Taps Coogan – May 13th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

In April of last year, I noted the following about Bitcoin:

If Bitcoin was measuring the risk for the inflation induced loss of fiat purchasing power, it would presumably track changes in real long term treasury rates, just like gold does. If the inflation adjusted yield on ‘risk free’ treasuries go up, all things being equal, the value of a non-yielding non-fiat monetary asset should go down and that’s exactly what tends to happen with Gold.

While some have pointed to Bitcoin’s recent outperformance of Gold as evidence that the latter has started to fail in its role as the primary non-yielding, non-fiat monetary asset, the opposite is true. Gold is doing what it is ‘supposed’ to do. Get worried about Gold’s role in finance when it stops tracking risk-free inflation adjusted long term yields (or start worrying about your ‘risk free’ and ‘inflation adjusted’ benchmark).

Bitcoin’s meteoric rise over the last six months means that it is measuring something other than fiat debasement or inflation fears. That something certainly seems to be the excessive stimulative ‘juice’ washing over financial markets and society at large.

Looking for a peak in bubblelicious market euphoria? Keep an eye on Bitcoin.

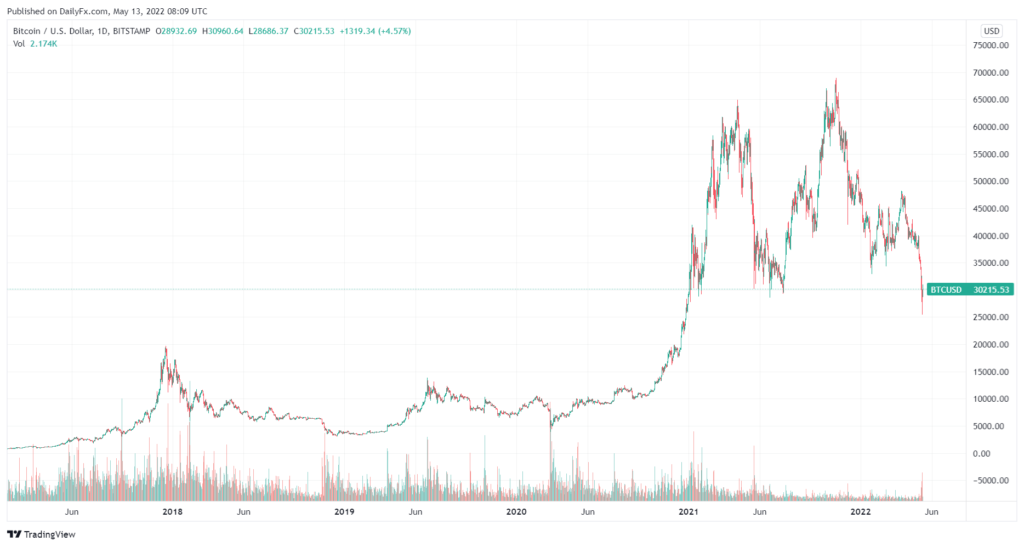

Well, here you go:

Bitcoin peaked with the peak of the mania last fall. It set a ‘lower-low’ yesterday, briefly trading below $26,000, a ~63% decline from its all time high. It may rally from here, perhaps strongly, but the bullish trend is broken. The excess liquidity isn’t coming back for the foreseeable future.

For those wondering, we recently wrote about how gold needed to break its correlation to real long term treasury yields for yours truly to understand the bullish case and described how and why that might happen. So far there is no sign that the correlation has broken, though its too early to declare an outcome.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.