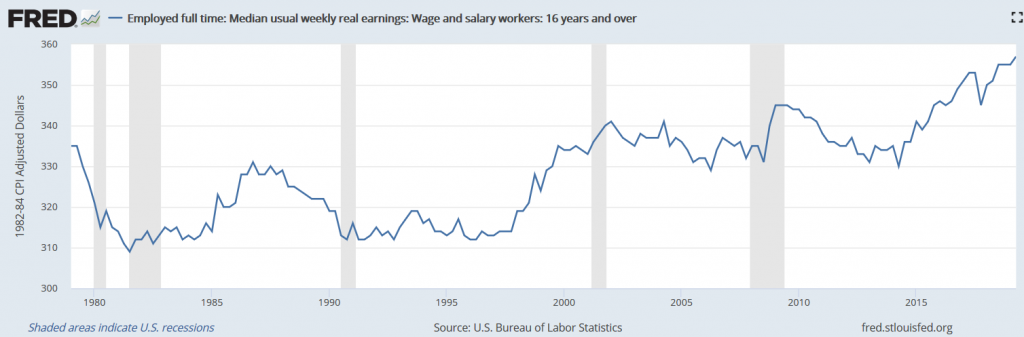

In contrast to these negative leading indicators: present measures of inflation, GDP, bank lending, and money supply growth are above average for this expansion and, in some cases, still rising. Real wages are presently rising at the fastest rate since the 1970s and unemployment is at 50 year lows. Although a recession is looking increasingly possible, it has not started yet. The difference is important.

More than anything else, the proximate factor that tends to turn a looming recession into an actual recession is a crack in the equity market. Once investor confidence gets meaningfully rocked and money gets pulled out of the market, liquidity starts drying up when it’s needed most.

By my estimation, equities have not yet suffered such a confidence-destroying crack. They did, however, fail to robustly establish new highs in August and, at the time of writing, are under considerable downward pressure.

I consider the current situation to be extremely fragile, though not yet broken. If this expansion is going to continue for a meaningful period, US markets must hold on to their increasingly tenuous bullish trend and the torrent of bad news must stop now.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.