Taps Coogan – July 18th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

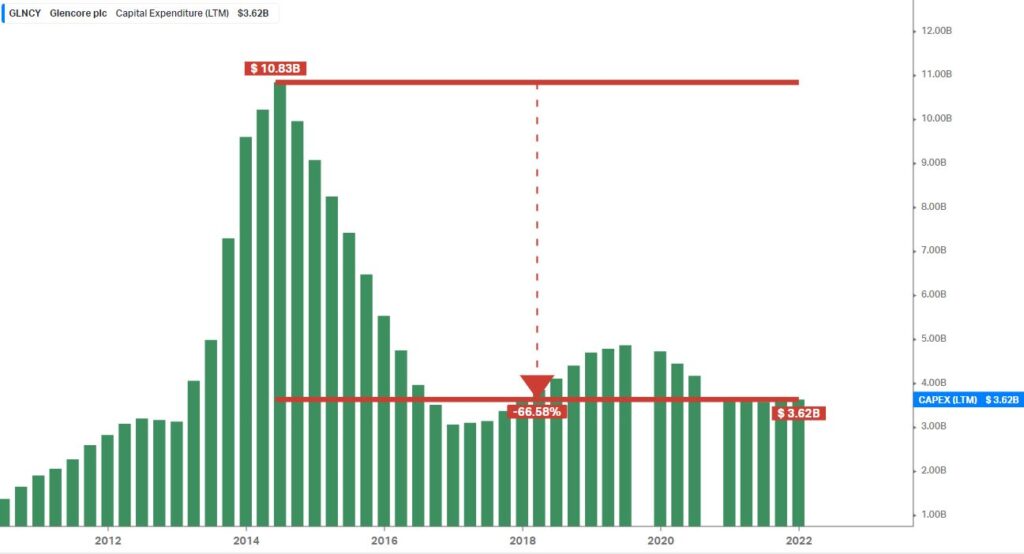

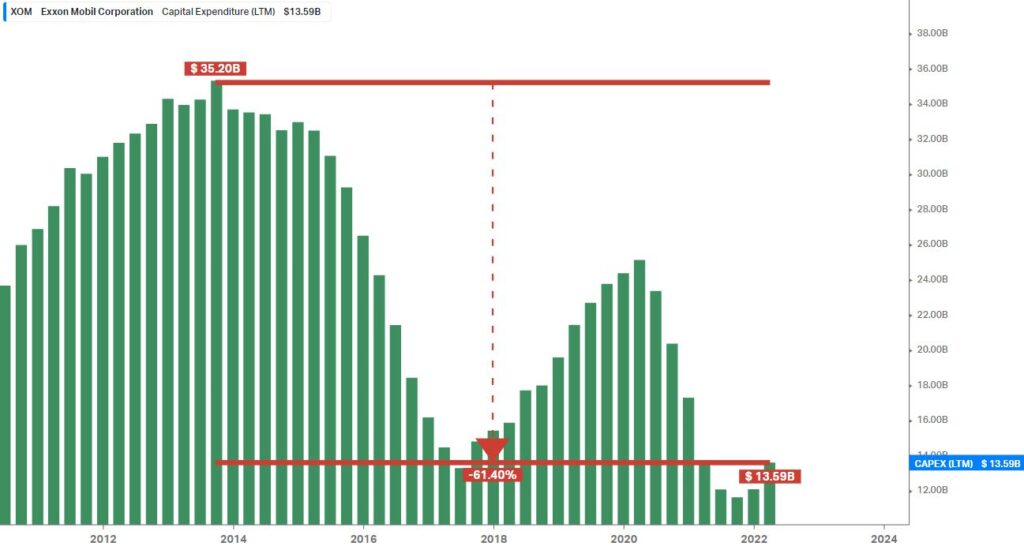

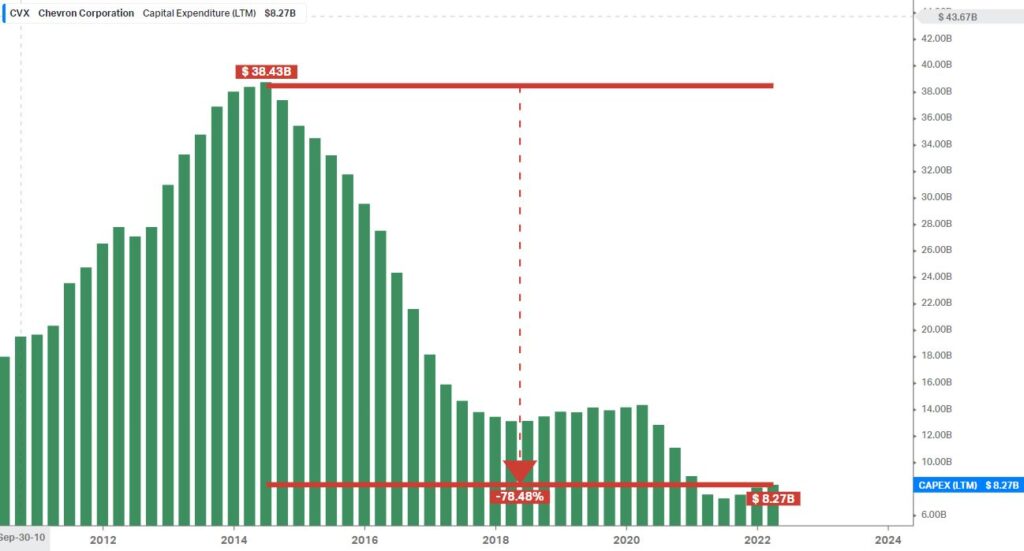

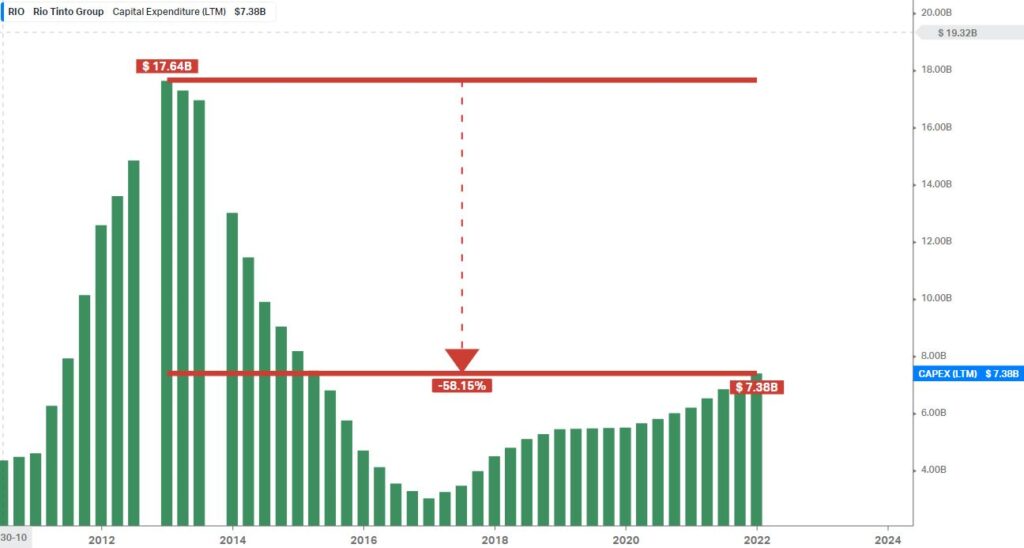

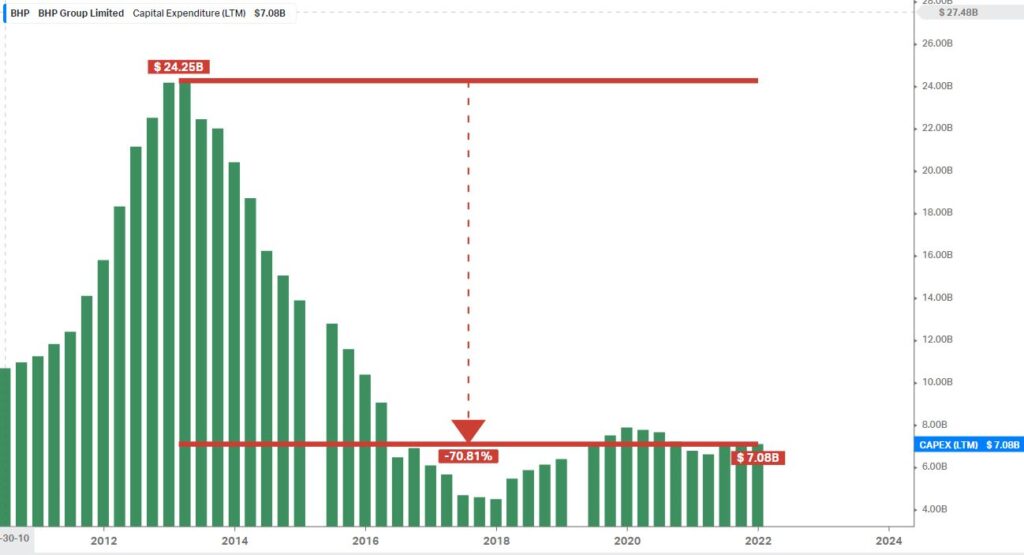

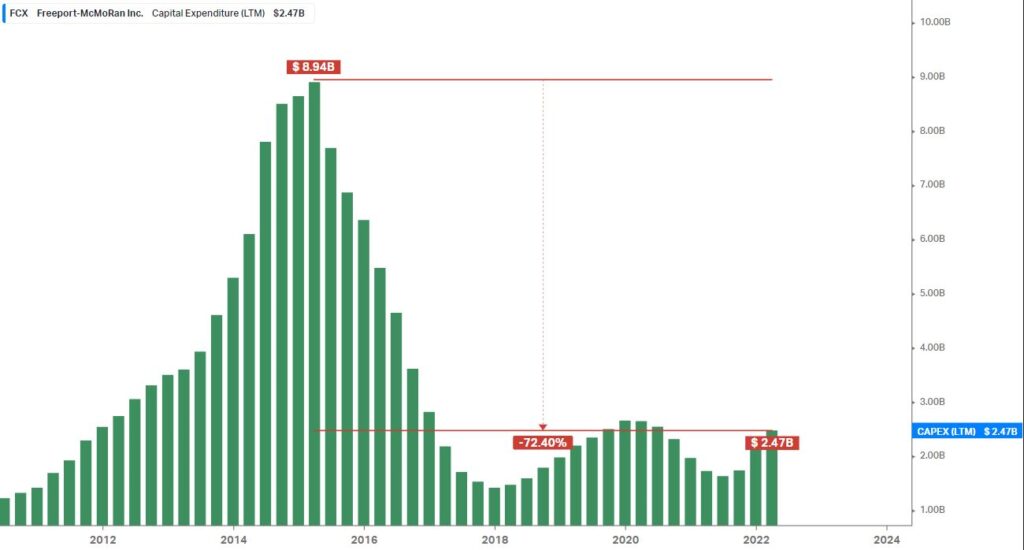

Despite tight physical inventories and demand forecasts for commodities like copper that wildly exceed expected production over the balance of this decade, capital expenditures (capex) at the world’s largest commodity companies, spending that maintains and expands production, remains dramatically lower than at the peak of the last commodity bull market (2013-2014). Glencore’s capex is down 66% from its peak in 2014, Exxon’s is down 61%, Chevron’s is down 78%, Rio Tinto’s is down 58%, BHP’s is down 70%, Freeport’s is down 72%, etc…

Glencore CAPEX

Exxon CAPEX

Chevron CAPEX

Rio Tinto CAPEX

BHP Capex

Freeport McMoRan CAPEX

Nonetheless, recession fears have led to sharp selloffs in most commodity markets in the past few months. Copper is down 31% from its recent highs, steel is down 37%, cotton is down 37%, gold is down 18%, oil is down 20%, Henry Hub natural gas is down 20%, etc…

Everyone and their dog is now predicting a recession, in no small part because of very high prices for commodities like oil, gas, and copper. As traders sell their commodity positions because of growth fears, commodity prices tumble. Yet, tumbling commodity prices reinforce commodity producers’ hesitance to increase capex budgets, leaving the pipeline of new projects woefully below what’s needed.

It’s a conundrum, but either the global economy ‘breaks’ and demand vanishes in a much more structural way, and we haven’t seen evidence for that yet, or prices will have to trend ‘high’ for long enough to entice companies to increase production more meaningfully.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Not mentioned, Russia Sanctions a major factor in pricing and availability of commodities such as oil, gas and copper. This adds more uncertainty and distortion to any supply/demand situation and investment decisions as political situation can change rapidly

Not just the sanctions but the war itself

The recent volatility in commodity prices could be a sign of falling liquidity. With the Fed voicing its intention of reversing its easing policy and beginning to tighten it is logical that sooner or later signs of less liquidity would begin to surface. More on how a lack of liquidity could devastate other markets in the article below.

https://brucewilds.blogspot.com/2022/07/falling-commodity-prices-could-signal.html