Taps Coogan – July 27th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

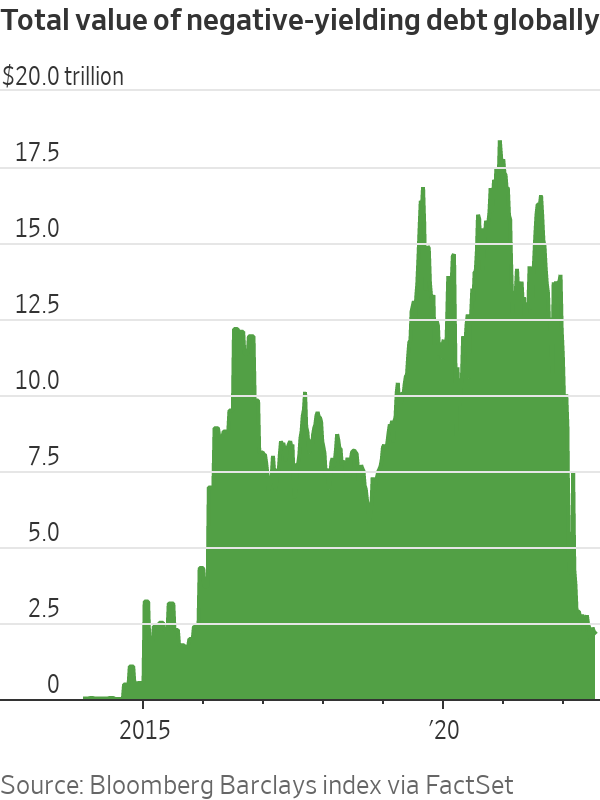

The following chart, from the Wall Street Journal via Acemaxx Analytics, shows how dramatically the world’s pool of negative yielding debt has shrunk.

The bizarre phenomenon of negative yielding debt, which burst onto the scene in a big way in 2014 when the ECB pushed its benchmark rates below zero, peaked at nearly $19 trillion in late 2020. By that time, the yields on most 10-year-or-less European sovereign bonds were negative, along with Japanese government bonds, and even some European corporate bonds.

Negative yielding bonds only ever made sense on a relative basis: Money could be made if the yields got even more negative, a trade which actually worked for a few years.

In evidence that there is still some logic left in the world, what was clearly one of the worst investment propositions ever, buying a bond guaranteed to lose money because you might be able to sell it to someone willing to pay a bigger premium for that loss, has done exactly what is should have: blown up spectacularly. Owners of once negative yielding ‘risk-free’ European sovereign debt are staring at double digit mark-to-market losses this year with little hope of ‘waiting it out.’

People who bought these bonds at deeply negative rates now face two choices, holding them for years and taking a guaranteed loss before even factoring in inflation, or selling them for a big loss and moving on.

Next comes the prickly question of how countries like Italy, Greece, or Japan will service their mountainous piles of debt at meaningful interest.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.