Taps Coogan – July 29th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

We’ve covered this topic a number of times because it is one of the most intellectually lazy narratives we’ve seen put forward by the Fed and Janet Yellen: the notion that falling nominal treasury yields are signaling falling inflation expectations.

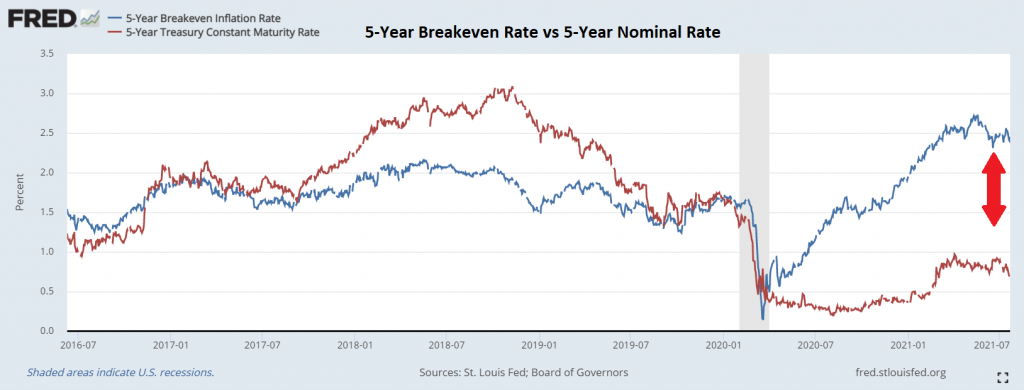

Forget that the Fed has bought most treasury issuance this year. Here is a chart with nominal 5-year treasury rates and the 5-year TIPS breakeven rate: the treasury market’s own implied average inflation rate over the next five years.

The only the thing the treasury market is saying is that it the Fed’s QE program has massively detached it from its own inflation expectations, expectations which remain near 13 year highs.

Inflation may go up, it may go down, but pointing to falling nominal treasury rates as an indicator of the later is not even consistent of the treasury market’s own measure of inflation over the next five years.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.