Taps Coogan – April 4th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

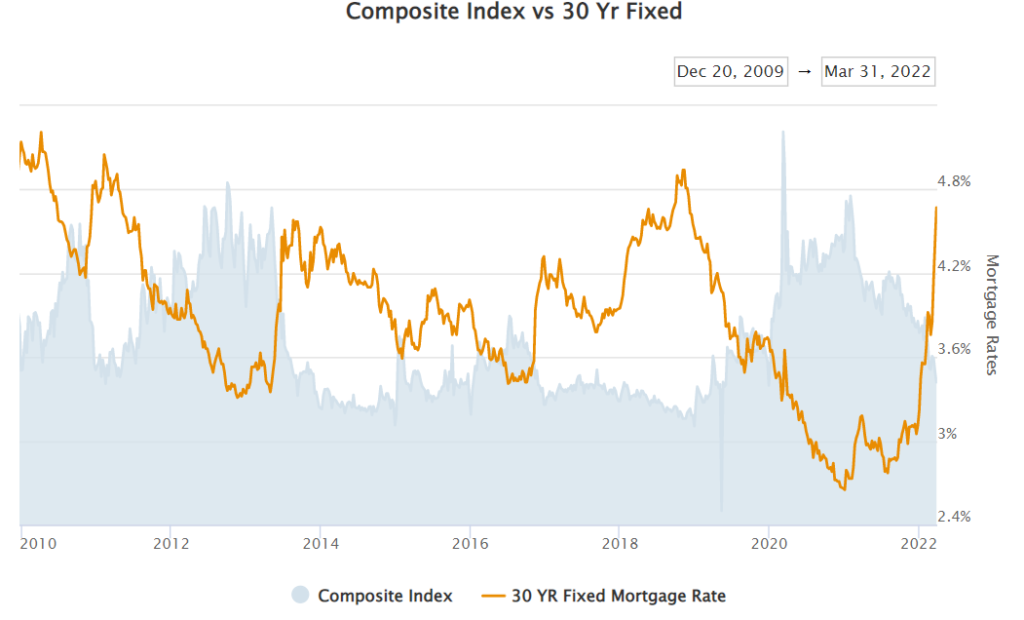

The average 30-year fixed mortgage has slingshot from an all-time low of 2.65% in January 2021 and a similar low of 2.77% in August 2021 to 4.67% as of March 2022, just shy of the decade high set in 2018 as the following chart from Mortgage News Daily highlights.

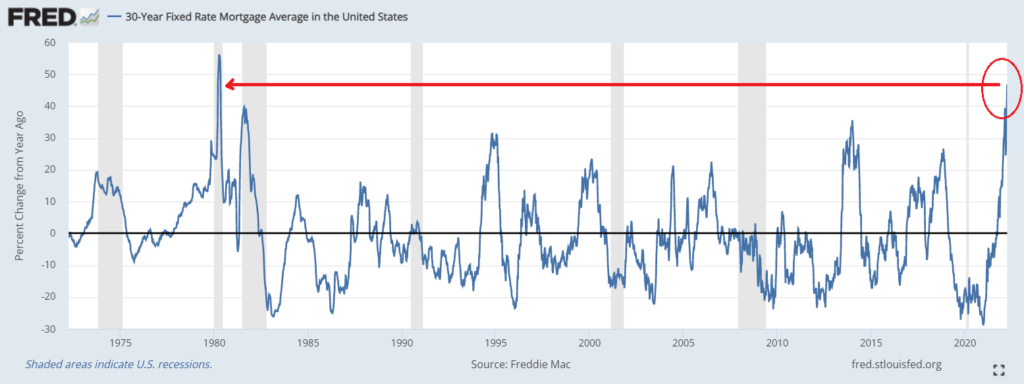

The year-over-year rate of increase in the 30-year mortgage is now the fastest percentage increase since 1980 and nearly the fasest increase on record. The cost of a mortgage is up nearly 50% over the past 12 months.

Year-over-Year Percentage Increase in 30-Year Fixed Mortgage

As home buyers know, the higher the mortgage rate, the less expensive of a home one can afford to buy. That means that increases in mortgage rates tend to put downward pressure on home prices.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

And yet, the very best savings rate remains around .50%. That sounds fair, no? One year CD = .80% Super! Inflation = 7.9%. Is this a great country or what? Retired? Have a cat? Share their food and buy an electric car.

Don’t worry, the Fed might hike another 25 basis points if stocks can handle it…. /s

Yes, the FED is perpetuating a moral inversion in which virtuous savers(taxpayers/middleclass) are wiped out to protect deadbeat debtors(the government class). And by “moral inversion, I mean “immoral”.