Submitted by Taps Coogan on the 26th of November 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

As has been widely discussed, the Federal Reserve resumed large scale Treasury purchases on October 15th and will be growing its balance sheet by $60 billion a month until at least sometime “into the second quarter of 2020.”

The problem necessitating the Fed’s newest treasury buying program (‘Not-QE‘) is a shortage of the excess bank reserves required to maintain the structure of overnight lending markets at increasingly low interest rates while funding-markets simultaneously digest all-time record high corporate and government bond issuance. Indeed, the need to expand the Fed’s balance sheet (the monetary base) is a predictable reaction to runaway federal and corporate borrowing (we anticipated it, as did others).

Despite the Fed’s ongoing efforts to downplay the significance and impact of its ‘Not-QE’ program, it is the very fact that QE is widely recognized as unwarranted based on current economic fundamentals that makes it so significant. Indeed, ‘Not-QE’ marks the moment when fiscal policy (aka runaway deficits), not economic fundamentals, starts setting monetary policy. To illustrate that point, consider this:

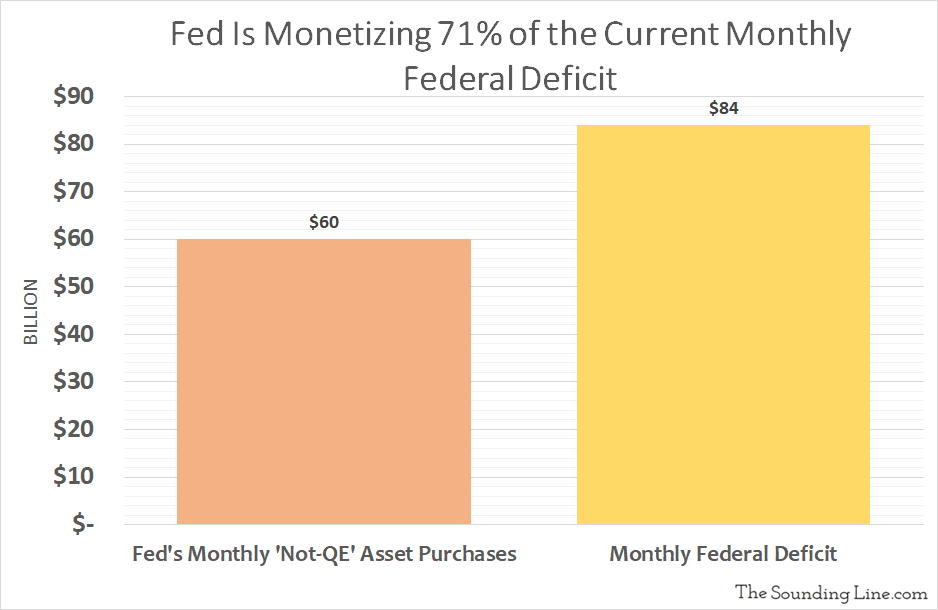

The CBO forecasts that the US federal budget deficit for the current fiscal year (FY 2020) will be an all-time record high of $1.008 trillion. $1.008 trillion equates to a monthly federal deficit of $84 billion. Meanwhile, the Fed is now ‘printing’ an additional $60 billion a month and buying treasury debt in order to expand the monetary base and accommodate growing liquidity demands. In other words, the Fed will be indirectly monetizing 71% of the monthly federal deficit at least until the second quarter of 2020. However, as recently as 2015, the monthly deficit was ‘just’ $27.25 billion. Put differently, if the federal government could reduce its deficit to 2015 levels, it would free up for financial markets almost exactly the same $60 billion of liquidity that the Fed is now printing every month.

Because the federal deficit is universally expected to continue to grow for decades, it seems doubtful that the Fed’s balance sheet growth will be ending any time soon. In any event, it will not end so long as the Fed wants to keep short term interest rates low. Welcome to QE-Forever.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

“Welcome to QE-Forever” Not exactly. It will come to an end. And, when that occurs, it won’t be pretty.