Taps Coogan – September 21st, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

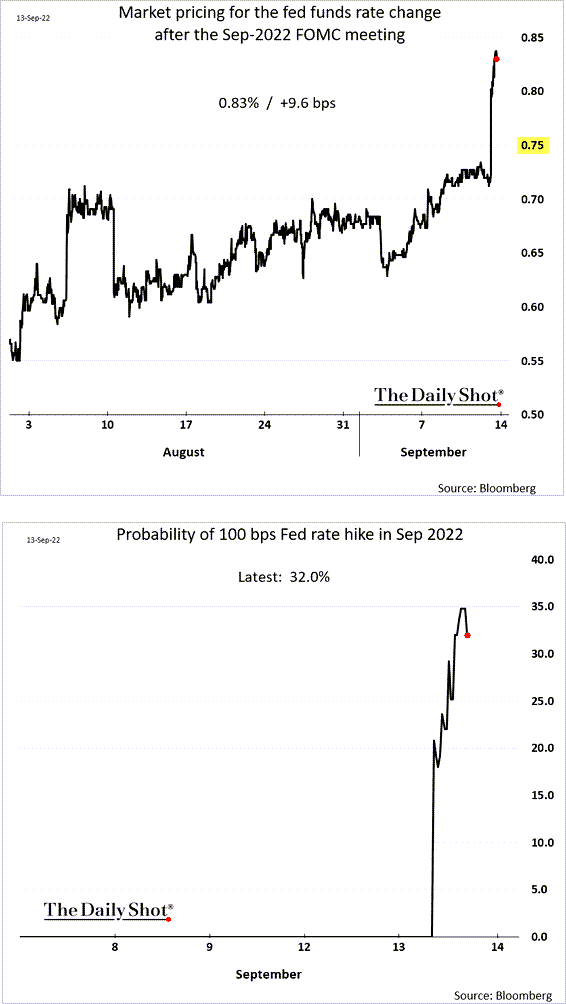

On the cusp of the Fed’s September FOMC press conference, markets are pricing a 83% probability of a 75 basis point rate hike and 32% chance of a 100 basis point hike, according to the following chart from The Daily Shot.

For a few months we have been in the camp that the Fed is hiking rates too quickly.

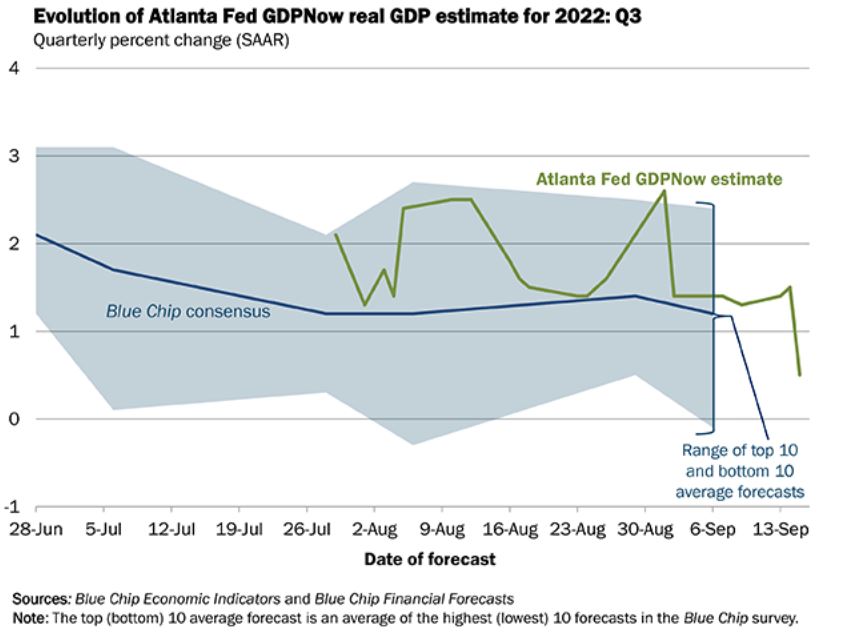

The admittedly inaccurate Atlanta Fed GDP tracker has crashed back to zero-ish levels for the third quarter, signaling a growing likelihood of a third consecutive quarter of zero-to-negative real GDP growth.

On top of that, both the stock and bond markets are signaling relatively high recession risk.

Quite a lot has been made about the fact that the August inflation numbers didn’t decline as much as expected, but the headline year-over-year inflation rate did drop for the second month in a row and further drops remain more likely than not.

Monetary policy works with long and variable lags and by the time the Fed realizes we’re in a recession they will have been tightening too aggressively for months at this accelerated pace. That raises the odds of severe outcomes and yet another pivot from the Fed. The Fed needs to prioritize the longevity of the tightening cycle, not the entirely arbitrary number of hikes every month.

If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any spam.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Totally disagree that the Fed is tightening too much at too rapid a rate. Even with a 75 point increase today, that would put the Fed Funds top of the range at 3.25%. The two-year Treasury is at 3.99 % and the 10-year Note is at 3.58%. Way behind the curve with inflation, year-to-year in excess of 8%, forget about the last two months zero or minimal increases, not a meaningful change in trend unless you are a politician. If Powell is going to quote Paul Volcker’s response to 1980ish inflation headed to the heavens, then he better put his… Read more »

Thanks for the well argued comment! We both want the same thing, a normalized interest rates regime and deleveraging. The difference in views is that I believe that the pace the Fed is going at may get us there for a few months before they end up with a total catastrophe that takes us back to accommodative policy. Frankly, we may have already baked that in due to the lags in monetary policy effects. In late 2018, when the Fed was halfway back to normal, I warned of the same thing. The Fed kept hiking instead of pausing and we… Read more »