Taps Coogan – March 10th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

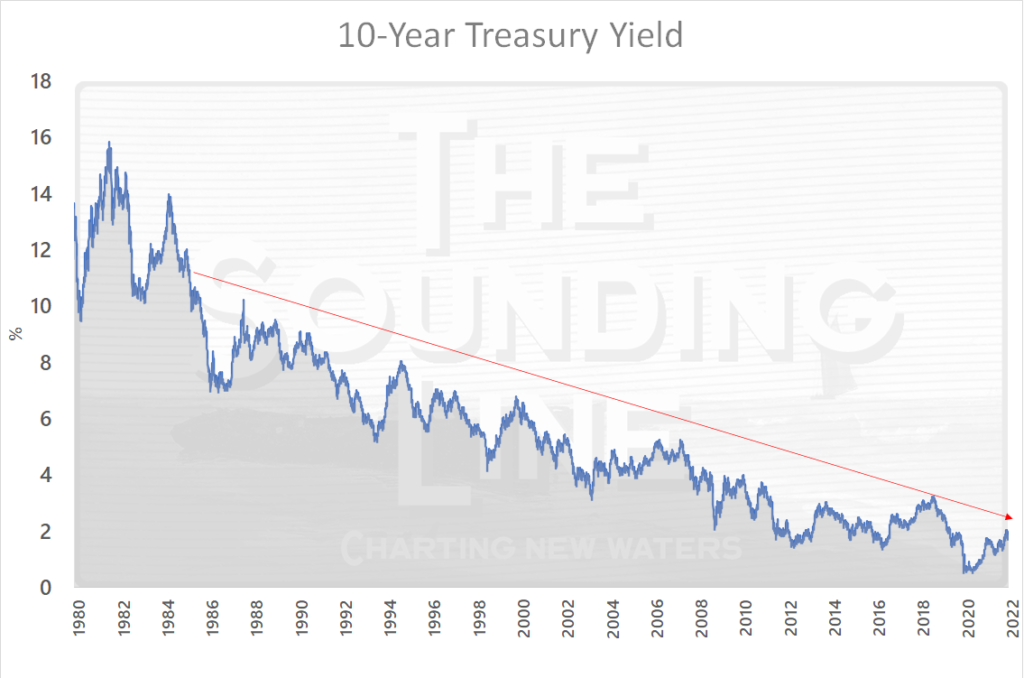

Despite everything from Covid to the surging national debt, runaway inflation, and Russia’s invasion of Ukraine, 10-Year treasury yields are still trending in their multi-decade downward channel.

Many arguments have been trotted out over the past 15 years about why the 10-Year would finally break out of the downtrend. Most of them revolve around high inflation causing negative real rates that would drive money out of the bond market.

Someday those arguments may pan out, but after a year of historically negative real rates, there is still no sign of it.

Among the many reasons for this (the Fed is still doing QE, investors/banks warehousing duration mismatch risk, etc…) Dr. Lacy Hunt continues to make the argument that few really want to accept: the only way out of a debt-trap is deleveraging and that excessive debt leads to lower interest rates, not higher ones, as it sensitizes the economy to rising rates (Gundlach’s law) while leading to excessive money supply relative to growth.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.