Taps Coogan – February 23rd, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

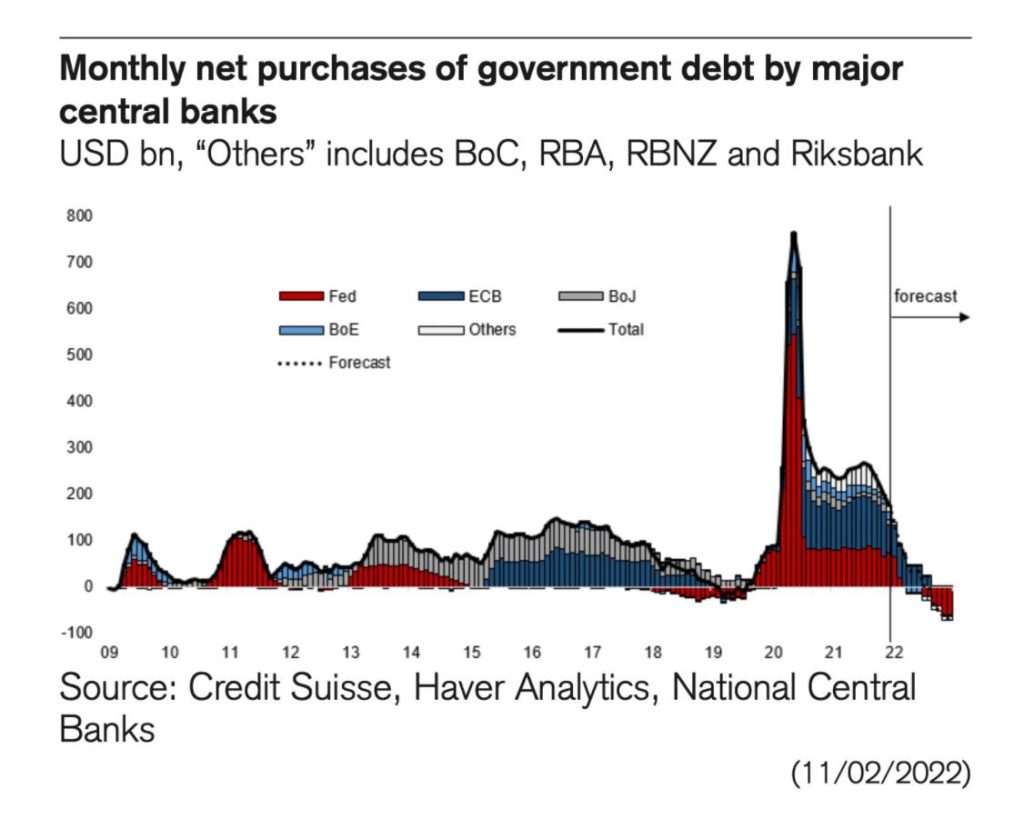

As Rick Santelli famously quipped the last time the Fed tapered QE: “All stimulus is fungible.” The point then was that while the US was shrinking its balance sheet, other major central banks were still printing and the net global central bank balance sheet was expanding – all that really mattered for buoyant risk assets at the time.

Fast forward to today and, given all of the taper talk, investor sentiment has started to notably sour. As the following chart from CS Research via Acemaxx Aanalytics highlights, perhaps investors shouldn’t fret quite so much, at least not yet.

We’re about two months farther forward in time than the forecast line in the chart above, but the global central bank balance sheet is still expanding at nearly peak-QE3 levels. Unbelievably, despite 7.5% CPI inflation, the Fed is still doing $30 billion of QE this month and, despite some murmurs of a wind-down this summer, the ECB has no plans to stop its QE program. Of course, markets are supposed to be forward pricing and we are pointing towards less and less QE, but for now, the spice is still flowing.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.