Taps Coogan – November 19th, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

The timing of the Covid pandemic has been particularly unfortunate. It didn’t just mean conducting a contentious presidential election amid the on-and-off-again suspension of societies’ social salves: sports, bars, restaurants, theaters, religious services, vacations, etc… It also started with most of the ‘reliable’ predictors of recessions having already fired off warnings throughout 2019.

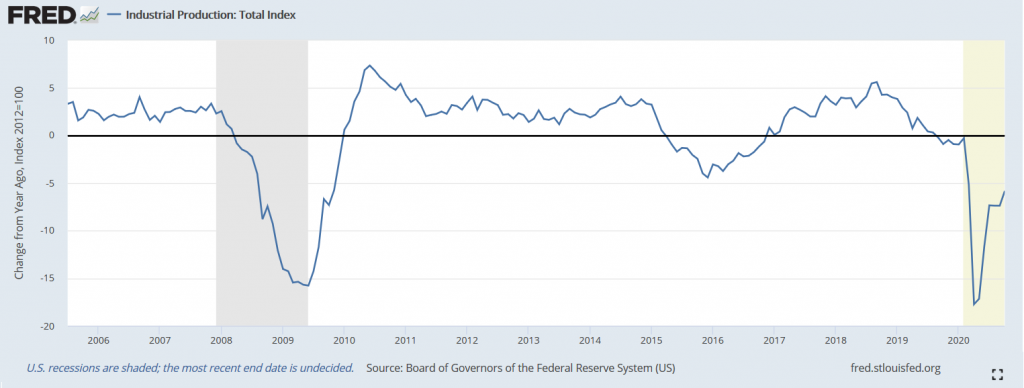

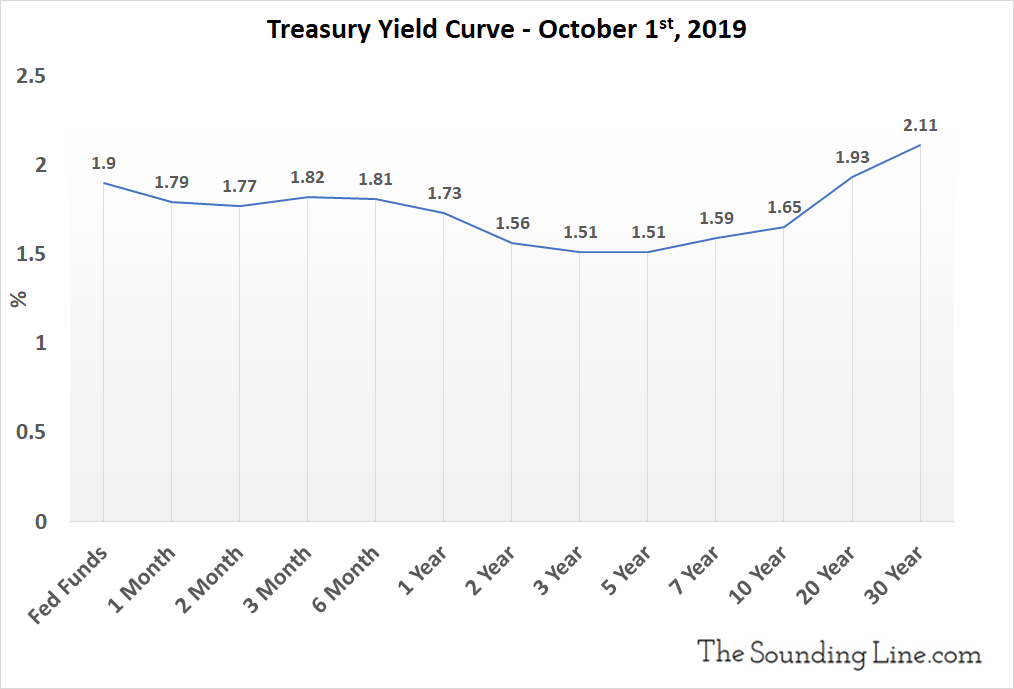

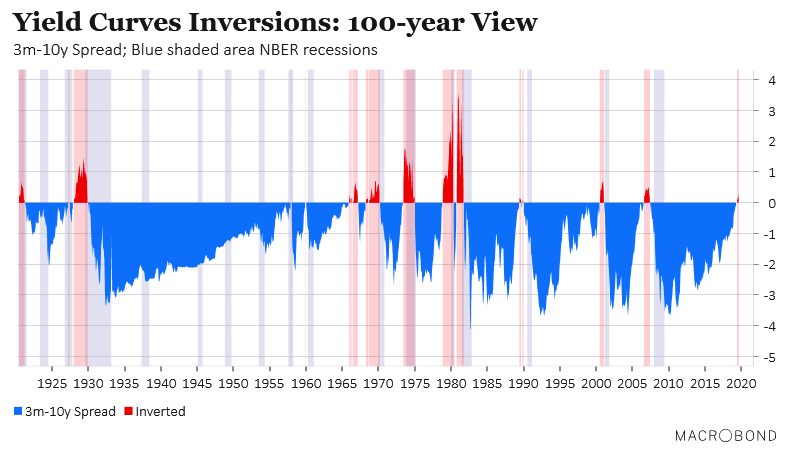

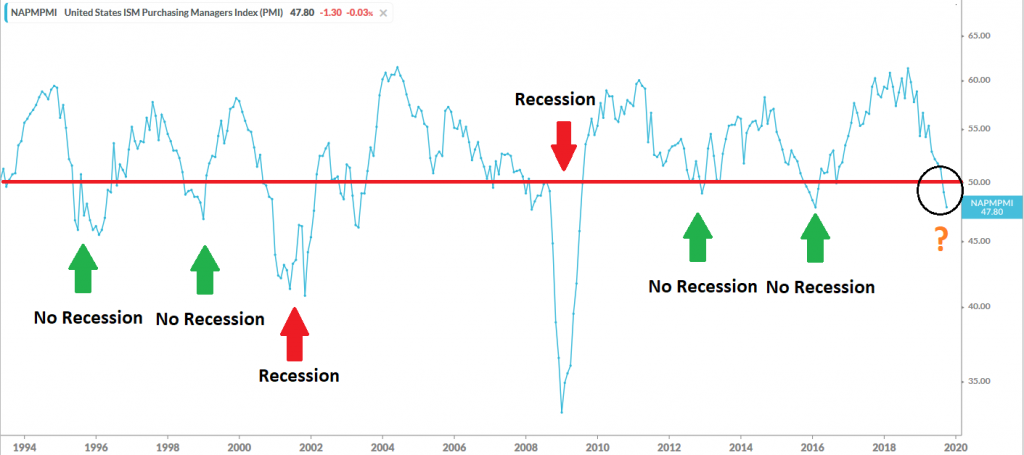

By the end of 2019, US industrial production was already negative on a year-over-year basis. The treasury yield curve had inverted. The ISM PMI index was in contraction and consumer optimism for the future versus present was at typical pre-recessionary levels. In light of these facts and the repo crisis of 2019, the Fed had already expended much of its limited conventional monetary stimulus by February 2020.

US Industrial Production Year-Over-Year

US Treasury Yield Curve Inversion in 2019

US ISM PMI in Contraction by Late 2019

Consumer Optimism About the Future vs. Present in 2019

While the US economy was arguably starting to bounce back by early 2020, ‘Phase Two’ China trade deal in hand and an exceptionally strong labor market still intact, the Covid pandemic made that argument irrelevant.

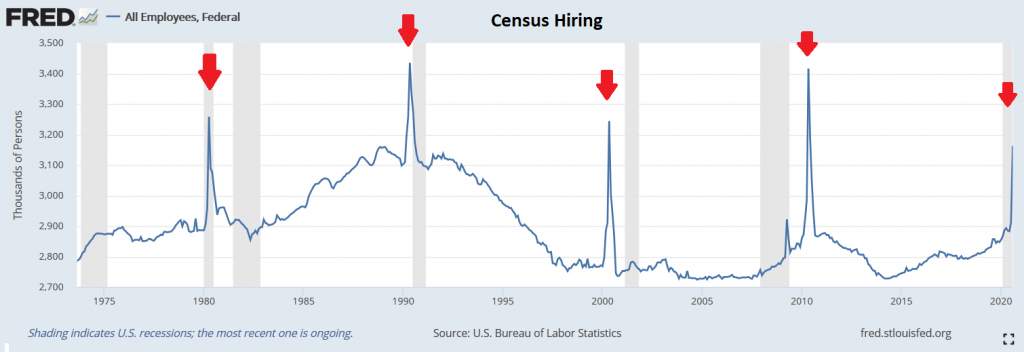

If there was any silver lining to the 2020 timing, it was that it coincided with the 10 year census hiring spree, which typically adds about three-quarters of a million temporary jobs to government payrolls.

Census Hiring Spree in September

Unfortunately, that census hiring spree appears to have been smaller than in the past and is already ending. The jobs are already running off of federal payrolls.

Federal Payrolls

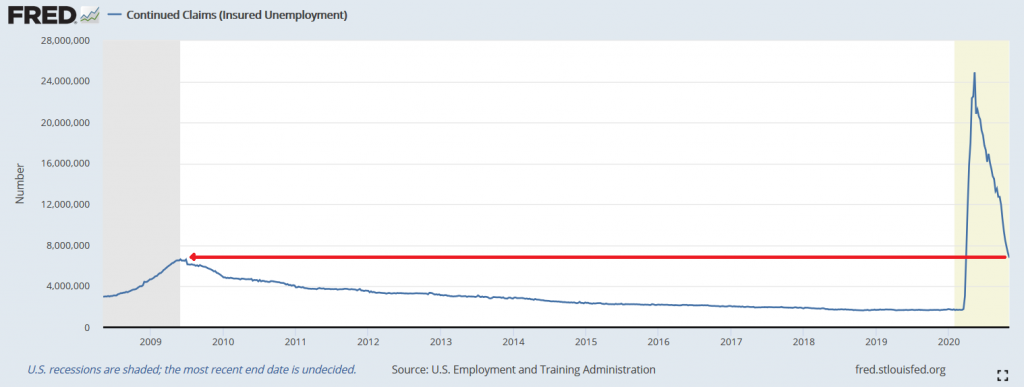

Compared to the magnitude of the increase in unemployment claims caused by Covid, roughly 32 million people, the census gains where never overwhelmingly important. They were, however, the only tailwind that the labor market had going for it.

The net-net of it all is that after a seven-month V-shaped labor market recovery, we approach the end of 2020 with more people on state unemployment than at the worst point in the Global Financial Crisis.

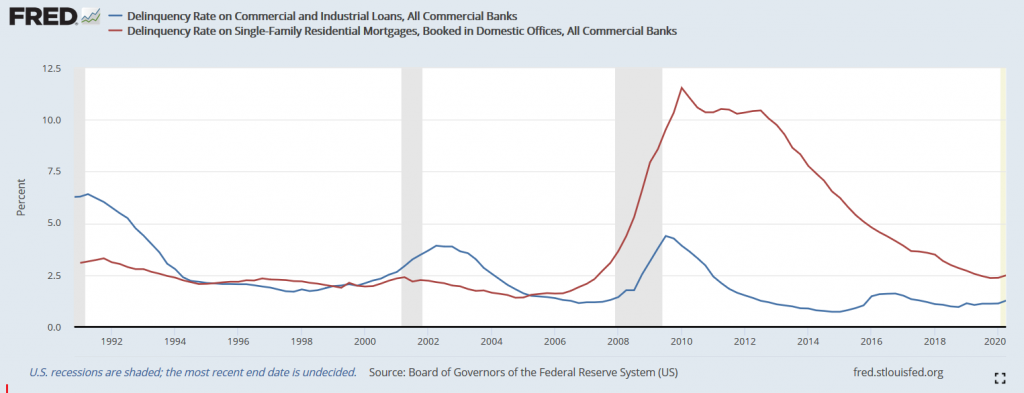

While there is likely a bit more ‘knee-jerk’ recovery left to go for the labor market, the business and housing delinquency cycle hasn’t even started. Getting back to where the economy was in the immediate aftermath of the Global Financial Crisis, let alone where it was in 2019, to say nothing of 2018, is going to be a big ask.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.