Taps Coogan – April 7th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

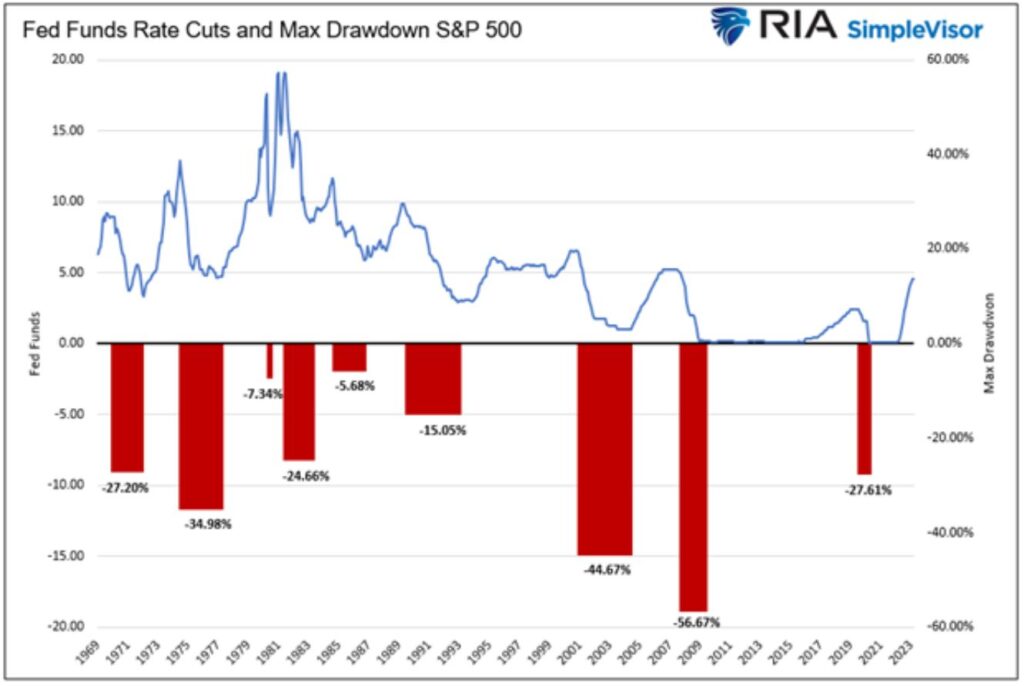

This won’t come as news to frequent readers but it’s worth repeating: rate cutting cycles have typically been the harbinger of bear markets. The following chart from Real Investment Advice highlights that reality. When the Fed is cutting rates, it’s usually because something is going wrong.

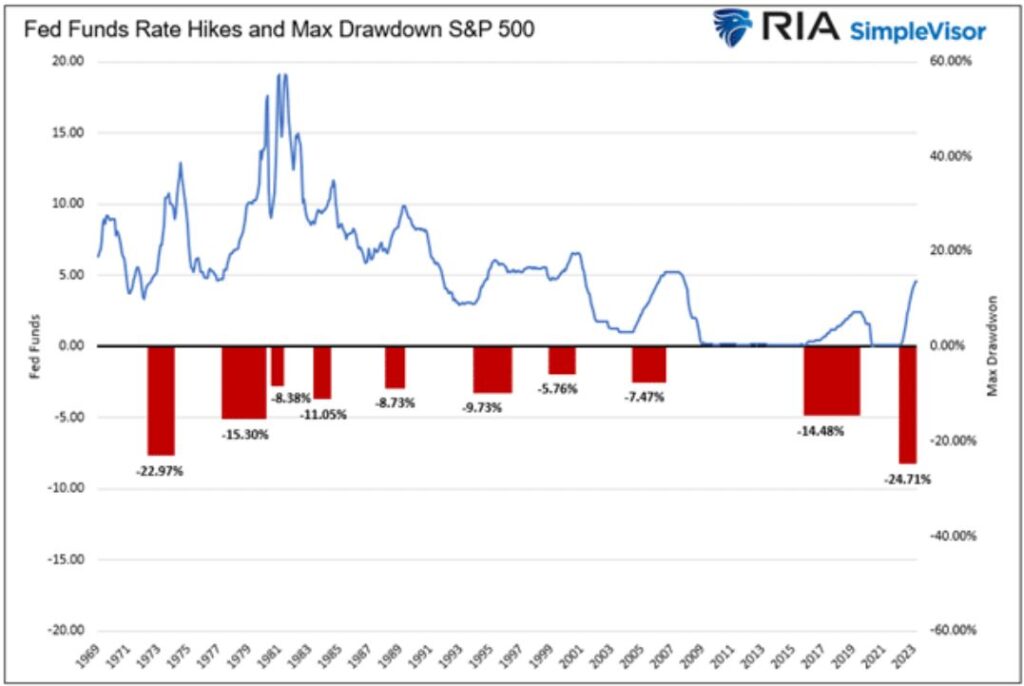

The aforementioned article from Real Investment Advisors is worth reading and raises the question as to whether the fact that we have already had a significant bear market mitigates the downside from here. The chart below shows drawdowns that started at the beginning of tightening cycles. Most tightening cycles start with a drawdown, though this has been an unusually big one.

The punchline of the two charts above is that bear markets are frequent when the Fed is tightening quickly and when they are cutting quickly. Bull markets tend to fill the intervening periods between aggressive tightening and cutting cycles.

This has been a particularly odd cycle with lots of unprecedented developments, so I wouldn’t lean to hard on historical precedents. The good news is that the presumptive Fed pause may be one of the ‘intervening’ periods mentioned above (or not). The bad news is that what comes after is probably a recession and a renewed bear market.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.