Submitted by Taps Coogan on the 11th of July 2018 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Allianz chief economic advisor Mohamed El-Erian recently spoke with CNBC to discuss the ongoing trade dispute between the US and the rest of the world. Contrary to the apocalyptic narrative being advanced in most media coverage of the trade dispute, El-Erian points out that there is a real possibility of a positive outcome, particularly for the US.

USA is poised to win a trade war, says Allianz’ Mohamed El-Erian from CNBC.

El-Erian:

“In relative terms we are winning and we will win the trade war… Just look at the performance of US markets relative to China and relative to others… The more interesting question is what happens in absolute terms and I think what the market has priced in is the following: that the tit-for-tat continues but ultimately it doesn’t lead to a full blown trade war, that we still get free but fairer trade… Is there a left tail? Sure there is. I think what the market hasn’t realized yet is that there is a right tail. I call it the Reagan moment for trade, that when people realize that at the end of the day the US will prevail because it’s a less open economy, because it’s a more dynamic economy, that ultimately you may end up in a situation where the US’s position in global economic terms is better off… Let’s not forget that there is a right tail as well as a left tail.”

“I am referring to the decision that President Reagan took to have a military build up with the then Soviet Union, with what he called the Evil Empire. Where there risks to that approach? Massive risks but at the end of the day, because the US was sure to win that war, as long as those risks were managed you ended up with changing the landscape of Europe and changing the position of the US, and I think that one of the up-side risks, it is a tail (risk), but… you may end up changing the global landscape in a way that favors the US because countries will realize that if we slip into a trade war, while everybody suffers, the US does better in relative terms.”

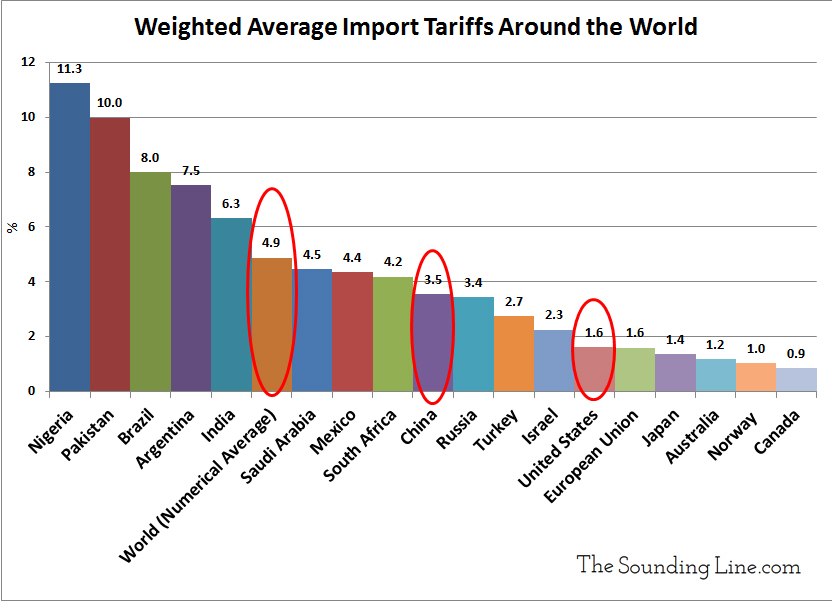

As we have noted here at The Sounding Line on several occasions, international trade is significantly less important to the US economy than it is to every single one of its largest trading partners and because the US runs such large trade deficits with nearly every one of its trading partners, it can always threaten to impose more tariffs than vice-versa. Furthermore, it is disingenuous to imply that the US is starting a trade war with countries like China, which have long imposed far higher import duties, stricter non-tariffs trade barriers, stolen intellectual property, and maintain massive trade surpluses. The objective of US tariff threats is primary to encourage other countries to lower their tariffs and restrictions to the same level as the US. This view is best exemplified by the US proposal to eliminate all automobile tariffs between the US (which charges 2.5% tariffs) and the EU (which charges 10% tariffs). The infamous Smoot-Hawley tariffs that the US imposed in 1930, which are widely believed to have contributed to the Great Depression, were done when the US was the largest exporter in the world, the complete opposite of the current situation, and not a particularly relevant historical analogue.

There is more to the interview, so enjoy it above.

P.S. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

It seems difficult to completely blank out the fact that our EROIE (energy return on energy invested) is heading south. With no cheap transportation, there will be no such thing a globalised economy. And I am not even factoring in the unbearable price of destroying our climate. At least if you admit that you can see that the world is bound to go through a massive deglobalisation soon. Or one which has even started already. Trump’s wall, MAGA, trade wars, Brexit, EU instability. All that is looking more and more like our global economy is coming out of age. Now… Read more »

If you haven’t read this piece, you might find it interesting:

https://thesoundingline.com/why-oil-supply-may-be-tighter-than-you-think/

Interesting. In fact the net energy flows entering Europe since 2008 has been steadily doing DOWN. GDP is correlated at 99% with oil consumption. Guess why we are struggling with our GDP. Shale oil is a scam. Heavy oil EROIE is about 4:1, barely enough to produce food on a large scale. You want to know our future? Read this https://medium.com/@albertbates/peak-mexico-6e34687817c2. In fact it’s not even our future. We might already be there, and maybe 2008 was only the result of the end of our industrial era started in the 19th century when fossil fuel were discovered.

El-Erian may be correct in his final assessment but there would be major upheavals within industrial sectors as well as financial/monetary/capital flow turmoil created in many debt ridden economies. Yes, there would be winners, but many losers with a distinct possibility for an international credit meltdown.

Agreed. We are starting to see those upheavals already in Turkey, Argentina etc…

President “Regan?” Come on, get a proofreader. And this – the US will prevail because it’s a less open economy…- should be MORE open, right?

Thanks for catching the Reagan error. Much appreciated. I have corrected it. Less open economy is not a mistake. In this context, by less open El-Erian means less dependent of international trade and more reliant on domestic consumption.