Taps Coogan – June 19th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

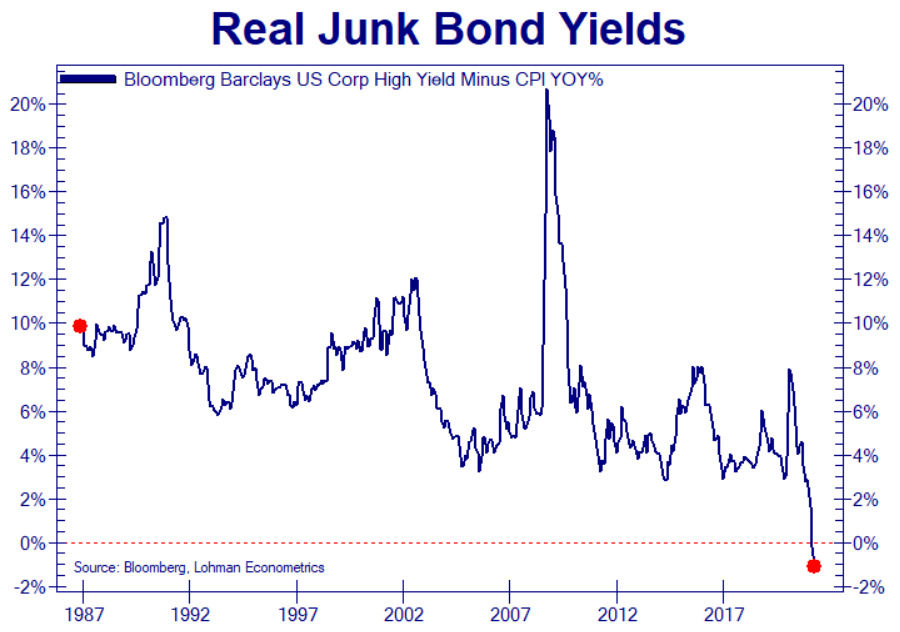

During a normal recession real junk bond yields tend to spike higher as an increasing number of junk rated companies get downgraded or go bankrupt. That is part of the healthy process of cleaning out bad companies and capital misallocation.

During our new Bizarro World recession, real junk bond yields plunge to record negative lows on the back of a free-money-for-all extravaganza, as the following chart from Not Jim Cramer highlights.

Whereas the recession and pandemic was apparently the best windfall gain to ever befall the junk bond market, getting back to normal on that chart, if such a thing is even possible, would look an awful lot like an ‘old fashioned’ recession.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

So thanks largely to the Fed, I can invest in highly speculative public companies with poor fundamentals and effectively lose money for it !?!? It’s like a new kind of warped market charity.

This level of mispricing of credit/default risk in bonds via Lilliputian sized yields NEVER ENDS WELL. The Fed has allowed the shakiest companies in town to obtain oodles of Not To Be Repaid DEBT that basically provides the cashflow to keep their sinking/stinking heads above water. Total Ponzi Scheme sanctioned by the U.S. Government. If CPI reported inflation is posting at 5% plus, you can imagine how many percentage points our Real Inflation numbers are for us peons factoring in real automobile costs, real housing costs, and throwing Hedonic Adjustments out the window. Junk Bonds today are a sure fire… Read more »

Today’s financial world is nothing like it was in 2008. Since then the top has been blown away due to massive money creation. The financial system has entered uncharted waters and it would be wise to take nothing for granted.

When we look behind the curtain it is difficult to ignore the numbers simply do not work going forward. The article below argues there is little comparison to anything we have witnessed in years gone by.

https://brucewilds.blogspot.com/2021/06/economic-evolution-turns-many.html