Taps Coogan – November 19th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

With the Chinese economy slowing considerably and the price of many industrial commodities such as steel, copper, and coal starting to cool noticeably, it’s possible to imagine inflation peaking on a year-over-year basis sometime this winter.

However, official inflation measures like CPI are unlikely to fall back to the Fed’s now suspended 2% target anytime soon. As the following chart from Nordea’s Andreas Steno Larsen highlights, the same math that has frustratingly skewed official inflation metrics lower for years is now going to work in reverse.

In 1983, the Fed controversially removed housing prices from its CPI calculation, part of a slew of changes – all of which just so happened to lower the inflation figures – and replaced housing prices with the ‘Owners’ Equivalence Rent’ concept (OER).

OER, and this is not a joke, is where the Fed surveys homeowners that do not rent their homes and asks them much they imagine that they would charge to rent their homes if they were to do so. All of that is done to avoid simply using home prices or actual rents, which have risen many times faster than the OER since it was implemented in 1983.

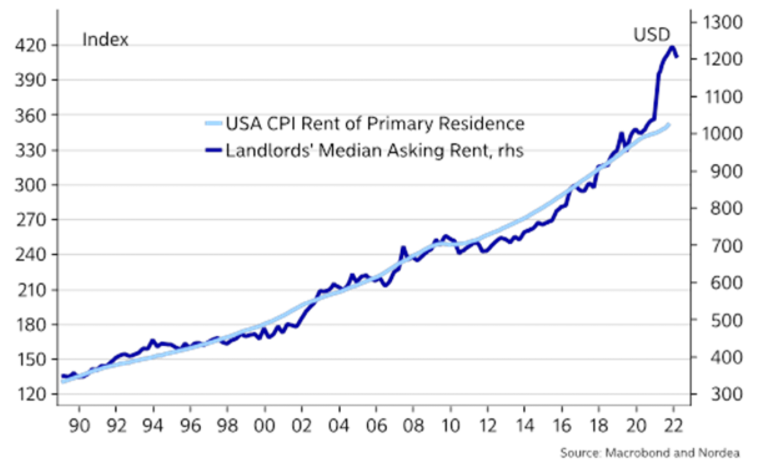

Take the chart above for example. While it looks like CPI rent component (which is based on OER) has tracked landlord’s median asking rents closely since 1990, take a look at the left and right axes. Landlord’s median rents have nearly quadrupled since 1990. The CPI rent component is only up about 180%.

Not only does OER badly understate actual housing costs, it lags real cost changes as well.

OER is the largest component of CPI and it has a lot of catching up to do to reflect the increase in rents that’s already occurred. Presumably, it will continue to hold CPI higher than it otherwise would be for most of next year. That means that a return to the Fed’s old 2% inflation target is still a long way off.

In light of the fact that the Fed’s lowball housing measure is now going to start pulling inflation higher (thought not as high as it should), one can imagine the Fed is contemplating how to tweak the calculation lower yet again. So, here is a helpful suggestion. Instead of surveying hypothetical landlords about their hypothetical rent, just survey actual renters about how much they think they should pay and, viola, the Fed will never have to deal with housing inflation again.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Rising property taxes and fees, utility bills, as well as increased maintenance cost, must be passed on or the supply of housing will substantially decrease. The article below delves deeper into why higher rents are in our future.

https://brucewilds.blogspot.com/2019/03/trends-point-to-rents-edging-higher-in.html