Taps Coogan – November 25th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

As World Richter of the Wolf Street like to say, of the Fed’s stable of official inflation metrics, Core PCE is consistently the ‘lowest lowball’ metric.

The current Core PCE inflation metric is the culmination of the game started by Arthur Burns during the 1970s when he began simply stripping everything out of the inflation calculations that he didn’t like, from jewelry to mobile homes, leaving just 35% of the original items in the inflation calculation by the end of the 1970s. Core PCE then throws every other trick in the book at inflation to make it look as di minimis as possible. It uses chain-type substitution, excludes food and energy, counts non-market determined healthcare prices from Medicare and Medicaid, uses Owner’s Equivalent Rent instead of actual rent or home prices, makes generous hedonic quality adjustments, etc…

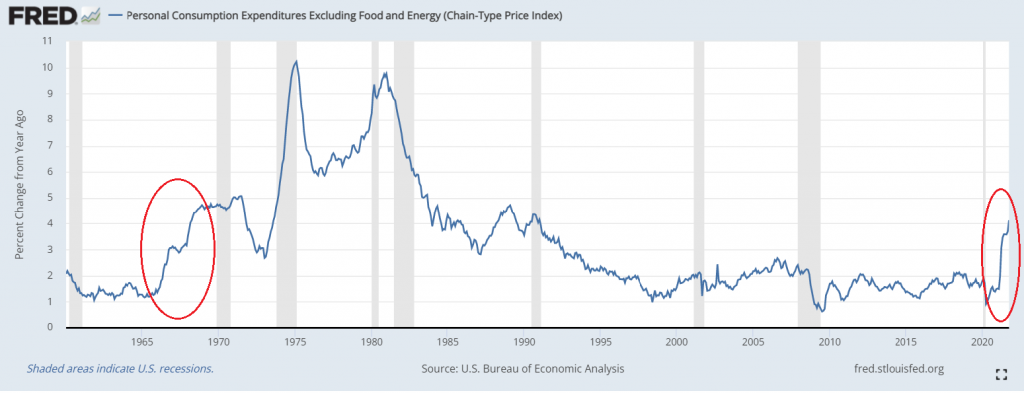

Regardless, even the Fed’s ‘lowest lowball’ inflation metric is screaming higher, with the latest print topping 4%, double the Fed’s target. A lot of headlines have noted that inflation has reached the highest level since the early 1990s, but the reality is that this the fastest increase in PCE Core inflation from a sub-2% base since the late 1960s.

PCE Core Inflation Year-over-Year

Despite the eerie similarity between the rise in inflation off of a sub-2% range in the late 1960s and today, the economic landscape is very different.

The late 1960s and 1970s saw the fastest increase in working age population growth in modern American history. It was the low point in Post-War debt-to-GDP, and financial assets, while expensive relative to the prior decades (which included two World Wars and the Great Depression), were unfathomably cheap compared to today.

It seems doubtful that today’s morbidly over-indebted economy and slowing demographics could power through years of rate hikes and bear markets while still producing inflation like we did in the 1970s, though if anyone could engineer such a feat it’s this ultra-extreme Fed.

Remember, there was not a single dissenting vote on monetary policy at the Fed all summer and fall as it kept QE on full blast despite the transparent fallacy of its ‘base effect’ argument and all incoming data suggesting that ‘transitory’ inflation was going to last radically longer than the Fed was stating in public. In fact, there has not been a single dissenting vote at the Fed on monetary policy since at least 2012, only the occasional dissent by Governor Bainard on Bank regulations.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.