Taps Coogan – March 17th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

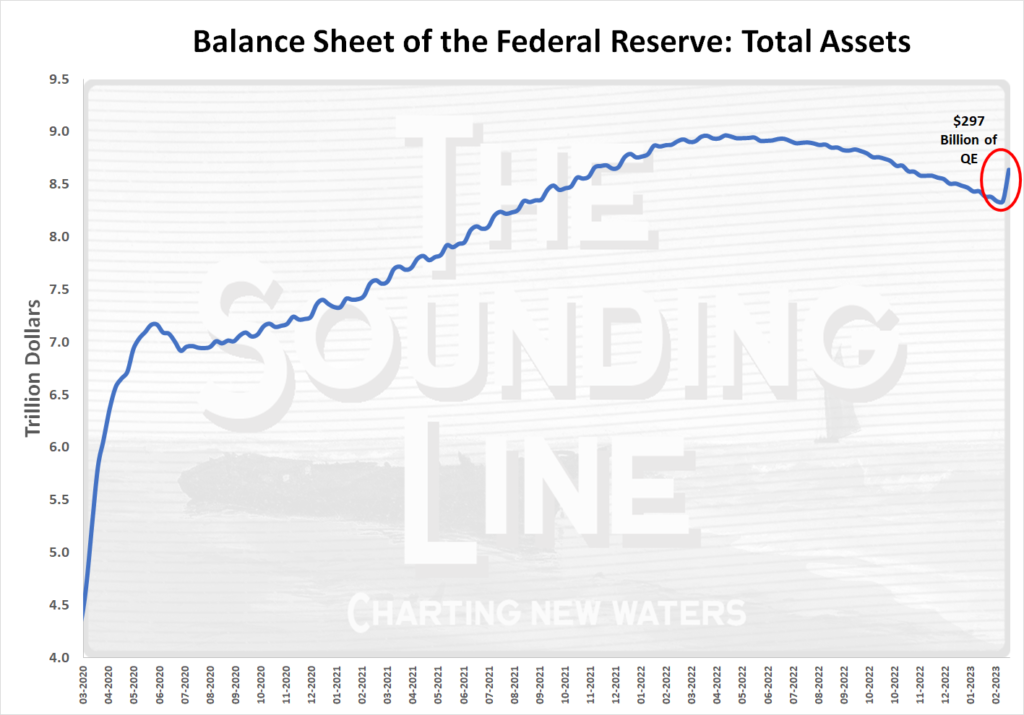

Owing to the two facilities that the Fed has created to backstop depositors in the failed SVB and Signature banks and provide liquidity to other banks, the Fed’s balance sheet has jumped by a stunning $297 billion this week.

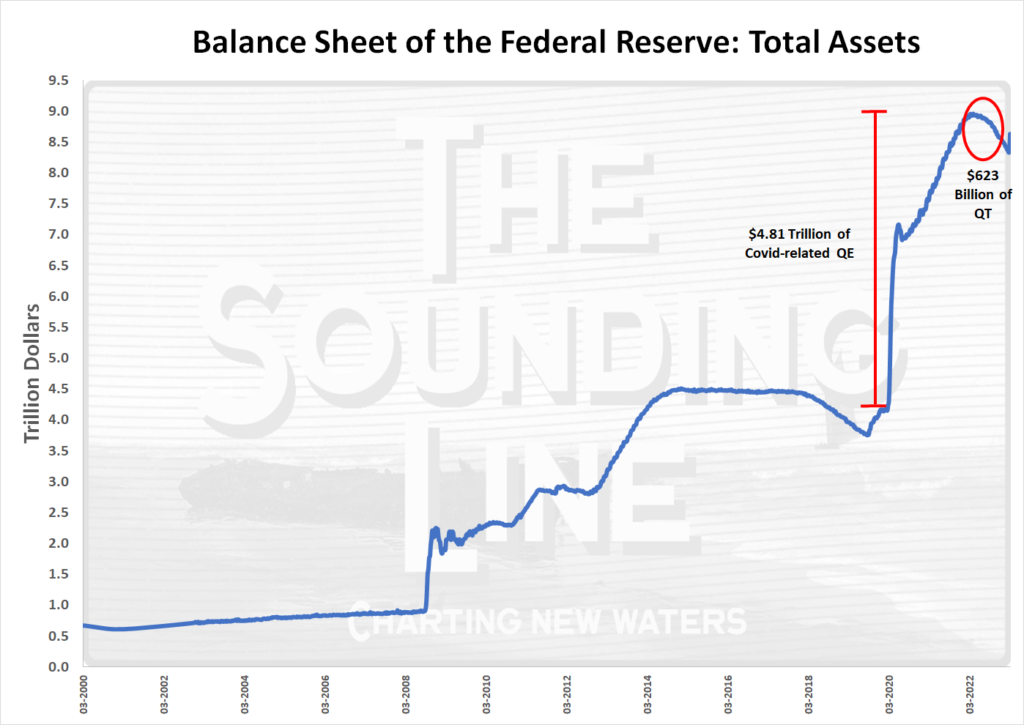

For some context, the cumulative reduction in the Fed’s balance sheet from the quantitative tightening (QT) program that started last Spring was $623 billion.

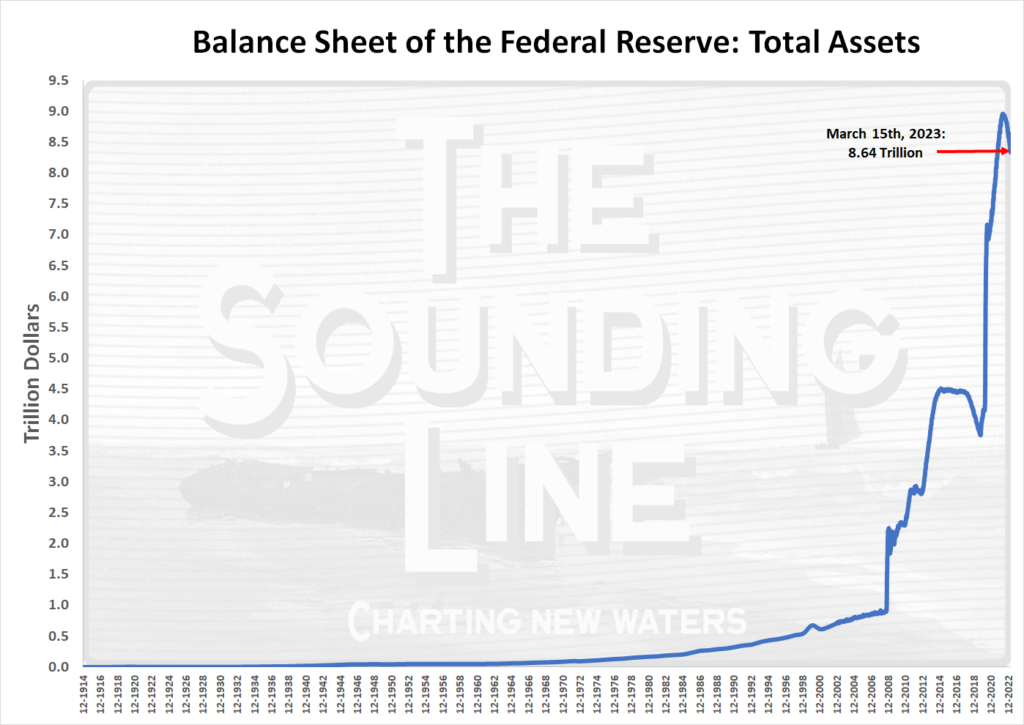

The chart below shows the Fed’s balance sheet growth since 1914. Since the Global Financial Crisis, the Fed’s balance sheet is up about 9,000% and the Fed’s balance sheet has more than doubled since 2020.

Zooming in a bit, we can see the Fed’s attempt to wind down its Covid era free-money bonanza. Of the $4.8 trillion of Covid related QE, the Fed managed to soak back up a paltry $623 billion before something broke.

The backstopping of depositors at SVB and Signature bank (depositor bailout if you prefer) and the creation of a liquidity facility for banks has already added back $297 billion, nearly half of the liquidity it drained through QT.

While the assets that the Fed has added back this week are not the Treasuries and Mortgage-Backed Securities that it has been shedding, they add to the monetary base and liquidity nonetheless.

It’s worth noting that the Fed has not announced an end to QT and so the balance sheet may shrink a bit more before the Fed throws in the towel. In any event, we have probably seen the low on the Fed’s balance sheet for this tightening cycle.

To this day, the Fed refuses to acknowledge a link between inflation and its decision to ‘print’ $4.8 trillion and encourage the federal government to hand it out helicopter-money style and then continuing to do that for an entire year after its favorite low-ball measure of inflation, PCE-core, had surpassed its 2% target. Go figure.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

“before the Fed throws in the towel”

What the F does that mean? So the bankers own this country then? And then when the “bets” they made turn sour it’s the taxpayer to the rescue once again?

WTF is going on !!!!!!!!

My take on this is a little different, backstopping a bank run does not result in more money being put into the economy to be spent. It is important to understand that small community banks are not in the same business as banks such as Credit Suisse. Small banks are far more rooted in the economy of Main Street. The challenge for the Fed is how to reassure depositors and support the banking system while continuing its battle against inflation. In many ways, the current liquidity issue is a situation the Fed created and must address. More on this subject… Read more »