Taps Coogan – May 30th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Back in mid March we posted an articled titled ‘Inflation Headed Above 3% in the Next Few Months?‘ in which we observed the correlation between the ISM Prices Paid index and CPI inflation, coming to the fairly straightforward conclusion that CPI inflation was “probably (headed) over 3%, and possibly over 4%, in just a handful of months.”

Two months later and CPI is sitting at 4.2%.

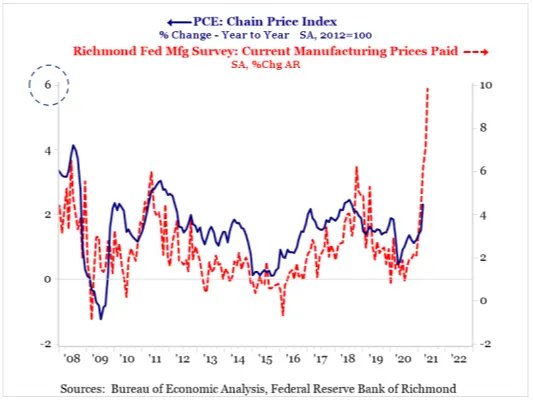

Today, we share the following chart from the Strategas via Jesse Felder. It shows a very similar relationship, this time between the Richmond Fed Manufacturing Prices Paid index and the PCE inflation rate (which is generally lower than CPI). This chart was published before the most recent PCE inflation data for April, which came in at 3.6%. It points to PCE inflation hitting something in the ballpark of 6% in the coming months.

Similarly to what we said back in March, PCE inflation likely won’t be 6% next month, but make no mistake, it’s pointed in that general direction. 4% seems probable. 5% is entirely possible.

It’s been somewhat amusing to watch acolytes of the ‘transitory inflation’ narrative react with shock to the recent spike in inflation as though somehow the act of declaring inflation ‘transitory’ would mean that it wouldn’t happen at all.

The transitory inflation resulting from shutting and reopening the entire global economy, expanding the monetary base by ~25%, and sending Americans trillions of dollars spending money is going to last longer than one month.

In the long run, the Fed may end up being right about transitory inflation, though based on the skittish reaction to March’s hot numbers, not before they get scared and change their minds. Indeed, that’s the Catch-22 of the whole thing. Transitory inflation is going to be surprisingly stiff right up until the moment that the Fed starts to worry that it isn’t actually transitory. Then we’ll be left with a highly indebted and over financialized economy, rising taxes, a shrinking workforce, and a Fed that’s getting worried about inflation.

Maybe the Fed should start interpreting “price stability” to mean “price stability.” That is to say, it might want to consider not incentivizing the sorts of asset and debt bubbles that drive out of control inflation followed by out of control deflation.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.