Submitted by Taps Coogan on the 24th of April 2020 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

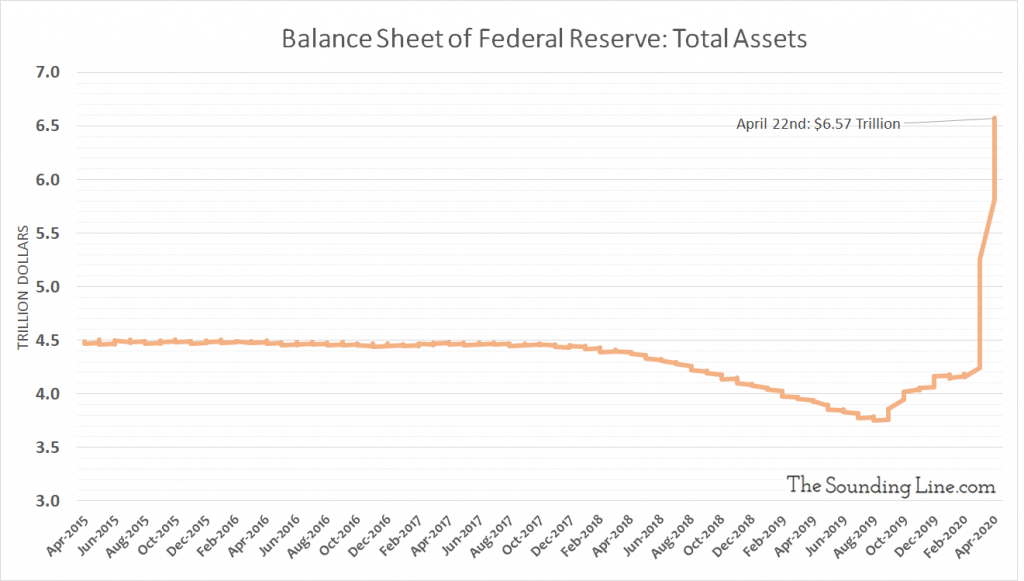

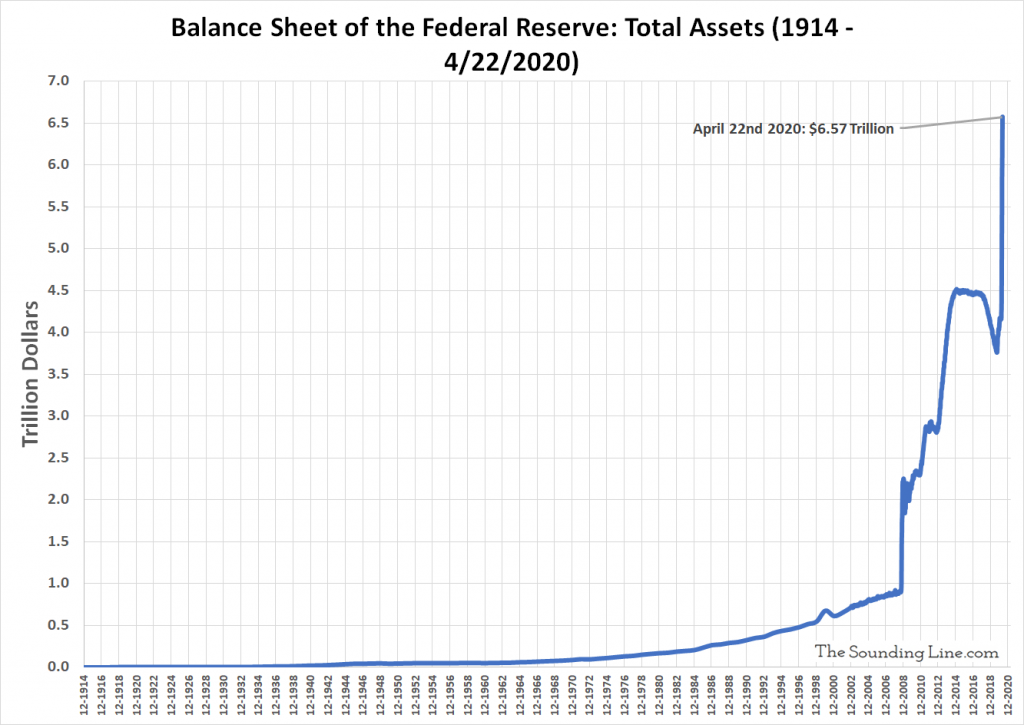

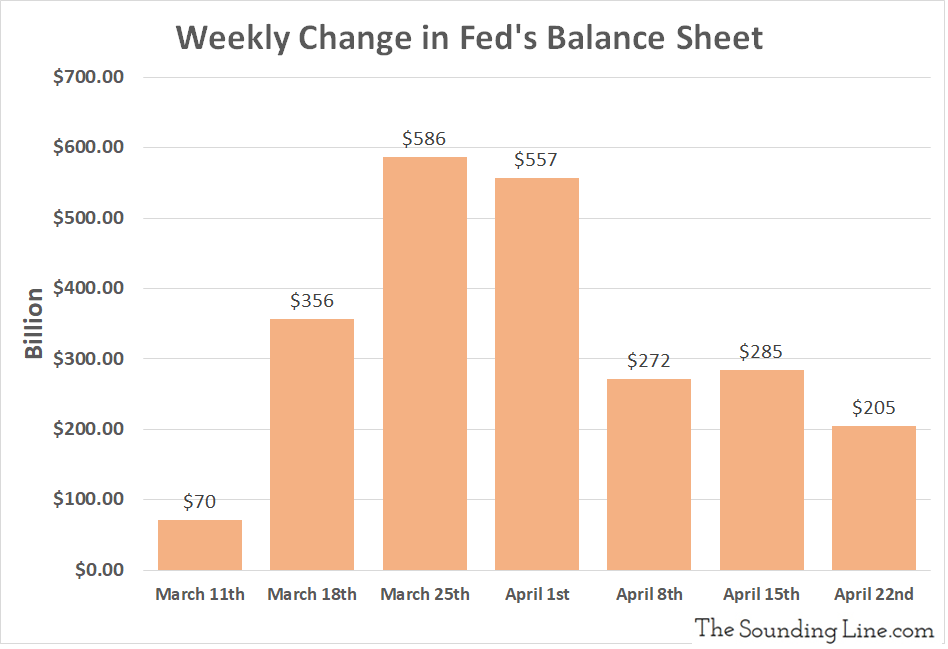

Data released last night (April 23rd) reveals that the Fed’s balance sheet has swelled by another $205 billion during the seven day period ending Wednesday April 22nd. The Fed’s balance sheet has now hit a total of over $6.57 trillion or 30.2% of US GDP.

Last week’s $205 billion buying-spree actually represents a sizable slowdown from the prior four weeks, which ranged from $586 billion to $272 billion. Nonetheless, the last week saw the Fed’s balance sheet expand faster than during all but two weeks of the Global Financial Crisis.

Over the past week, the Fed bought another $120 billion in Treasury securities and another $54 billion of mortgage backed securities, bringing its holdings of each to $3.9 trillion and $1.6 trillion respectively. It made a ‘modest’ $1.7 billion in additional loans to its alphabet soup of Special Purpose Vehicles, to whom it has now lent $122 billion. It also did another $31 billion in currency swaps with other central banks, bringing its total swap lines to $409 billion. The Fed shed roughly $23 billion in repos.

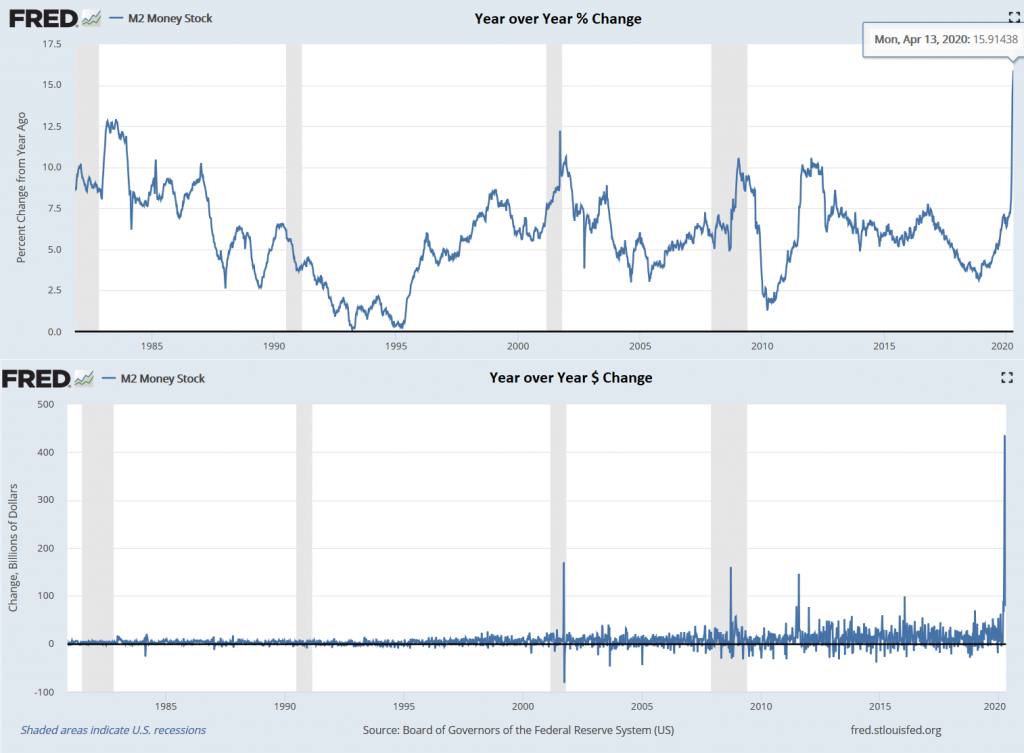

Meanwhile, the money supply, as measured by M2, is now growing at the fastest pace on record, both in dollar value and as a percentage. As the following charts show, QE-Unlimited is having radically stronger effects on the money supply than past QE programs.

This new breed of massive monetization, direct deposits into people’s bank accounts, unemployment payments that in many cases amount to pay raises, and business loans that are actually grants, is not your ‘old-fashioned’ QE. Great caution is urged when assuming that the effects QE-Unlimited will be similar to past QE programs.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

It appears things may be spinning out of control.