Taps Coogan – October 18th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

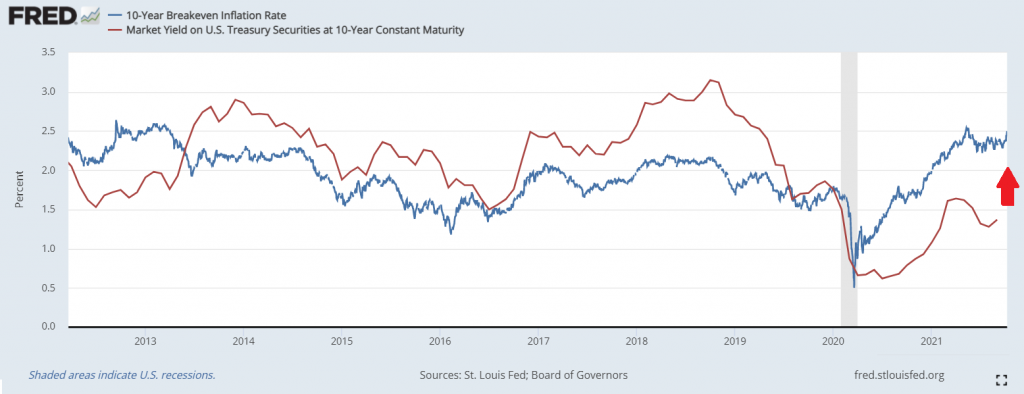

We wrote repeatedly over the spring and summer to not overinterpret falling treasury yields as an indication that inflation was headed quickly lower, as was being argued at the time.

We took that stance for two reasons. The first reason was that the Fed was buying over 100% of net treasury issuance, meaning that treasury rates were no longer even a remotely free-market determined price. The second reason was that inflation breakevens, the treasury market’s internal measure of future inflation, were still running hot.

Well, fast forward to today and thanks to the debt ceiling, net Treasury issuance has actually been negative since June. Meanwhile, the Fed has bought another $300 billion of treasury debt, and breakevens are headed higher again.

So with the inflation outlook still looking hot and the Treasury about to issue $400 billion in new debt, it seems more likely that interest rates will catch up to breakevens than the other way around. In other words, yet another narrative dismissive of persistent inflation, the presence of low benchmark rates, is poised to fall by the wayside.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.