Taps Coogan – February 13th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

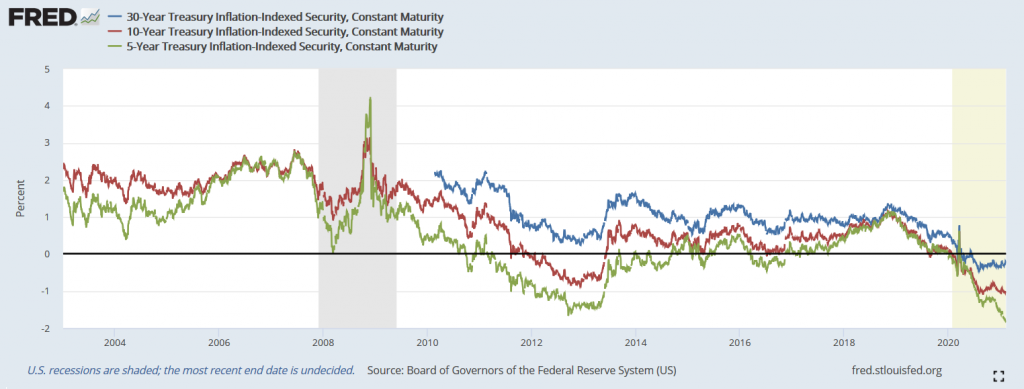

The 30-Year TIPS has been trading with a negative yield since last March. The same is true for the 10-Year TIPS and the 5-Year TIPS.

5-Year, 10-Year, and 30-Year TIPS Yields Are All Negative

These negative TIPS yields are saying that investors expect inflation to exceed nominal treasury yields over a five, ten, and thirty year time horizon.

Does that mean that investors will automatically lose purchasing power by holding onto Treasury bonds? No. If yields fall further, investors can sell their bonds for a capital gain before they mature and if growth disappoints and CPI comes up short, the real yield on these bonds may turn positive again. Neither prospect is all that unreasonable, especially with the Fed promising to suppress yields for the foreseeable future.

However, for the beleaguered Social Security Trusts, which are 100% invested in non-marketable treasury debt, falling yields do not offer an opportunity to capture capital gains. For better or worse, the trusts are prohibited from trading their securities like a hedge fund or buying other assets. That means that for the Social Security Trusts, if real yields end up being negative over the lifetime of these bonds, returns will fail to keep pace with inflation and they will lose purchasing power.

Meanwhile, Social Security outlays are indexed to increases in inflation.

If the TIPS market’s inflation forecasts are correct (they aren’t perfect), the Social Security Trusts’ returns are going to be negative on an inflation adjusted basis for the next 30 years. Unfortunately, the Social Security Trust fund was already starting to shrink on an absolute basis before Covid struck and decimated the US workforce.

To keep Social Security solvent, either the Fed has to relent in its plan for perpetually negative real rates, payroll taxes need to be raised, or the retirement age must be increased.

Of course, the best outcome would be an extremely robust increase in economic growth along with a massive expansion in labor participation and wages. As we have been saying since day one of this website, accelerating economic growth is the only ‘good’ solution to most of these problems. Economic policy should be singularly focused on attempting to produce it lest we will succumb to a self-reinforcing loop of slowing growth, increasing debt, rising taxes, and general suffering. It’s never been more important.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. The Sounding Line is now ad free and 100% reader supported. Thank you to everyone who has donated.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.