Taps Coogan – April 11th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

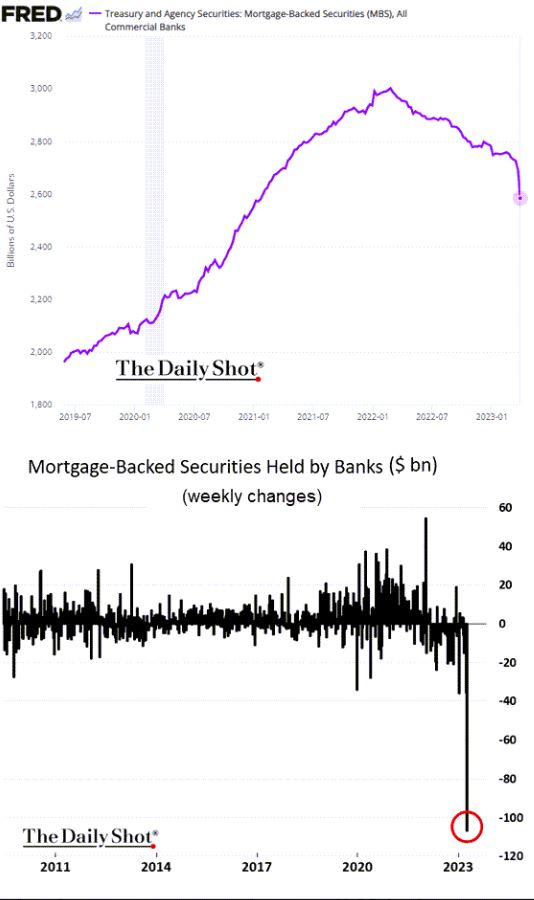

The following chart, via The Daily Shot, highlights the record move by US banks to dump low yielding mortgage backed securities.

As we’ve noted before, the problem facing banks like First Republic is that the yield on their assets (loans they’ve made and securities they’ve bought) is lower than the Fed Funds rate.

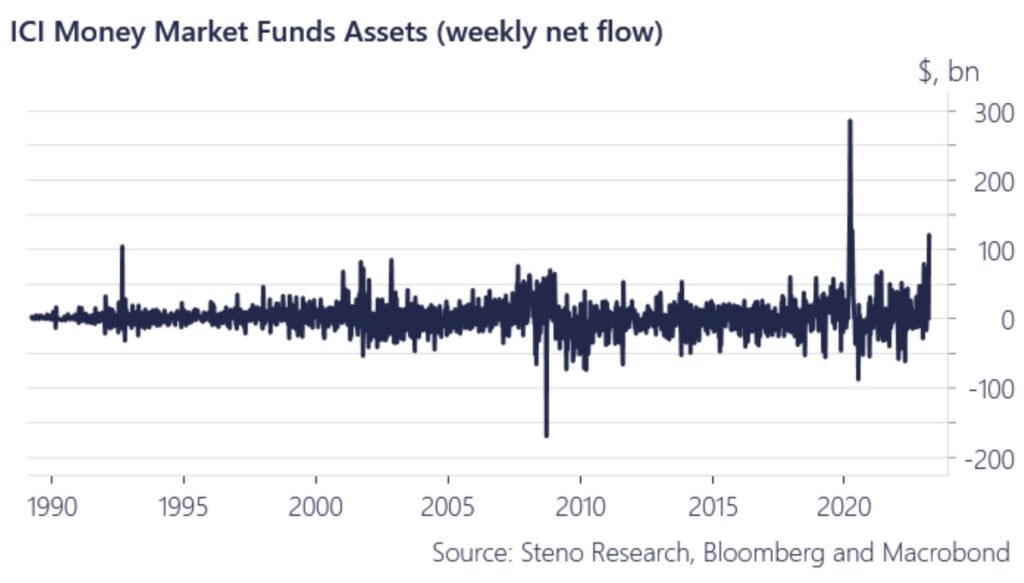

While most banks are still paying next to nothing on deposits, that is changing. Savers can get >4% in treasury money market funds and are finally starting to move their money out of deposits.

One way or the other, banks are going to have to start offering competitive deposit rates. For some banks that, may mean eventually paying >4% to fund a pile of mortgage-backed securities that barely yields 3%. It is therefore no surprise that banks are eager to offload low yielding mortgage backed securities written at the ultra low rates of yester-year, even if that means taking mark-to-market losses.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.