Taps Coogan – August 14th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

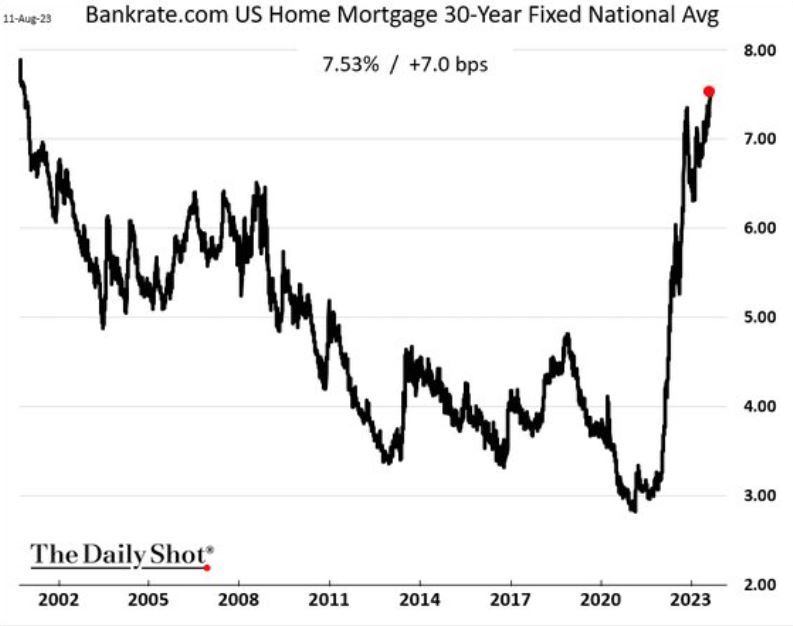

The benchmark 30 year mortgage rate has finally eclipsed 7.5% and set a 20 year high, per Win Smart:

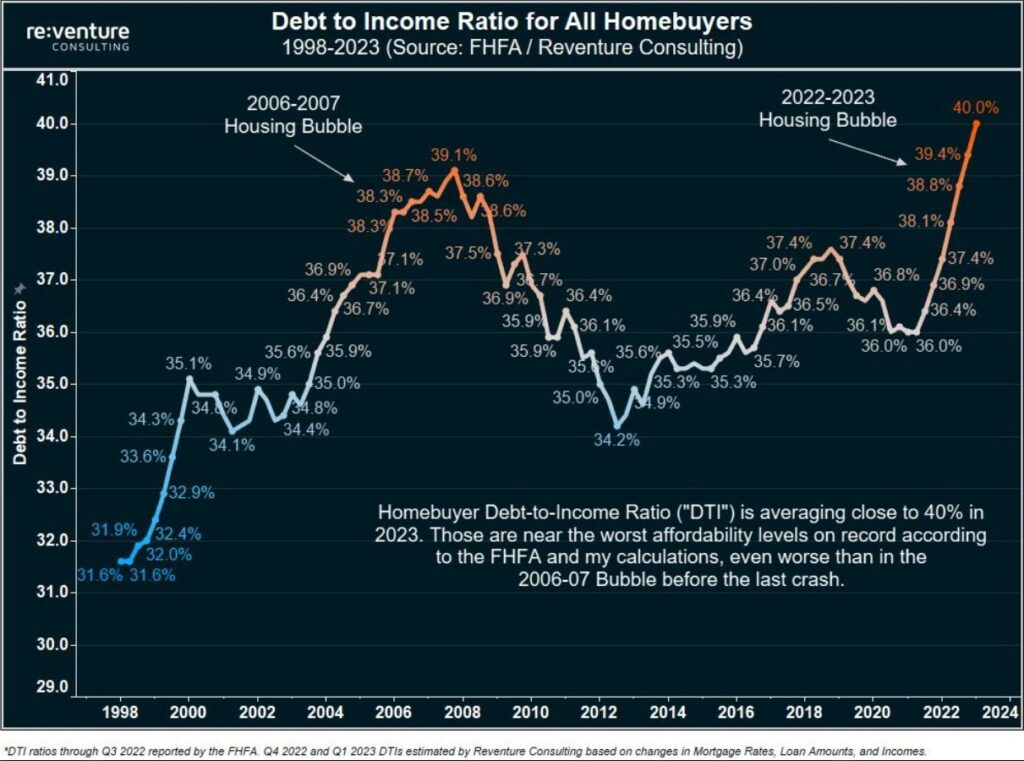

Many people are pointing out that the rise in mortgage APRs is leading to the highest portion of household income going to mortgages for new homebuyers in decades:

That has led to numerous false comparisons to the Housing Crisis. However, the vast majority of homeowners have existing fixed rate mortgages below 5%. For these homeowners, the burden of their existing mortgage has likely been improving as average wages rise due to inflation and their mortgage stays the same. These homeowners are very strongly incentivized to hold on to their mortgages and their homes.

Of course, the poor affordability of new home purchases will continue to put downward pressure on home prices but the prevalence of legacy low fixed-rate mortgages should keeping existing home owners from flooding the market with inventory. That sets us up for a longer-term, slower moving decline in home prices and that is unlike what happened during the Housing Crisis.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.