Submitted by Taps Coogan on the 25th of May 2017 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

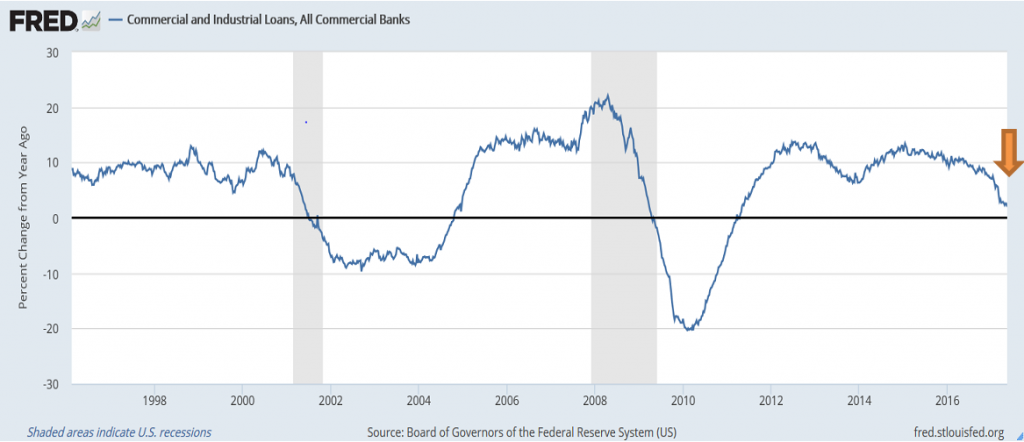

Back in early April, here at The Sounding Line, we warned of decelerating US corporate debt growth consistent with the deteriorating economic conditions of a recession. Along these same lines, we now present the following chart which shows a similar deterioration in commercial and industrial debt growth, a much broader measure of business lending, which includes all non-financial business lending such as non-corporate and private companies.

Typically, commercial, industrial, and corporate borrowing slows during or preceding recessions, as weakening economic conditions drive companies to shelve investments, expansions, and spending. The lack of business spending in turn dampens economic activity and reduces the supply and velocity of money in the economy. This creates a negative feedback loop that recessions feed off of.

All eyes should be on these indicators as continued weakness will make a formal recession quite likely.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.