Submitted by Taps Coogan on the 11th of February 2017 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

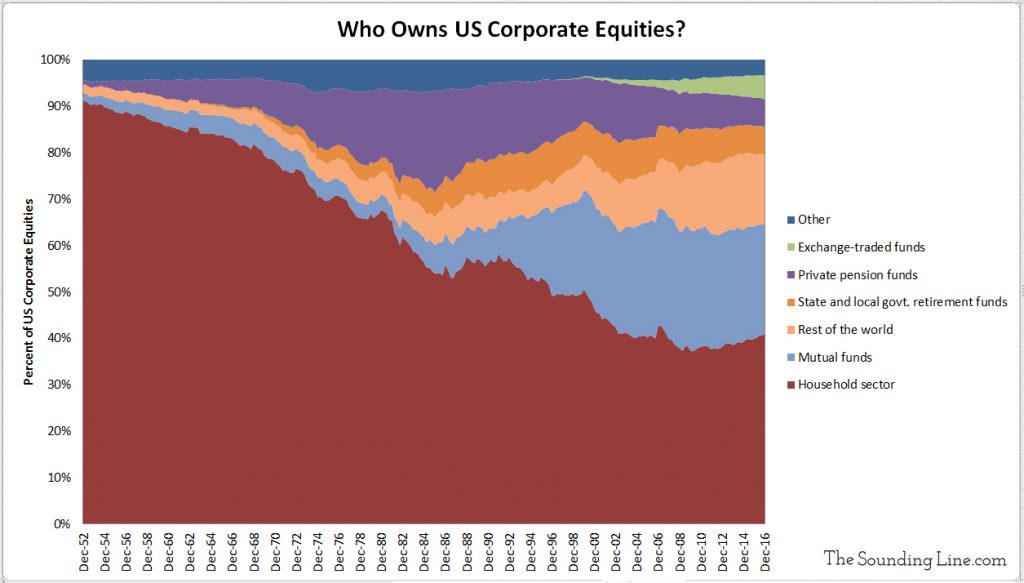

During America’s industrial heyday in the 1950’s and ‘60s, the vast majority of individual corporate equity and stocks were directly owned by individual American households. As these stocks gained in value during decades of rapid advances in technology and productivity, the gains and dividends benefited American households directly.

Yet times have changed. As the following chart shows, American households have gone from directly owning over 90% of corporate equity in 1951 to owning just 40% today. In place of households, have come mutual funds, ETFs, and foreigner investors, which together now own nearly 50% of all US corporate equity. To be clear, American households in turn own a great portion of mutual funds and ETFs, but this is not the same as direct ownership. The little known secret about mutual funds is that 99.6% of them underperform basic market indices like the S&P 500. For the ‘privilege’ of having your money managed by mutual funds, they will then charge fees which eat up gains and deliver lower returns. The rent seeking mutual fund industry has managed to insert itself between American households and direct ownership of equity while producing arguably no value. The same is true, to a lesser degree, of many ETFs which increase market volatility and leverage, charge fees, and have been shown to lead to speculation and lower returns. Many companies which once gave their employees direct company stock as part of their retirement benefits have deferred to 401(k)’s which often forbid the direct purchase of stocks in favor of mutual funds and ETFs.

Also visible in the chart below is the decline in pension funds and government retirement plans which are increasingly liquidating their assets as they fight a losing battle against demographics and low labor participation.

The American household has been sidelined from direct participation in equity markets and thus the behavior of the market has changed. Increasingly, foreigners, money managers, and derivative products like ETFs, are driving the market.

The next decline in stock prices will largely be a question of what drives these players to sell, and how rapidly they unwind, and less a question of what household investors do. While mutual fund managers may seem like a steadier hand in turbulent times, replacing millions of individual investors with a handful of managers (with questionable track records) and highly leveraged ETFs reduces market liquidity and increases its circularity. When the market does eventually dip, all bets are off.

If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any spam.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.