Taps Coogan – August 16th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

Imagine that you are financial institution with capital that you need to make a return on.

You can either:

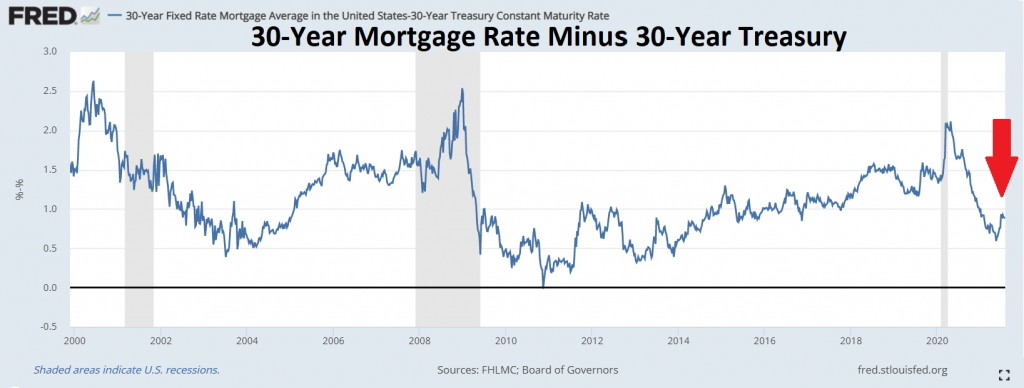

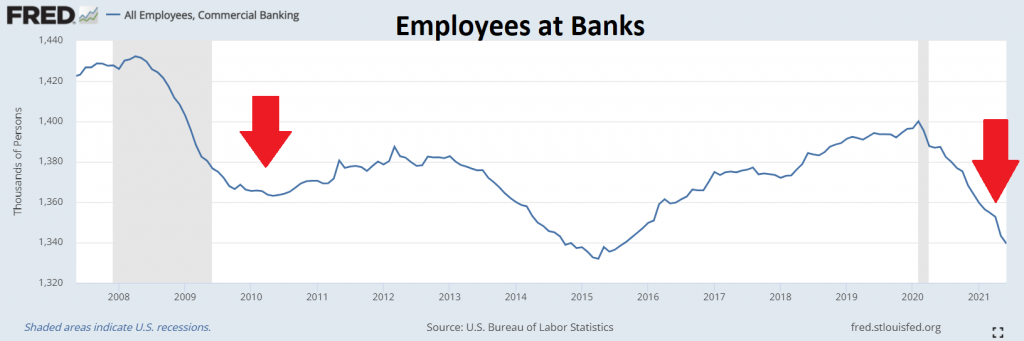

Hire accountants, managers, sales people, customer service, marketing, advertising, compliance, HR, etc… and get into the byzantine business of being a regulated retail bank writing 30-year mortgages yielding 2.8% before defaults and inflation in a grossly overheated housing market, assuming you can find enough people to lend to – which you likely cannot.

Or….

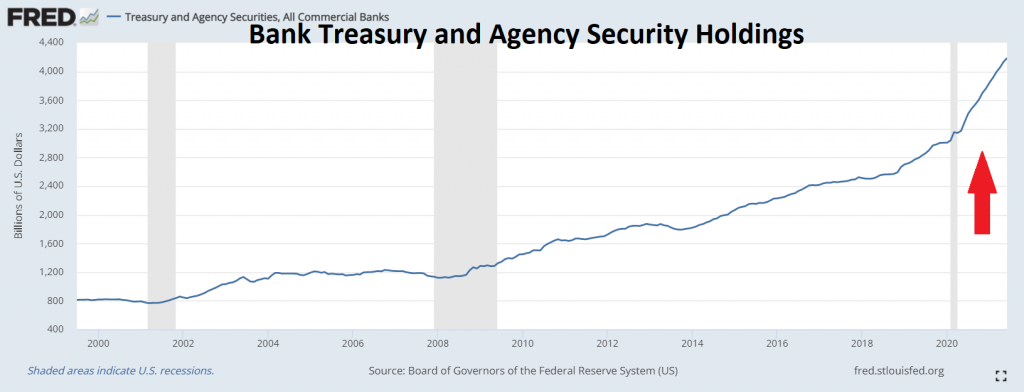

You can fire everybody and buy 100% risk-free 30-year treasuries yielding just 0.89% less.

So, what have banks decided to do?

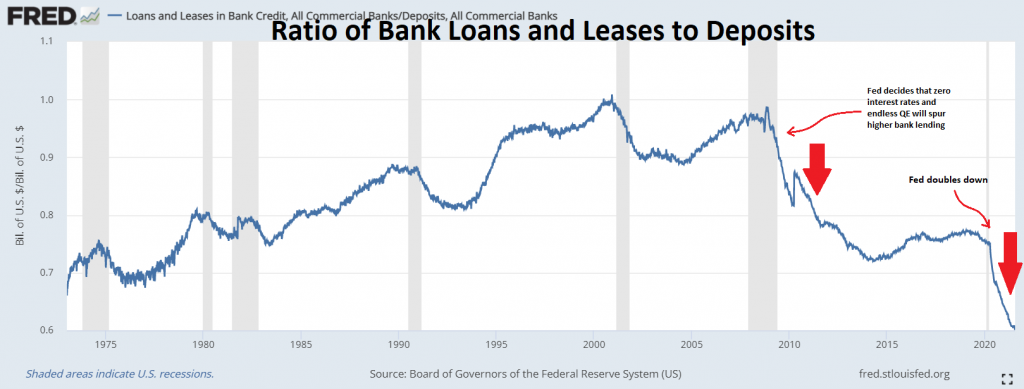

The charts above show that banks’ loan-to-depsit ratios have cratered since the era of forver accommodation started in 2009, their treasury and security holdings have risen nearly 500%, and bank employment has dropped.

Somebody might want to explain to the Fed that endlessly low interest rates might not be the panacea of good capital allocation decisions that they imagined… In fact, it is transforming the banking system into the vestigial organ of finance, a sort of intermediary holding zone for debt on its way to the Fed only willing to write loans to people with little-to-no credit risk out of force of habit.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.