Taps Coogan – October 5th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

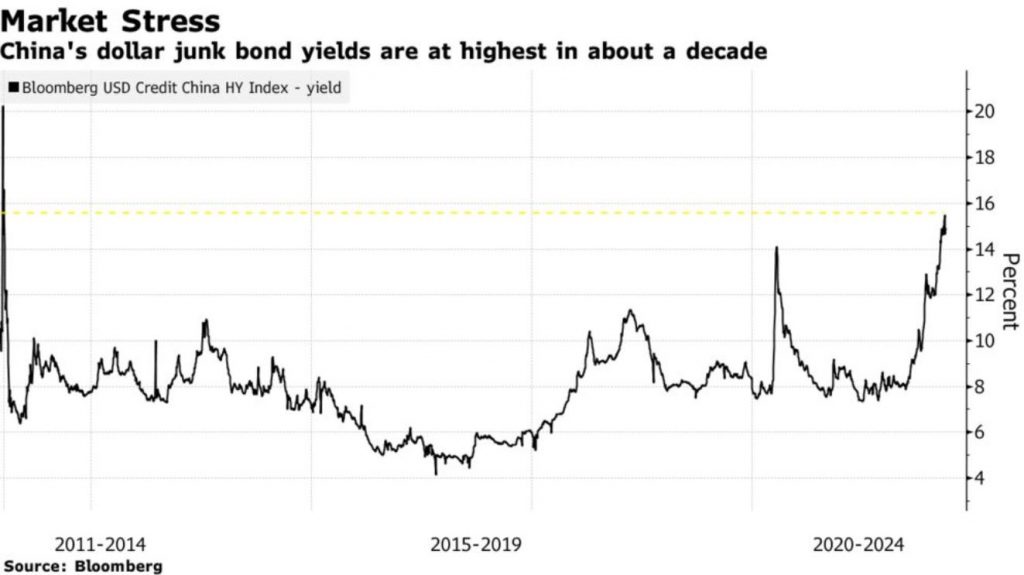

Nearly a month ago, we warned that Chinese dollar denominated junk bond yields had spiked to their highest level since the first wave of the Covid pandemic early last year.

Fast forward to today, and the worsening Evergrande crisis has pushed Chinese junk bond yields up to over 15%, a number last seen during the Global Financial crisis over a decade ago, as the following chart via Win Smart, CFA reveals.

We’ve shared discussions here at The Sounding Line from people who believe Evergrande represents a systemic risk to the global financial system and those that don’t. However, the rising borrowing costs rippling through the Chinese financial system increasingly tilt the odds towards the latter.

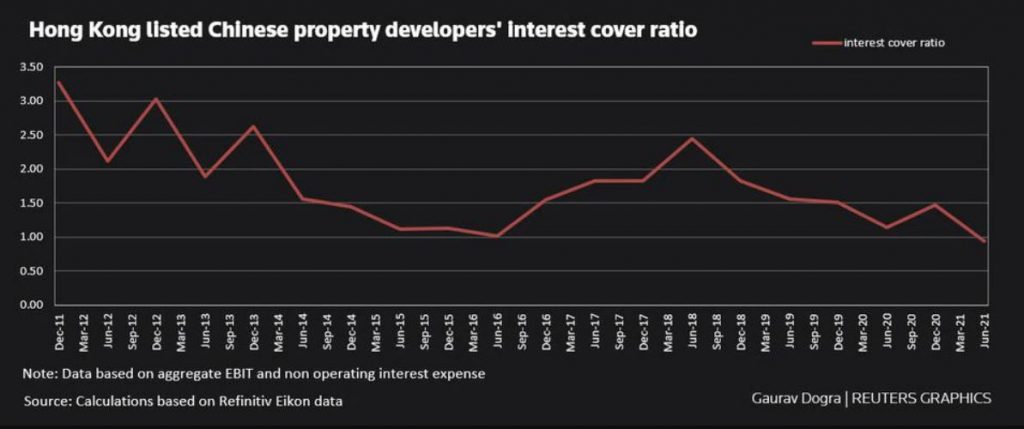

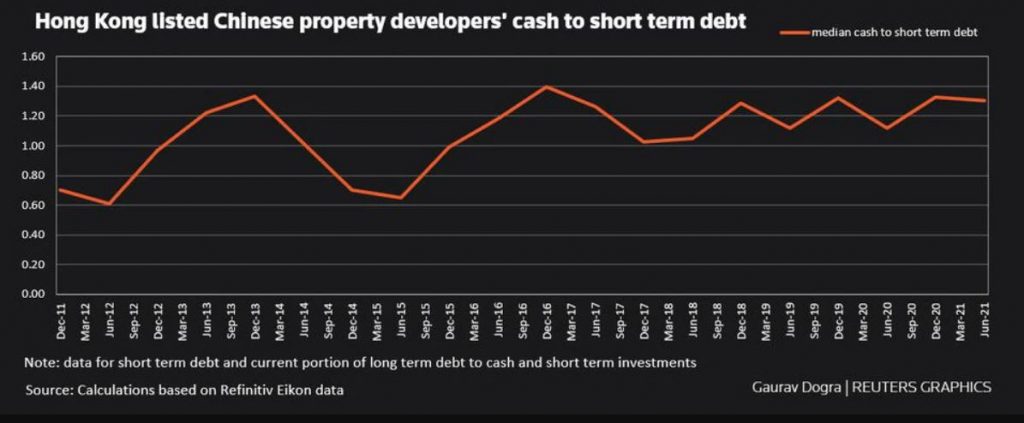

Ominously, the following chart from Reuters reveals that Hong Kong listed Chinese property developers’ interest coverage ratio (the ratio of their non-operating interest expense versus earnings before interest and taxes) was below ‘1’ before Evergrande went belly up and junk yields started spiking. In other words, Chinese property developers writ large were not making enough money to pay their now spiking interest expenses and, as the second chart below reveals, are barely carrying enough cash to cover one year of short term debt, virtually guaranteeing an ugly scramble for cash.

As we’ve noted before, debating exactly how the Evergrande default ends up getting handled is missing the point. The bigger point is that the highly leveraged and excessive real-estate development model that has been the key mechanism used by Chinese leadership to boost its economic numbers is breaking down for good. At a minimum, that will have broad implications on Chinese and global growth for years to come.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.