Submitted by Taps Coogan on the 13th of September 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

Yesterday, I described why I view the $16 trillion pool of negative yielding bonds to be, in effect, the largest negative-carry short trade in history. Negative yielding bonds are an unconscious bet that global growth will remain increasingly disappointing, if not outright recessionary, and that inflation will fall below zero and stay there for decades.

Virtually everyone that I speak to, listen to, or read has become highly concerned with the possibility of a recession in the near future. This near universal recession fear has, largely unintentionally, set up a $16 trillion trade that can only profit from a recession: negative yielding bonds.

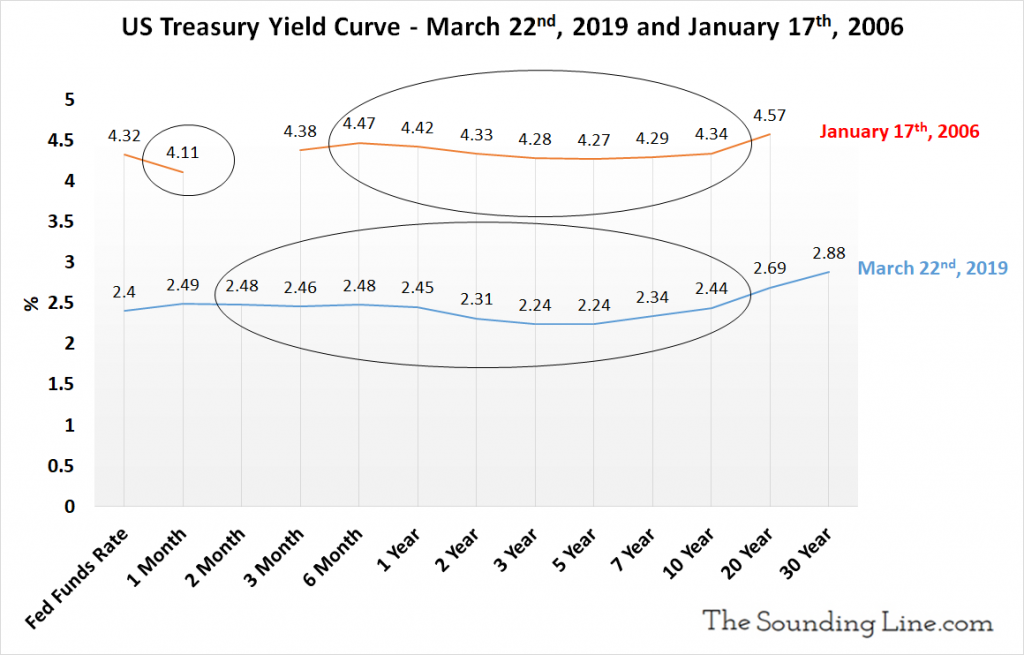

The case for a recession is compelling. Several of the most reliable leading indicators of recessions since World War II have been triggered in several developed economies. These include yield curve inversions, manufacturing PMIs, aggregate work hours, and global trade volumes. Even the United States’ low unemployment rate is, counter-intuitively, a sign that the economic expansion is nearing its end.

However, I can’t shake the feeling that if we do have a recession soon, it would be the first one that was forewarned of by nearly every investor, banker, and analyst in the world.

While Japan has showed that it is possible to have a recession with near-zero interest rates, it is not an easy thing to do. How many businesses are going to go bankrupt when rates are zero, credit is plentiful, and investors view earnings as optional?

With central banks already slashing interest rates and reserve requirements around the world and the ECB relaunching QE, the delay between the leading indicators of a recession and the actual start of a recession may be substantially longer than normal. It could take years.

Even a slight improvement in the current outlook is going to be very uncomfortable for the investors who hold $16 trillion of negative yielding bonds. Consider that most of the investors buying these ‘safe-heaven’ bonds are intrinsically loss-adverse and probably not yet fully aware that they are holding a negative-carry bet on a recession.

Many investors in negative yielding bonds don’t have much control over the requirement to buy these bonds. They are pension funds, insurance companies, or banks with regulatory requirements that force them to own allocations of sovereign debt. However, there are many investors that can sell these bonds and they will if the recession starts looking less certain.

That means that, if the economic outlook improves, potentially trillions of dollars of investor capital may start looking for a new home. Presumably, some of it will end up in equities.

Either we are slipping into a recession here and now, or there is going to be another ‘great rotation’ out of bonds before this central bank economics experiment blows up in everyone’s face.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

We are well into the retirement of the first batch of baby boomers who now depend on pension funds/savings of one sort or another.I see a major catastrophe in the offing when the pension funds are not returning enough to maintain their standard of living.That combined with the criminal manipulation of the cost of living increases makes certain a road to misery !