Taps Coogan – May 22nd, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

The following article is reposted from Statita.com:

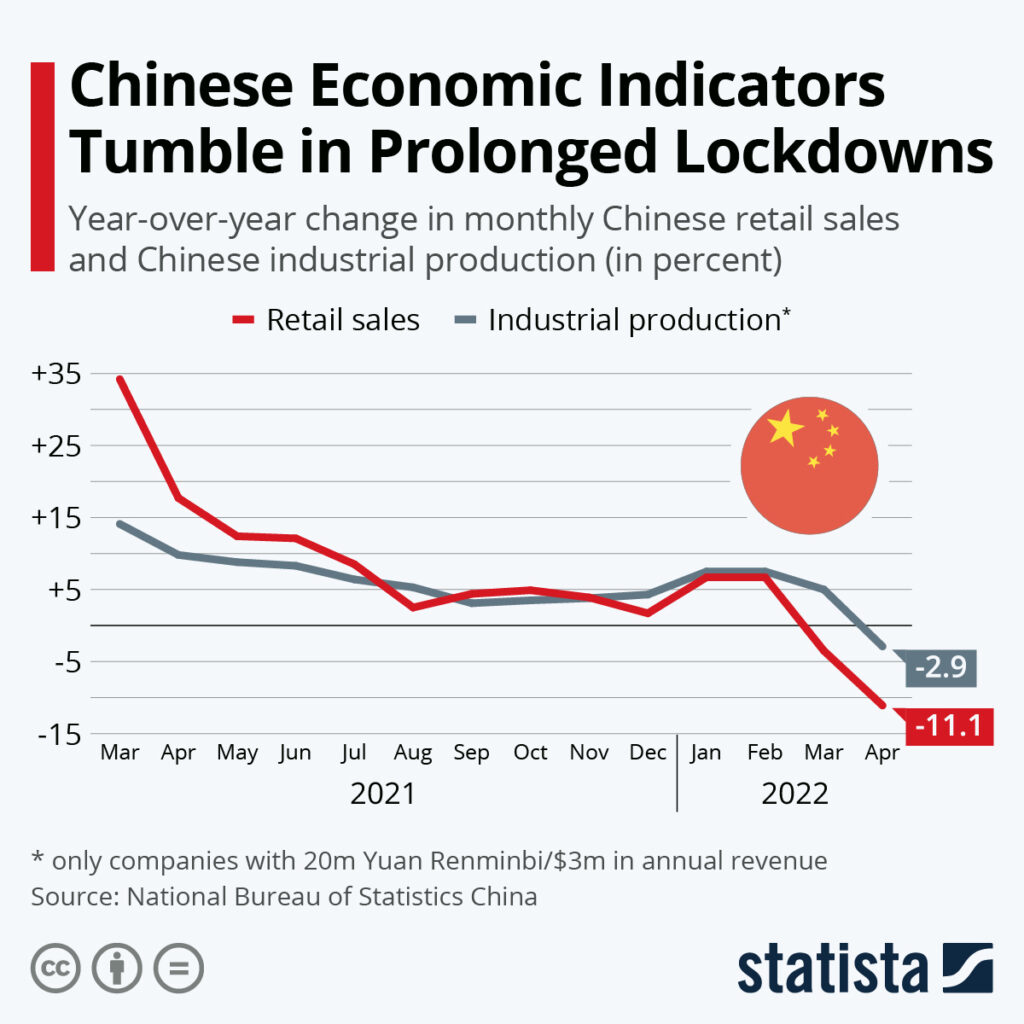

Following prolonged coronavirus lockdowns in major cities like Shanghai, Chinese businesses are feeling the crunch of the restrictions. Both retail sales and industrial production exhibited negative growth in April, the National Bureau of Statistics China said in a release Monday. Retail sales had already shrunk in March, albeit on a lower level. Analyst had expected less than stellar results for the month, but did not predict this grave a decline.

Chinese retail sales and industrial production grew rapidly in the beginning of 2021 as consumers and companies were catching up after the 2020 Covid-19 market slump. Later in 2021 and into 2022, the important economic indicators had stabilized on a slightly lower level than pre-pandemic. Since then, the inevitable clash of the more contagious Omicron variant with China’s zero Covid strategy has been leading to China’s economy taking its second Covid hit.

In response to the news, Asian stocks struggled on Monday, dragging already flailing global markets down with them as worries about economic growth are once again rising. Some hope might be on the horizon as Chinese officials said that an reopening in Shanghai should start June 1.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.