Submitted by Taps Coogan on the 17th of April 2020 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

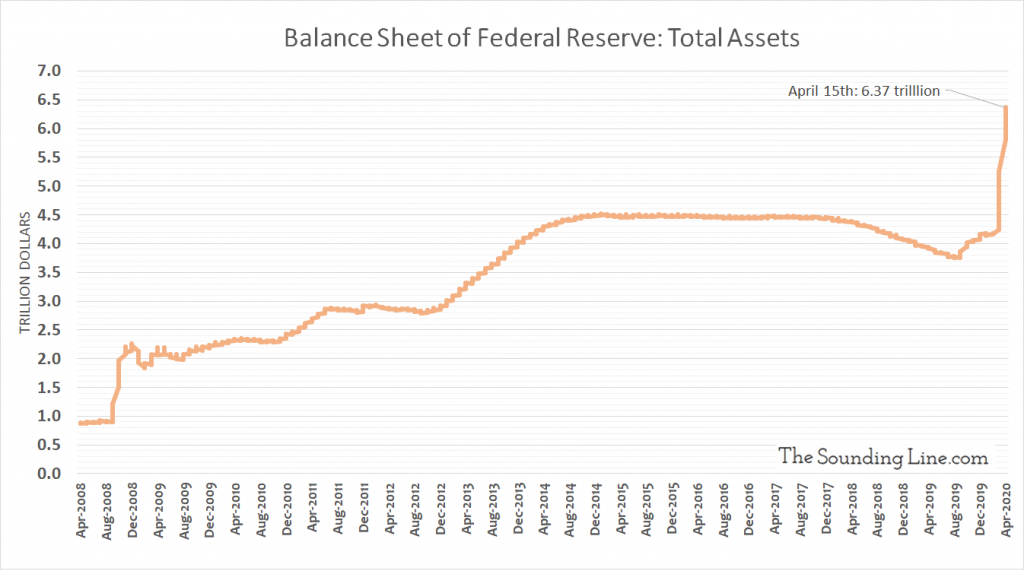

Data released last night (April 16th) shows that the Federal Reserve ‘printed’ another $284 billion dollars during the seven day period ending on April 15th, bringing its balance sheet up to $6.37 trillion or 29% of US GDP.

After printing over half-a-trillion dollars a week for the two weeks ending on March 25th and April 1st (the Fed data set goes from Wednesday to Wednesday), the Fed has settled into a roughly quarter-trillion dollars a week ‘printing’ plan for the last two weeks. At the current pace, the Fed’s balance sheet should be just shy of $7 trillion by the end of the month.

Over the past week, the Fed bought another $154 billion in treasury securities and $108 billion in mortgage backed securities, and performed another $20 billion in central bank currency swaps. The Fed shed roughly $11 billion in repos.

As economist Daniel Lacalle recently noted: “When the Fed did QE in the years following the 2008 financial crisis monthly Treasury purchases never exceeded US Treasury net issuance, but the Fed is now on track to buy double the amount of net issuance.”

When the Fed did QE in the years following the 2008 financial crisis monthly Treasury purchases never exceeded US Treasury net issuance, but the Fed is now on track to buy double the amount of net issuance pic.twitter.com/LXKNK3alzu

— Daniel Lacalle (@dlacalle_IA) April 17, 2020

Even the largest deficits in history aren’t enough to keep up with the Fed’s printing presses.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.