Submitted by Taps Coogan on the 9th of February 2020 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

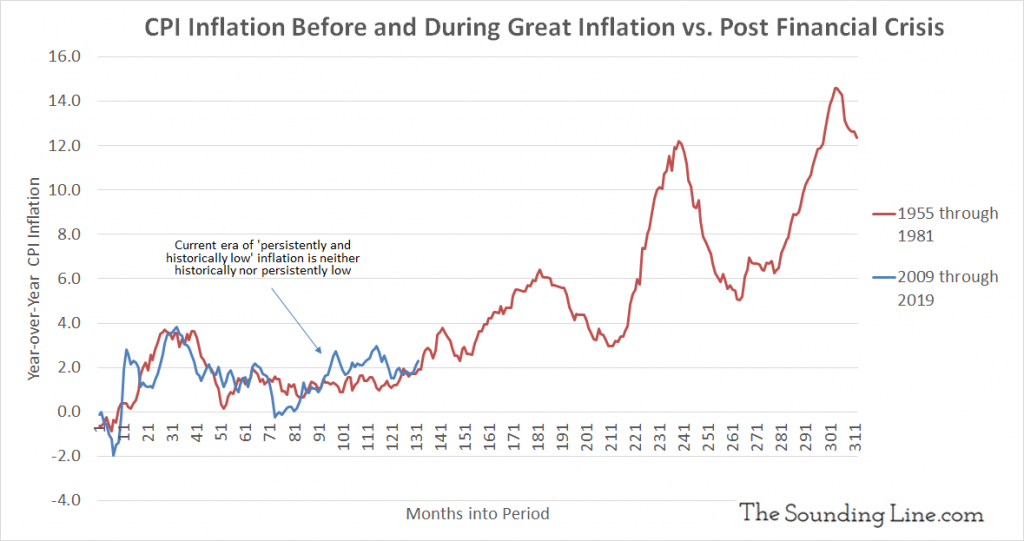

You would never know it while listening to today’s central bankers bemoan ‘historically and persistently low inflation,’ but inflation was actually lower during the decade that proceeded the ‘Great Inflation’ of the late 1960s and 1970s than it has been during the past decade.

From 1955 through 1965, just prior to the start of ‘Great Inflation’ in 1966, CPI inflation averaged just 1.5% per year. Over the past ten years (2009 through 2019), CPI inflation has averaged 1.8%. Those who think that today’s ‘low’ inflationary environment has been historically low or long, caused by some previously non-existent economic force, or that technological advancements are the determinant factor driving inflationary trends are encouraged to examine the chart below.

Jerome Powell best encapsulated today’s obsession with the idea that inflation is somehow historically and persistently low when he declared that the inevitable return of interest rates and inflation to 0% was the “greatest monetary policy challenge of our time.”

Not only has inflation remained lower for longer in the past, the last time it did so, it didn’t end with interest rates back at zero. It ended with over 20 years of disruptively high inflation.

Ignore for the moment that today’s ‘low’ CPI inflation is simply a statistical artifact of averaging compulsory expenses with high inflation rates (education, healthcare, housing) and discretionary purchases with low inflation rates (toys, phones, etc…). The implication that low inflation has become an impediment to growth doesn’t really stand up to examination. Several of the most robust periods of economic growth in American history have occurred despite, because of, or perhaps entirely unrelated to low inflation and outright deflation. Nearly the entire 19th century, which saw rapid technological advancement, industrialization, and economic growth in the US occurred despite outright deflation at most times. More recently, the 1950s and 1960s, arguably America’s economic golden era, witnessed lower inflation than today.

Today’s obsession with getting 1.6% PCE inflation to 2.0% at any cost is simply the inability of central bankers to accept that an economic expansion will not conform to a completely arbitrary 2%-at-all-times-for-all-countries PCE inflation target. Considering that the very same central bankers consider today’s roughly 2% real GDP growth rate to be inline with long term potential, expanding the monetary base of the US by several percentage points of GDP in order to close a 0.4% shortfall in PCE inflation completely dismisses the wildly more dangerous risk that this period of low inflation will end exactly the way it did last time or that inaccurate inflation measures are understating today’s true inflation rate.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Much of the 70s inflation flowed from higher oil prices and the bill from Vietnam War spending. A new wave of inflation will soon be washing over us..

Which is why I think the potential peaking in US shale output is really important, even if it makes for pretty dry reading

The oversupply from Asia began about then so difficult to determine cause and effect. I studied the period to try and show what happened.

I’m so tired of hearing about this “low” inflation nonsense………A fucking #11 and Carl’s JR is over $10 mother fucking dollars……enough already. A fucking starter home is $600K…….and my income hasn’t increased since 1997. So take your low inflation nonsense and shove it.

I agree that official inflation measures are understating real inflation, particularly for items that consumers can’t do without (education, healthcare, food, housing etc…), by averaging it with cheap junk that doesn’t matter (toys, phones etc…). I have have written about that before. The point of this article is that even the official numbers are not all that low by historical standards

The two industries with the most government involvement are healthcare and education, the two industries with the largest price increases for the last 2 decades are healthcare and education. The reason given for such government involvement in healthcare and education is ……to control costs. And I was ranting a bit in my original post because I keep hearing this “inflation targeting” bullshit with endless articles about the “lack” of inflation……in the age of zero wage growth (and I have a rant on the “wage growth” articles I’ve been seeing as well) ANY inflation is a killer.

Couldn’t agree more

I guess we will just ignore the fact that CPI is a poor proxy for inflation

True, and the point of this article is that, even by official measures, it’s not low all that low. I added a sentence to that effect, if it wasn’t clear

Good Job. Have a history of US banking on the net and this made a great addition. Not crazy about the graph so I made a few changes.

Thanks

Feel free to use it. link would be appreciated.

Thanks. Will keep the site in mind for future articles and will link to if I use it.