Submitted by Taps Coogan on the 17th of September 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

All other things being equal, issuing bonds does not add to the money supply, as we discussed in detail here. Unless the monetary base is expanding (the Fed’s balance sheet), growing bond issuance means that money has to be diverted from some other part of economy. If bond issuance continues to grow unabated, all other tings being equal, interest rates should eventually rise.

Therefore, the following combination of factors should not be able to persist for very long: the largest and fastest growing US government bond issuance in history, the largest and fastest growing corporate bond issuance in history, nearly the lowest bond yields in US history, tight yield spreads, and a flat-to-shrinking monetary base.

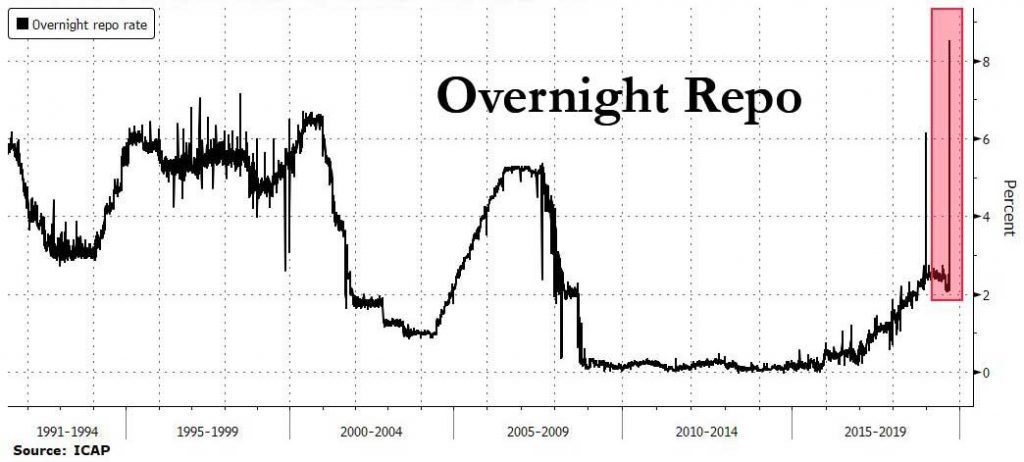

Nonetheless, that it exactly where we have been for much of 2019 and there isn’t any sign that bond issuance will slow down anytime soon. It is an intrinsically unsustainable trend and, as we have discussed many times here at The Sounding Line, it is putting enormous pressure on dollar funding markets. Cracks have been emerging all year and, yesterday, the largest crack yet appeared in short term dollar funding markets. General Collateral repo rates surged by the largest amount on record, almost 8%. It is a major sign of dysfunction in a backbone funding market.

Commercial banks have likely been the main source of the dollar liquidity that has propped up the bond market for the last few years. However, these growing overshoots in short term funding rates point to the following conclusion: banks are running out of the excess reserves required to maintain the structure of short term dollar funding markets.

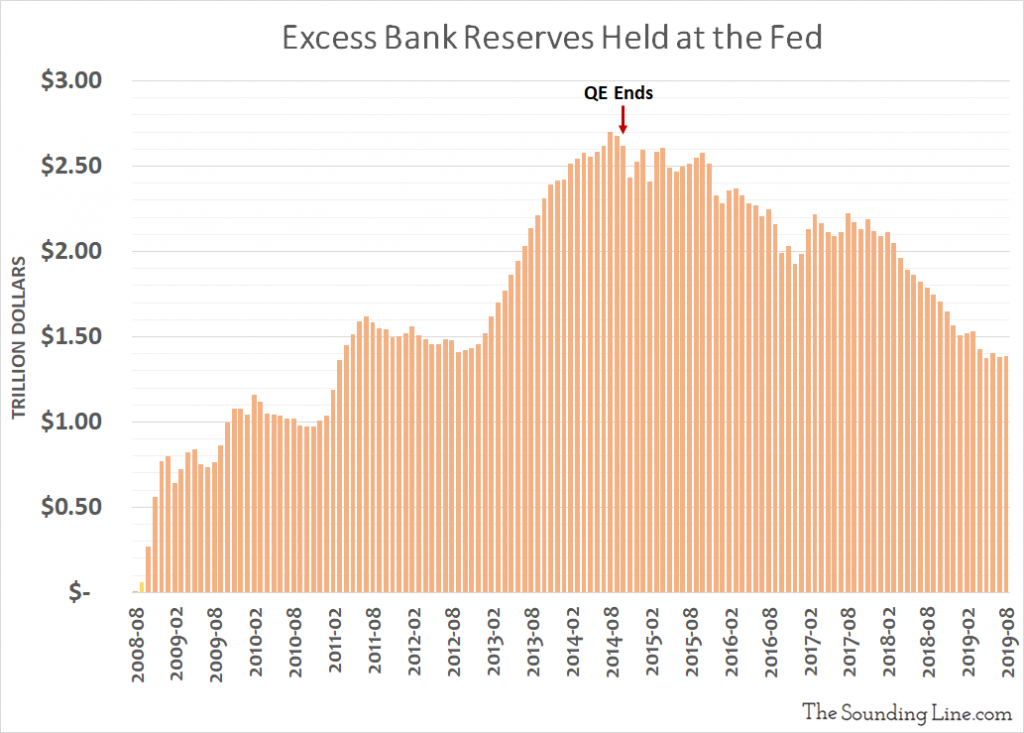

Since the Federal Reserve ended QE in October 2014, excess bank reserves have fallen by $1.23 trillion. While the Fed reports that banks still have $1.38 trillion in excess reserves, that is largely a misnomer. The excess reserve figures published by the Fed refer to reserves in excess of basic monetary reserve requirements, but not necessarily the reserves required by monetary authorities in other countries, reserves needed based on stress testing results, and reserves needed to meet a variety of other banking regulations that have emerged since the financial crisis. The degree to which bank reserves are truly in excess of all of the various other reserve requirements is largely unknown. Arguably, the only way to know that the overall banking system’s excess reserves are dwindling is that it would cause the Fed Funds Rate to rise above the IOER. That has been the case since March.

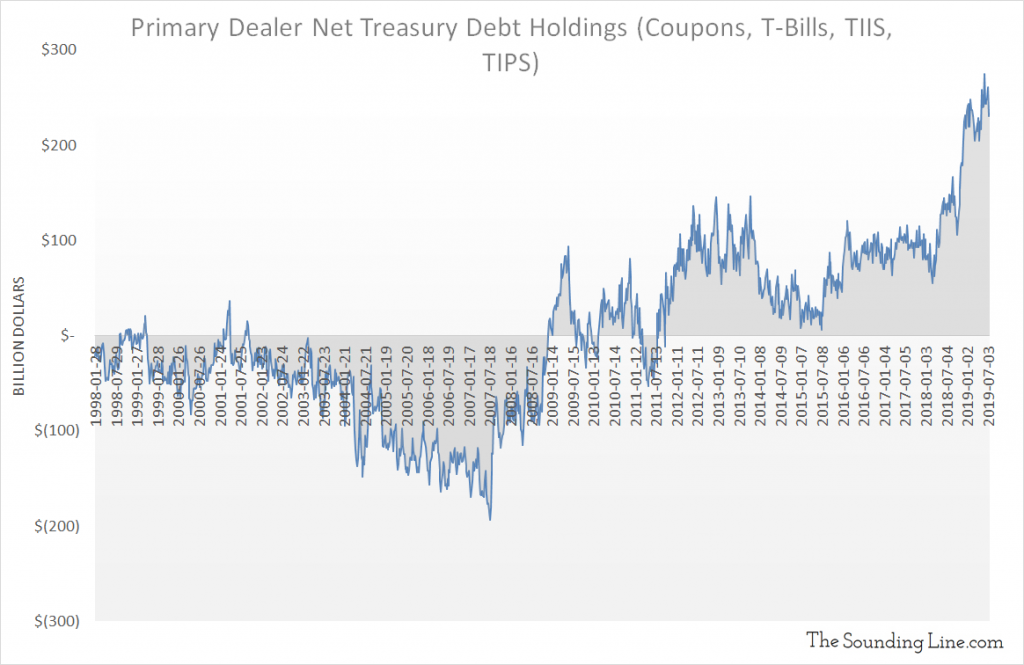

The other main source of dollar liquidity has been primary dealers which have soaked up an extra $100 billion of US treasuries this year, pushing their holdings to record levels. That cannot continue forever.

There is a looming US dollar liquidity shortage. If the Fed wants to keep interest rates low while the US government and corporate America continue their historic borrowing binge, the Fed is going to have to restart QE sometime very soon. When they do, remember that it has little to do with stimulating the economy and everything to do with unsustainable deficit spending.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.