Taps Coogan – October 16th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

Ask a deflationist why they think inflation has undershot their expectations for the past decade and one of the answers you’re likely to get is that the US has imported considerable deflation from low wage manufacturing exporters like China.

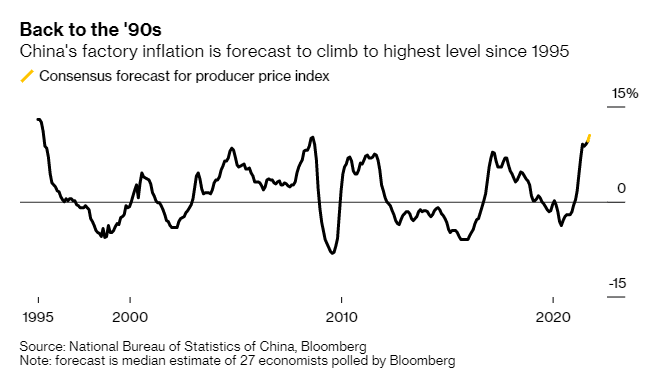

Well, as the following chart from Christophe Barraud reveals, that theory no longer applies as consensus estimates point to Chinese factory inflation jumping from current levels, the highest since 2009, to their highest since 1995.

Whether the current wave of inflation proves temporary or not is an increasingly irrelevant question. To tweak the catchphrase of Zerohedge, everything is temporary on a long enough timeline.

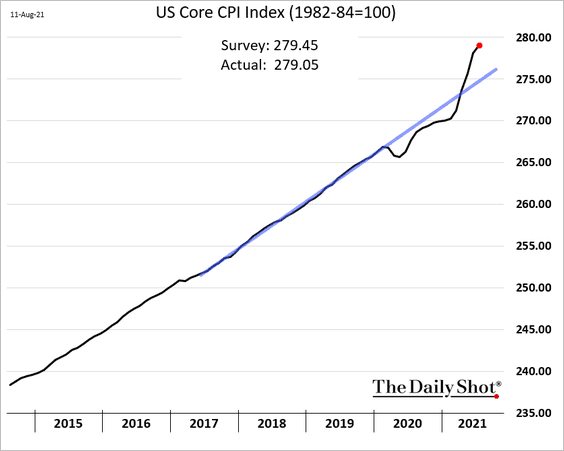

The current bout of ‘temporary’ inflation has already lasted most of this year and things like Chinese Factory inflation suggest that it will continue to be with us for months to come, regardless of whether year-over-year peak in CPI may be in the books. We overtook the pre-Covid trend line on US inflation months ago, meaning we are losing purchasing power far faster than is consistent with a long term 2% inflation target.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Problem is no other country can replace Chinese cheap, large, reliable, politically stable labor force. Indonesia comes closest with population of 200 million. All others in Asia are in100 million range. Therein lies importance of Asia Pacific to U.S. interests,

India is the new China with the twist that its actually a democracy which means it will look more troubled from the outside but function better in the long run