Submitted by Taps Coogan on the 12th of September 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

The only way to make money on a negative interest bearing bond is if interest rates become even more negative and you sell the ‘hot-potato’ bond to someone else at a markup.

Presumably, interest rates will only fall further if the growth and inflation outlook in countries with negative rates (Europe and Japan) continues to fall. Considering that the growth and inflation outlook in those countries is already bordering on a recession, I view negative rates as a massive negative-carry bet on a recession in Europe and Japan.

Investors are guaranteed to lose money on these bonds unless their bet on even lower rates proves true. With the exception of short-traders, very few investors have extensive experience with such negative-carry trades. By definition, negative-carry trades require very good timing. Exceptionally few investors have good timing.

The irony about negative yielding bonds is that they are supposed to represent the least risky assets in the financial world. In turn, they are generally owned by institutions and investors with the lowest risk appetite. In fact, most investors in negative yielding bonds are insurance companies, banks, and pension funds which are forced to hold the bonds for regulatory reasons intended to reduce their risk. Regulations aimed at ensuring certain critical institutions never take loses on their bonds now all-but-guarantee that they take losses on their bonds. How central banks have perverted our financial world…

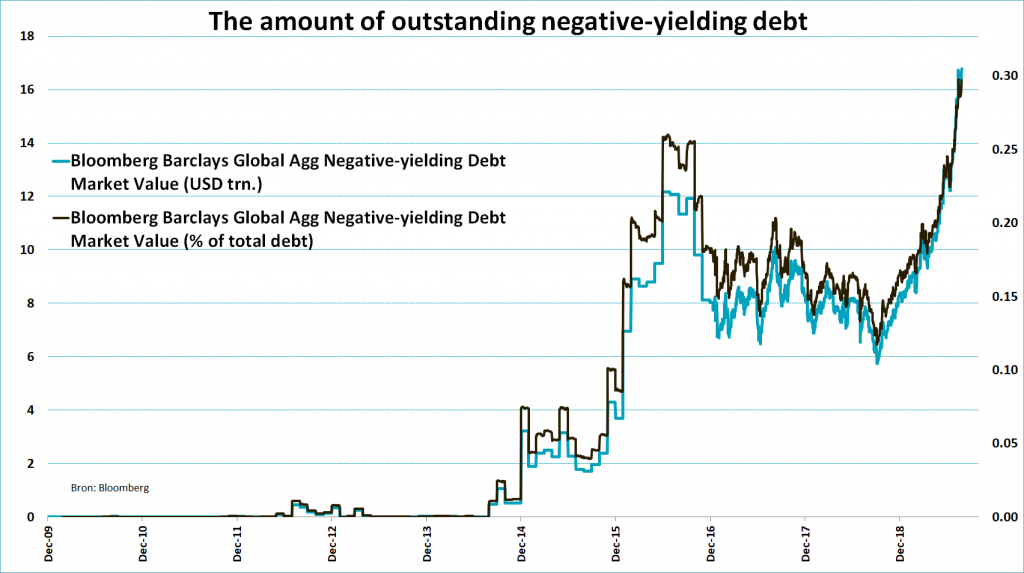

There is now somewhere around $16 trillion wrapped up in the negative rate bond trade. It must be the largest negative-carry bet in history, by an enormous margin. It is also essentially a short trade on the global economy.

All of which begs the following question: what if we don’t have a global recession? If not, the most risk adverse investors in the world are going to get stuck holding trillions of dollars of negative yielding bonds, some with maturities as long as 30-years. They will either have to take big losses selling these bonds, or sit out whatever is left of this expansion.

It is only a slight exaggeration to say that the greatest risk facing institutional investors today would be the lack of a recession. More precisely, they are doomed if there is a recession and doomed if there isn’t.

At the crux of this brave new financial world is a classic circular logic problem. The increasing size of financial markets relative to the underlying economy has made them the determinate factor in household wealth and spending. Household spending has, in turn, become the largest component of the economy in developed countries. Thus, household spending has become the largest determinant of the trajectory of monetary policy. Yet, monetary policy has become the determinate factor in financial market pricing. In other words, markets are pricing central bank policy and central bank policy is increasingly based on financial market determined factors. That’s what happens when you have a market based system and then let central banks manipulate all of the price signals.

As if the self-referencing doom loop of extreme monetary policy wasn’t sufficiently intractable, consider this: what will happen to global growth if the most conservative institutional investors in the world start losing trillions of dollars on an improving economy?

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

How much unrest do you think there will be when a large percentage of retired individuals here in the US receive letters from their pension announcing a significant reduction in the monthly payment? While this has happened before to a relatively small number, were this to hit en masse it won’t be pretty.

I have to laugh, President Trump yesterday goaded the Fed to bring on negative rates. If it were to actually happen, he would be toast. Given these and many other pronouncements, I don’t believe that he really wants a second term.

Meanwhile, inflation is really not that far from the Fed’s 2% target:

https://thesoundingline.com/inflation-in-the-1960s-was-lower-than-it-is-today-then-it-went-parabolic/

Please consider adding my recently published article through the Campbell Law Review journal entitled, “The United States’ National Debt and the Necessity to Prepare for its Default” to your web site. Here is the link: https://scholarship.law.campbell.edu/clr/vol41/iss2/3/ . Abstract: In many ways, the 2008 financial crisis seems like a distant memory one that many would just as soon forget. Another financial crisis is coming that will make the 2008 crisis pale in comparison. The future financial crisis lies in the massive national debt that has now passed the $22 trillion mark. The national debt continues to grow dramatically and, within the… Read more »

Thank you for sharing your interesting paper. I have added it to the Top News Story column.

Thanks for a great article, well said! The idea that the bond market is a bubble about to pop is a subject not to take lightly. This matter has been scrutinized many times in recent years and little has really changed except debt has grown much faster than the economy in general. The so-called experts such as Paul Krugman in the ivory towers of academia in many ways pose one of the greatest threats to our economic stability in that they often fail to see potential second and third order effects of debt monetization. The article below delves into why… Read more »