Submitted by Taps Coogan on the 3rd of May 2017 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

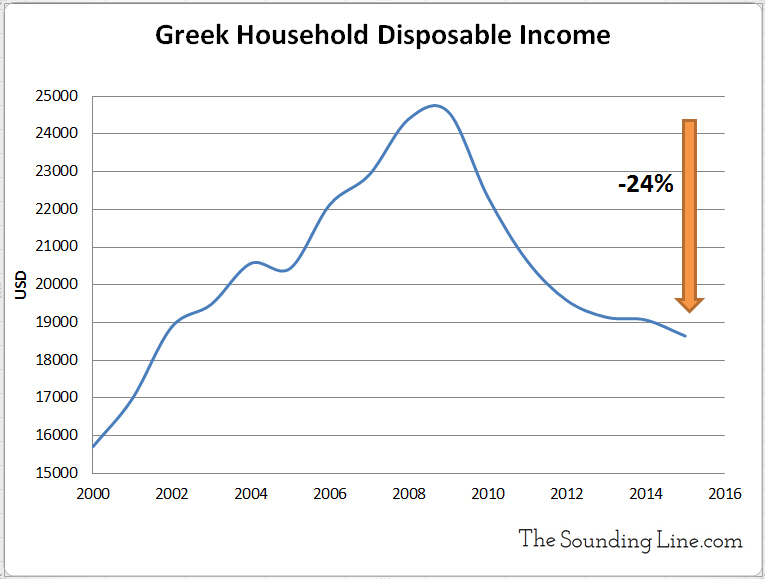

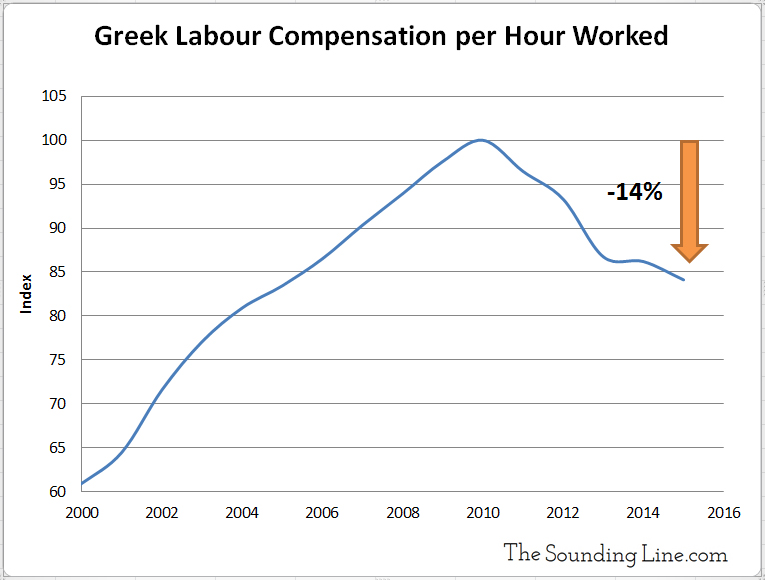

We have written about the worsening Greek debt crisis many times here on The Sounding Line (most comprehensively here). In a nutshell, the Greek debt crisis started in 2010 with a national debt of 329 € billion. After more than 435 € billion in bailouts, debt restructuring, and new loans from the EU and IMF, today Greece owes 350 € billion. Meanwhile, its economy has shrunk by an astonishing 45%. Despite having all but disappeared from the news cycle, the Greek debt crisis has never been worse. As the following charts show, the result is that the Greek people continue to suffer. Household disposable income in Greece has fallen by a record 24% since 2009 and hourly wages have fallen nearly 14%. Neither show any sign of recovering.

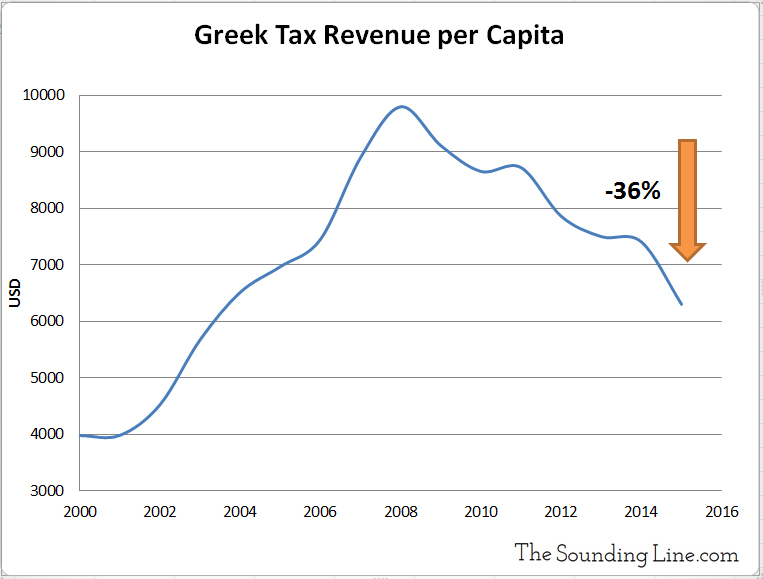

Accordingly, Greek tax revenues per capita have fallen nearly 36% since 2008.

How Greece can continue to service a growing debt with a shrinking economy and declining per capita tax revenues is clear: it cannot. As we have stated several times, one way or another, Greece is going to default. It might be called debt re-profiling, or debt forgiveness, or it might be through the introduction of a new currency. The fact that Greek 10-year sovereign bonds are trading at 6.7% (at the time of writing) is one of the wonders of the modern financial world.

P.S. We recently added email distribution for The Sounding Line. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.