Submitted by Taps Coogan on the 26th of July, 2017 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Here on The Sounding Line, we have documented a growing list of metrics that reveal how US stock prices are outstripping underlying economic fundamentals and traditional valuation metrics (here, here, here, here).

From a somewhat different perspective, we present yet another long term economic relationship that points to the overheated nature of US equities.

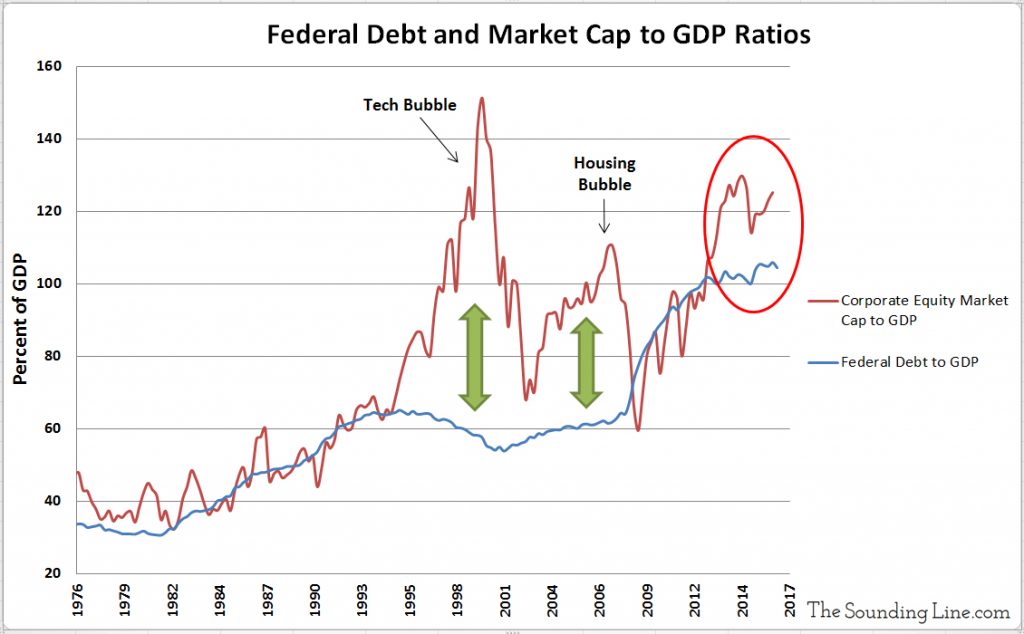

Since at least the 1970’s, there has been a very close correlation between growth in corporate equity market capitalization as a percent of GDP and the total federal debt as a percentage of GDP. Historically, the federal debt and US corporate equities have moved lock step as the two largest publicly traded financial asset classes in the country (and world). There have only been three times since the 1970’s when market cap widely outgrew the federal debt: the tech bubble, the housing bubble, and since 2013.

Why the relationship between the two matters:

To be clear, one does not necessarily lead to the other and by no means does growth in the federal debt drive sustainable stock appreciation. Far from it.

The key to the relationship is risk profiles. Like personal asset allocation plans providing different risk profiles based on the ratio of stocks to investment grade bonds, this metric is a proxy for the risk profile of the entire US economy and invested capital. During periods of wide divergence, such as during the dot-com bubble and the housing bubble, a large transformation in the risk profile of the economy’s capital takes place. Instead of the near parity of asset allocation between ultra-low risk US government debt and much higher risk corporate equities that occurs during stable markets, during periods of speculative bubbles, multi-trillion dollar imbalances occur. It is the resulting excessive risk profile that volatilizes and fragilizes financial markets. Today we are experiencing yet another imbalance, with the economy’s asset allocation increasingly tilting towards higher risk assets. That may continue for some time and may get far worse, but if history is any guide, it won’t last forever.

P.S. We have added email distribution for The Sounding Line. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.