Taps Coogan – December 30th, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

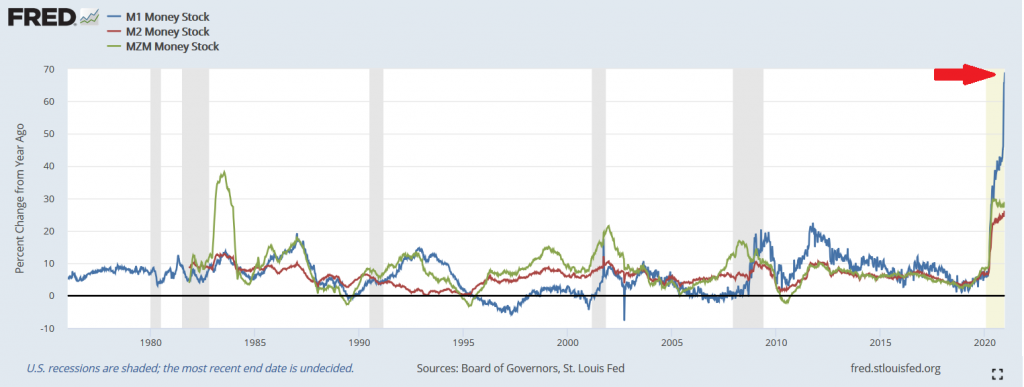

The year-over-year growth growth rate of the M1 money supply just keeps pushing relentlessly higher. As of the most recent data from mid-December, it is running at a 69%, the highest rate on record by a country mile.

M1 money, the narrowest measure of the money supply, includes cash, coins, savings/checking accounts, and similar types of money. M2 and MZM, broader measures of the money supply, remain near-or-at record growth rates as well, albeit lower than M1.

We keeping reporting on the acceleration in the money supply because every few weeks the numbers just keep pushing into previously unimaginable territory. These kinds of growth rates are simply historic.

Furthermore, whereas prior QE programs did not have a clearly observable impact on the money supply, today is different. The fusion of QE-Infinity and Congressional stimulus/transfer payments (helicopter money) is translating directly into the money supply. The argument that because prior QE programs didn’t create more consumer inflation, QE-Infinity won’t either should be treated very skeptically.

Keep in mind that all of these figures predate the most recent stimulus bill and, of course, any follow up bill to push the transfer payment checks to $2,000.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. Also, please consider sharing this article so that we can grow The Sounding Line!

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

People should be forced at gun point to talk about these narrow “money” measures velocity components as well… M1V, M2V, MZMV… more “money” going nowhere fast…

I used to talk about velocity a good deal. The problem is that it isn’t a measured value. It’s inferred. They just divide GDP by the money supply. In an environment where the money supply isn’t changing much, it has some limited information value. But in a wild money supply growth environment like today, it produces a number that tells you that the economy doesn’t grow as fast as the Fed prints, which is both obvious and meaningless.

If it were both obvious and meaningless, people wouldn’t be arguing over whether there is inflation and what kinds may be present or not, yet that isn’t the case at all… and assumes that any of these M* measure equate to what is used as money in the modern sense and not some textbook egg head sense…

My comment probably sounded snarkier than I intended. I just mean that the way velocity is calculated is by dividing GDP by money supply, and GDP is much bigger the money supply. So unless GDP grows at the same % rate as money supply (which implies a larger $ value growth), velocity will fall when there is a lot of liquidity creation. Basically new liquidity has to create many multiples in GDP for velocity to not go down, which it doesn’t. Velocity basically just tells you if the money supply is expanding quickly or not. If it is expanding, velocity… Read more »

The huge jump in the size of the money supply means that if economic activity ever really picks up (which it presumably will), there will be way too much money sloshing around. Velocity could still be very very low at that point and just a small increase could cause a lot of inflation.