Taps Coogan – December 2nd, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

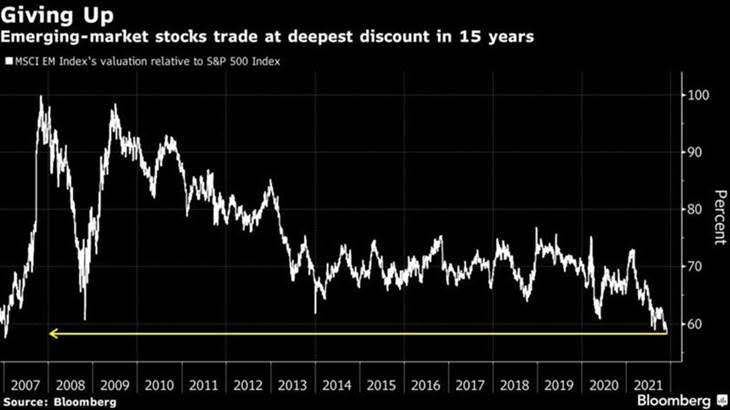

The following chart, from Bloomberg via Daniel Lacalle, shows the relative valuation of emerging markets to the S&P 500 since late 2006.

The punchline is that emerging markets have reached their lowest valuation relative to US stocks since early 2007, before the Global Financial Crisis broke out.

There are numerous reasons for this, but if I had to pick one, as Daniel Lacalle also notes, it’d be the large weighting of chronically poor performing state-backed or state-owned companies in many non-US markets. The heavy weighting of Chinese companies, which have also done dismally poor over the last decade, hasn’t helped either.

While treating highly differentiated emerging market countries as a homogenous group hasn’t been a winning strategy, several emerging markets have done very well during this period, notably India, which is the best performing major market in the world this year.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

US is also overvalued. This gap will be closed by larger relative losses in the USA.

Entirely plausible. All a question of how much pain the famously weak-kneed Fed will endure to do the right thing while half the FOMC gets replaced by ultra-Doves in 2022. Love your site BTW