Taps Coogan – March 20th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

A month ago we warned that retail investors had gone ‘all in’ on the rally that had peaked out just days earlier. Fast forward a month and the imprudence of buying a rally based on the idea that the Fed was going to slow the pace of and already-way-too-tight hiking campaign is self-evident.

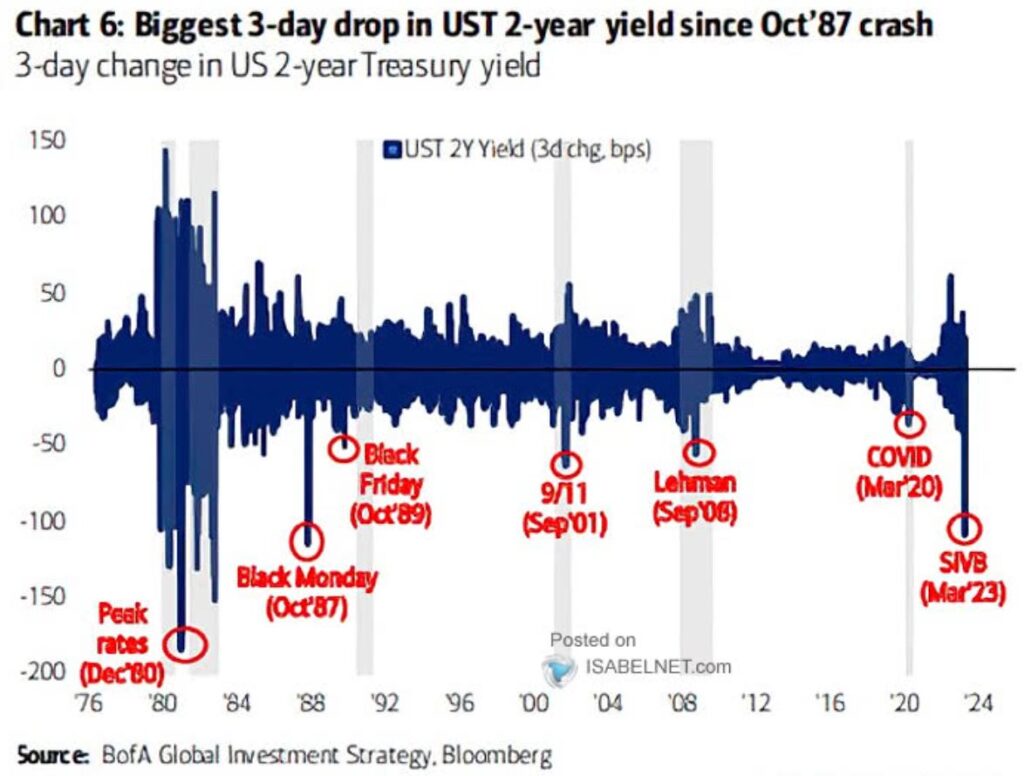

Lest is wasn’t obvious enough, the following chart from Bank of America via Isabelnet highlights the gravity of the warning that the treasury market is flashing.

The ~120 basis point drop in the 2-year last week was the largest since the 1987 ‘Black Monday’ crash, the worst one-day stock market drop on record. Past examples of large 2-year drops are all ominous as they reflect a radical increase in expectations for monetary loosening. That never happens for ‘good’ reasons.

There are a lot of hot takes on SVB, Signature, Credit Suisse, etc…

We would focus on a this:

Banks fail when they can’t meet their capital requirements, not because they lose money, Credit Suisse, which has lost money on-and-off for a decade, is exhibit A of this dynamic.

A failure to meet capital requirements typically happens when depositors quickly pull their money from a bank.

A run on deposits can start for any reason, logical or not. Today, the reason is not about defaults or bad debt but the belated realization that the yield on the assets of many banks is less than the Fed Funds rate. As deposits move into money markets due to absurdly low deposit rates, the cost of funds for banks is rising towards the Fed Funds rate (though it’s still pretty far away). SVB had the added problem that market-to-market losses on their portfolio of low-yielding long-duration assets meant that selling their assets didn’t really improve their capital ratios.

While many banks will be posting losses for years if deposit rates get anywhere near the Fed Funds rate, that isn’t an entirely ‘logical’ reason for bank runs. Banks can lose money without nessearily blowing up.

This is a ‘fixable’ situation in so much as banks can raise deposits rates and eat the compressed net interest margins as they roll their assets into higher yields. Furthermore, if Fed cut rates back down to 4% or so, likely still a sufficiently restrictive stance to keep inflation trending lower, they’d mitigate the severity of the problem.

Unfortunately, as of last week, we are no longer in a ‘logic’ driven process and the Fed can’t be counted on to make sound policy decisions.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

IF the Fed pivots look out below!