Taps Coogan – September 17th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

Just a couple years ago, one of the main critiques of the decade long bull market in the S&P 500 was that the robust earnings-per-share growth of the prior years was the result of share count reductions via buybacks while overall corporate earnings languished.

In further evidence of just how ‘crazy’ the world has become in the last 20 months, the new bull market has completely disconnected from even those earnings-per-share estimates, as the following chart from Michael A. Arouet shows.

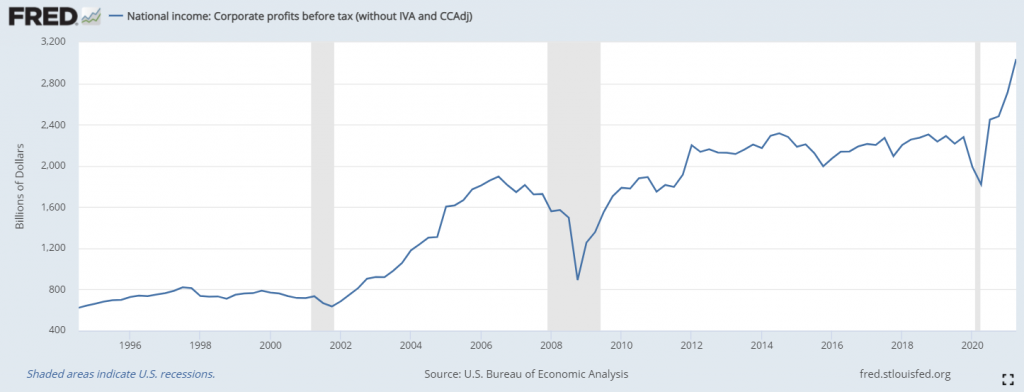

And yet… despite the S&P 500 running well in advance of earnings per share estimates, actual earnings, which flatlined for nearly a decades prior to Covid, have gone through the roof thanks to endless waves of stimulus.

Before Covid, when overall earnings growth was bad, all that mattered to markets was earnings-per-share. Now, that overall earnings are great, lagging earnings-per-share no longer matter. If you’re trying to make sense of any of this, you’re missing the point. The Fed is ‘printing’ $120 billion a month and buying financial assets. That’s what matters and efforts to fit a fundamentals driven narrative to rising asset prices are just that: a narrative.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.