Submitted by Taps Coogan on the 4th of November 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

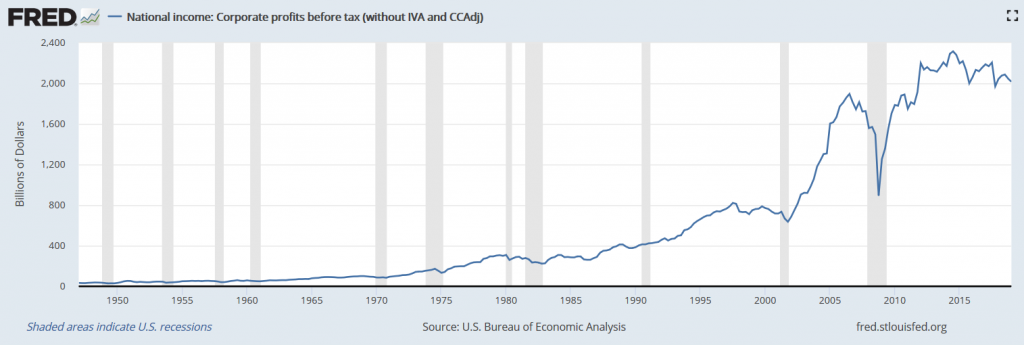

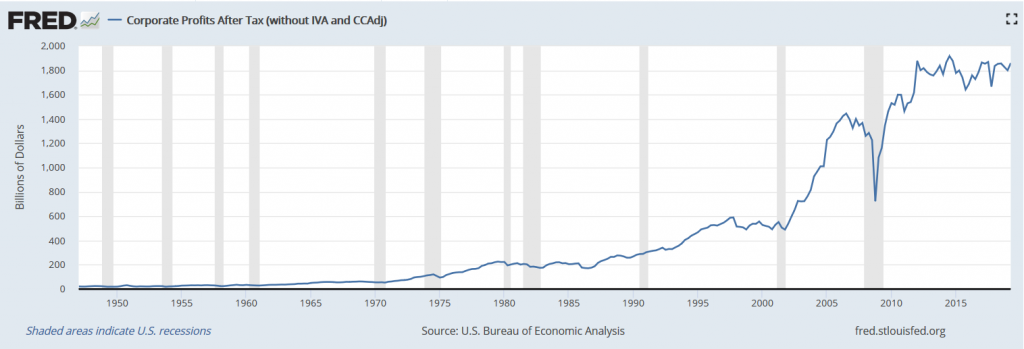

As the third quarter earnings season wraps up, the US corporate sector looks poised for yet another quarter of slightly declining total earnings. For those keeping track, US corporate earnings are still below the level first reached in 2012 (both pre and post-tax). In fact, when adjusted for inflation, pre-tax corporate earnings have actually declined 16% since their pre-Financial Crisis peak in 2006. For all intents and purposes, corporate America hasn’t experienced real profit growth in 13 years and counting. Meanwhile, the S&P 500 has risen roughly 140%.

Pre Tax Corporate Earnings

After Tax Corporate Earnings

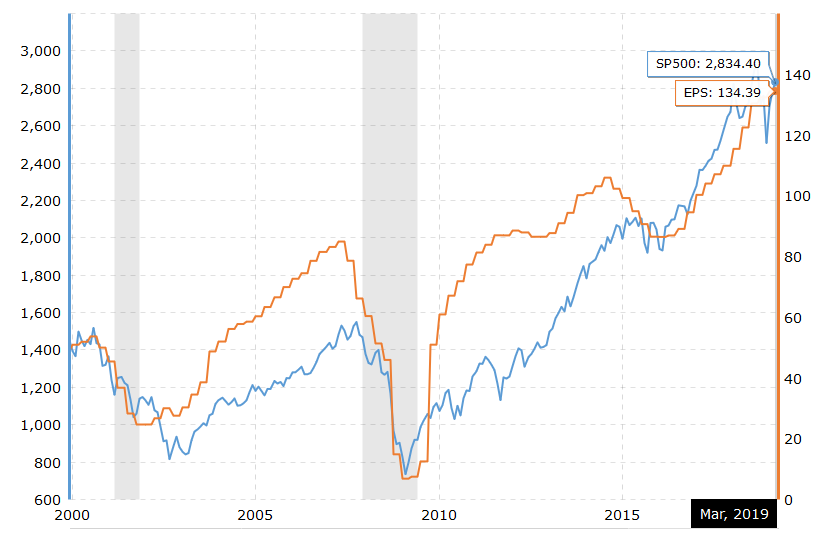

You would never know that US corporate earnings have been stagnating for over a decade by looking at S&P 500 earnings per share, which have largely kept pace with S&P 500 share price gains.

S&P 500 and S&P 500 Earnings per Share

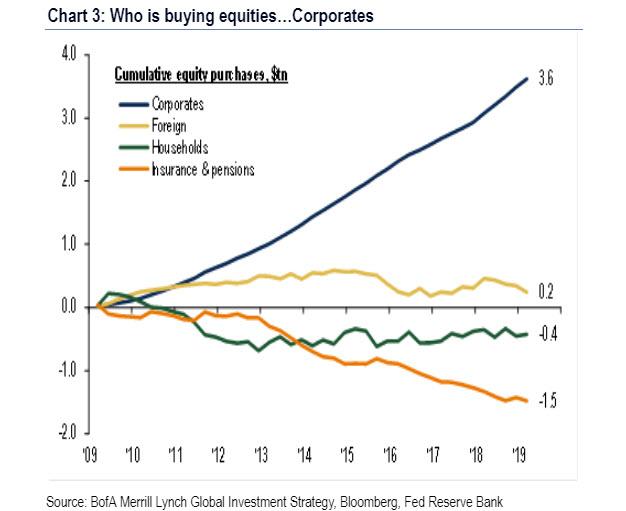

That is because the rise in earnings per share, despite flat-to-declining overall corporate earnings, is mostly the result of falling share counts due to corporate share buybacks. The S&P 500 share count is well below pre-Financial Crisis levels (PDF). In fact, corporations themselves have been the only major net purchasers of US equities since the Financial Crisis.

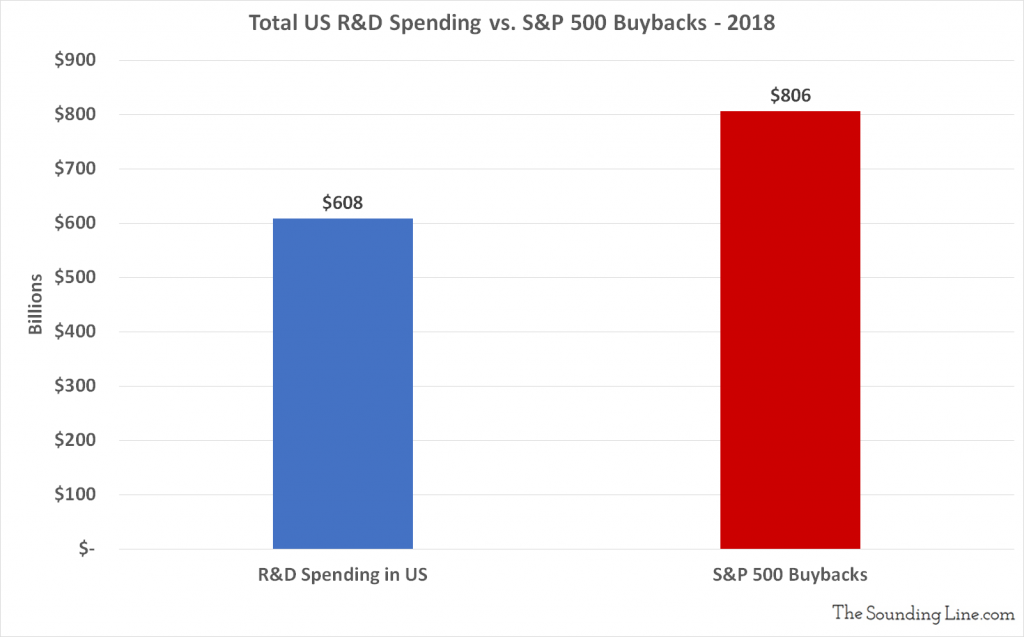

Combined, S&P 500 companies spent over 100% of reported earnings on buyback and dividends in 2018. As we have noted before, buybacks from S&P 500 companies now outpace all R&D spending from all sources in the US economy.

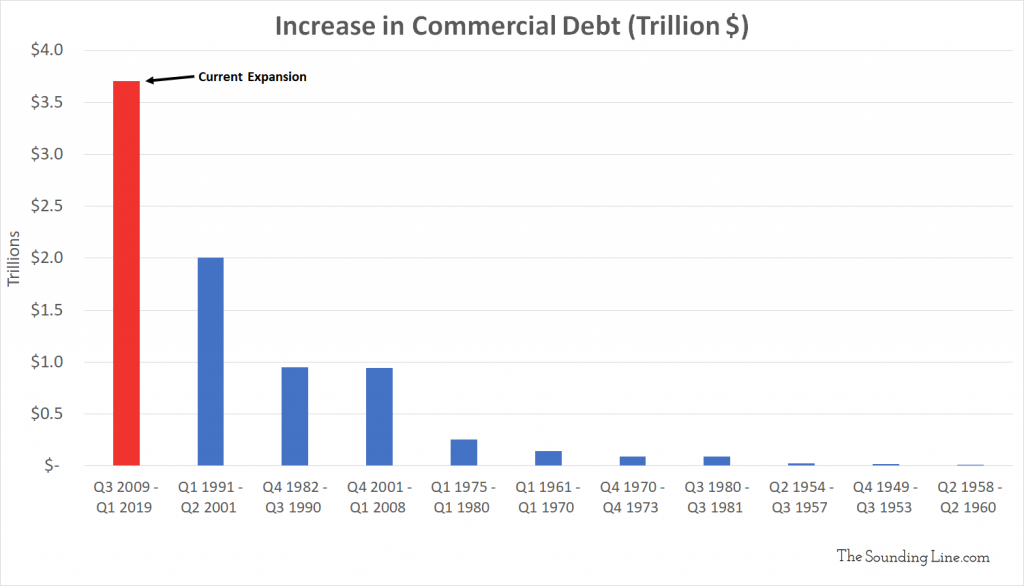

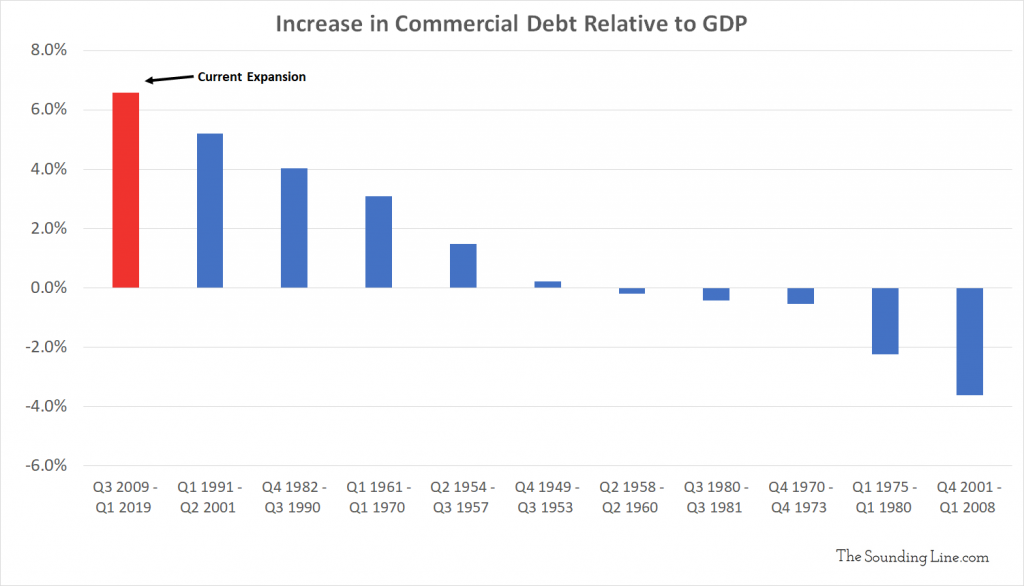

It is not a coincidence that this expansion has also seen the largest increase in commercial indebtedness on record. Commercial debt (bonds, loans, and leases) has increased by nearly $4 trillion since the Financial Crisis, the largest increase relative to GDP on record.

Corporate America has been able to go on a debt binge since the Financial Crisis for one reason: artificially low interest rates. Artificially low rates are keeping debt serving costs manageable and investors unconcerned with bloated corporate balance sheets. It is the main engine keeping share prices marching higher.

In a much more straightforward way, low interest rates are propping up bond and lending markets. The global bond market is now the largest on record in absolute dollar value, and relative to the global economy. Meanwhile, interest rates are the lowest in recorded human history (give or take a month). Concisely, that makes this the largest debt bubble in recorded human history.

Everything in the financial world today is built on a foundation of low interest rates. That foundation of low interest rates is, in turn, predicated on essentially one thing: low inflation, or at least, low inflation the way central banks measure inflation. Simply put, low inflation is what allows central banks to maintain accomodative monetary policies.

It is worth keeping that in mind as central banks constantly bemoan a general lack of inflation. Perhaps it is a blessing in disguise that their policies are so obviously ineffective at creating the inflation that they perplexingly seek. Let’s hope it stays that way.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Low inflation? BY doctored CPI standards, perhaps. But, Financial Asset inflation is the culprit in this most distorted cycle of credit creation in History. Financial prestidigitation is keeping the Lemmings stampeding into over valued, over bought and over bullish markets. As Ludwig von Mises said, “There is no means of avoiding the final collapse of a boom brought about by credit (debt) expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit (debt) expansion, or later as a final and total catastrophe of the currency system involved.”

Agreed