Taps Coogan – October 18th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

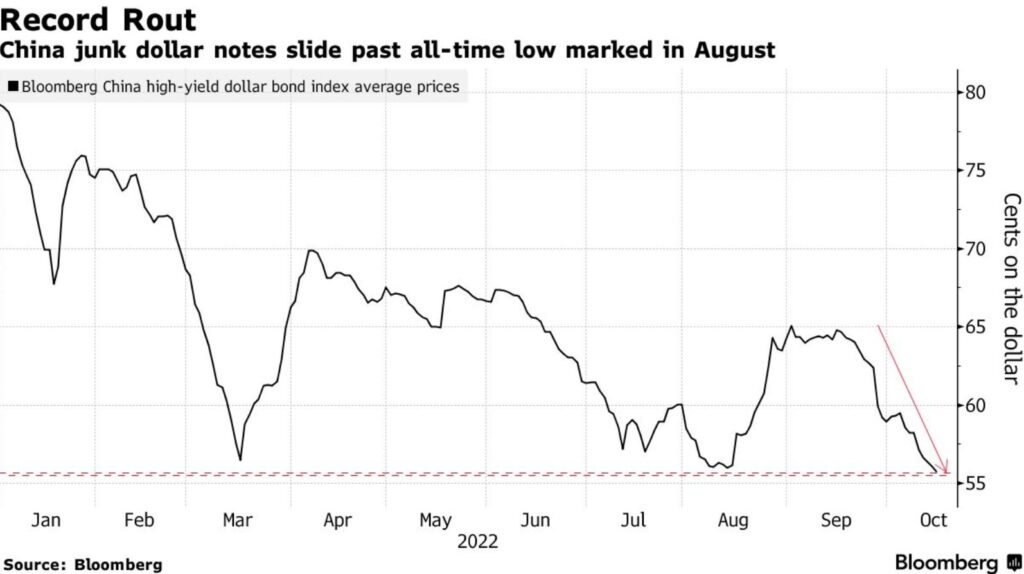

The following chart, from Bloomberg, highlights the fact that the value of Chinese junk dollar bonds has slid to a new record low in the last few days.

Chinese junk bonds are trading at 55 cents on the dollar, implying massive default risk. At the start of October, Chinese junk bonds marked their seventh consecutive quarter of losses. A recent Chinese central bank survey noted that 73% of respondents thought homes prices would stay they same or fall further.

Given the severity of the weakness in China’s housing market, local governments have started buying up properties directly from struggling developers. Of course, selling property to developers is the primary funding mechanism for local government budgets, so we’re curious how that will work in the long run.

Local governments in China have been using excessive real-estate development as the key mechanism to meet arbitrary growth targets for decades. Even if the issue of what to do with excess inventories of shoddily built ghost buildings is resolved, there’s another problem. Now, China’s population is shrinking. Who needs more apartments when the population is shrinking and where will all the fake growth come from when the construction stops?

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.