Submitted by Taps Coogan on the 8th of February 2017 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

In the recent post ‘Europe is On a Precipice’ we remarked about the convergence of events in 2016 and 2017 that threaten the EU and the Eurozone. Among those events are: Brexit, Trump, the re-emergence of the Greek debt crisis, and the upcoming Dutch, French, and (assumed) Italian elections, all of which feature anti-EU candidates/parties polling in first or second place. Given that the ascendancy of at least one of these candidates/events is not only plausible but probable, the risk of some form of Eurozone sovereign debt crisis appears massively underestimated.

In addition to these adverse political developments, the underlying economic imbalances in the Eurozone are once again accelerating. One way to visualize these imbalances is to refer to the Target2 interbank settlement system for the Eurozone. We first talked about the Target2 system back in early 2016 as part of our trilogy ‘The Euro – Help or Hindrance’ and summarized:

The Target2 balance represents the money ‘owed’ to the ECB by the various national central banks in the Eurozone. A fairly concise explanation of the statistic can be found here (link). Put simply, if someone with a Greek bank account owes money to someone with a German bank account, that debt can be settled through the Target2 system which allows the monitoring of the net balance of payments owed by the various central banks. Positive values indicate that the central bank is owed money and negative values indicate that it owes money’

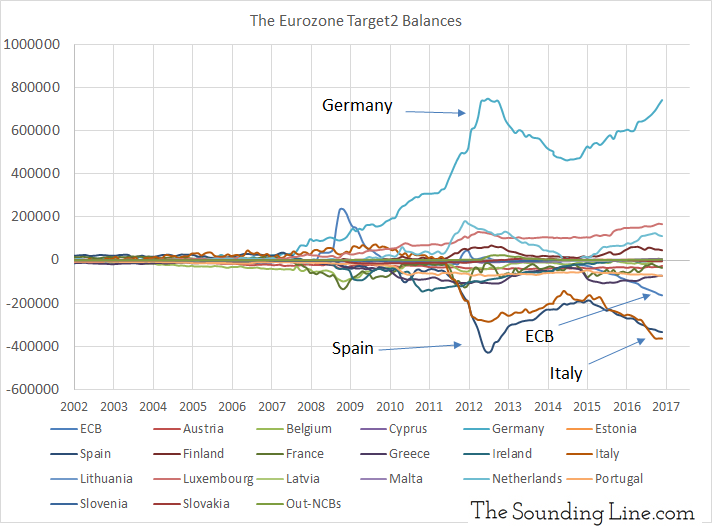

As the chart below shows, the financial imbalance between Germany and the rest of the EU has returned to the highs of the 2012 European debt crisis. Perhaps it is fatigue with perennial Eurozone economic crises, but the level of alarm being raised today does not appear commensurate with that of 2012 or of the current instabilities in the system.

Not only is the positive German balance approaching all-time highs, but Italy’s balance is making all-time lows. Since the Italian banking crisis emerged in 2016, Italy has surpassed Spain to emerge as the largest loser in this system. Interestingly, the European Central Bank (ECB) has surpassed Greece to have the third largest negative balance. This is likely a result of their purchases of sovereign debt as part of their endless QE programs.

Quite a debate has raged about the extent to which the Target2 system is showing household wealth flight versus the flight of capital from low to high quality financial assets. Given that the flight to ‘high quality’ assets is evidently code for ‘German’ assets, the differentiation is essentially academic. Whether capital is moving to Germany as a result of household consumption of German products or whether it is moving as a result of consumption of German financial assets isn’t particularly relevant. The point is that the flow of money is massively imbalanced.

This is the moment when the Eurozone most needs pro-growth structural economic and fiscal reforms. Monetary stimulus clearly isn’t working. Unfortunately, it is not clear if a political mechanism even exists within the Eurozone to implement such a structural multi-state reform program.

In the meantime we wait on the outcomes of a year chock full of elections.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

You called exactly this over a year ago, well done!

Move along, nothing to see here, only Versailles II in progress, subscribed by chancellor Kohl and fulfilled by chancellor Merkel.